NIGHT Token Price Prediction and 2025-2030 Investment Outlook: Deep Dive into Midnight Market Performance

Key Takeaways

- NIGHT token launched on December 9, 2025, with price plummeting from $0.105 to $0.0232 on day one, down 77.92%

- Current crypto price approximately $0.0232, market cap $385 million, ranked #209 on CoinMarketCap

- Technical indicators show oversold conditions, short-term bounce possible to $0.080-$0.100 range

- Long-term price prediction: 2030 target price $0.50-$0.60, dependent on enterprise adoption and DeFi integration

- MEXC Exchange offers best liquidity and zero-fee trading, the preferred platform for trading NIGHT

Introduction

NIGHT Token Price History Analysis

Launch Day: Beginning of Extreme Volatility

- Opening Price: Approximately $0.035

- All-Time High (ATH): $0.105 (within hours of launch)

- 24-Hour Low: $0.0232

- Price Fluctuation: Over 200%

Current Market Data (As of December 10, 2025)

- Current Price: $0.0232

- 24-Hour Trading Volume: $29.74 million

- Market Cap: $385 million

- Circulating Supply: 16.6 billion tokens (69% of total supply)

- Fully Diluted Valuation (FDV): Approximately $557 million

Technical Indicators and Chart Analysis

Relative Strength Index (RSI) Analysis

- 4-Hour RSI: 28 (oversold territory)

- Daily RSI: 32 (approaching oversold)

Moving Average (MA) Analysis

- 7-Day MA: $0.045

- 25-Day MA: N/A (too short listing time)

- Current Price vs 7-Day MA: Price below average by approximately 48%

Volume Analysis

- High market activity

- Sufficient liquidity support

- Continued investor interest

Support and Resistance Level Analysis

- First Support: $0.020

- Second Support: $0.015

- Strong Support: $0.010

- First Resistance: $0.035

- Second Resistance: $0.050

- Strong Resistance: $0.080

NIGHT vs Other Privacy Coins Comparison

Market Cap and Valuation Comparison

Project | Market Cap | Circulating Supply % | Technical Features |

Monero (XMR) | $3 billion | 100% | Ring Signatures |

Zcash (ZEC) | $800 million | ~70% | zk-SNARKs |

Midnight (NIGHT) | $385 million | 69% | zk-SNARKs + Compliance |

Technical Advantage Comparison

- Selective Disclosure: User-controlled information transparency

- Enterprise-Level Compliance: Meets GDPR and other regulatory requirements

- Developer-Friendly: TypeScript smart contract language Compact

- Ecosystem Integration: Seamless integration with Cardano DeFi

NIGHT Token Price Predictions: 2025-2030

End of 2025 Prediction: Conservative Recovery

- Federated mainnet on track for Q1 2026 launch preparation

- 100+ ecosystem partners confirmed participation

- Validator node growth exceeds expectations

- MEXC and major exchanges provide sufficient liquidity

- Normal project progression pace

- Market volatility gradually decreases

- Token unlock pressure absorbed

- Overall crypto market bear trend

- Increased regulatory policy uncertainty

- Competitors launch similar products

2026 Prediction: Ecosystem Breakthrough Year

- Federated mainnet launch

- Expected price range: $0.10-$0.20

- Incentivized testnet launch

- Hybrid dApp deployment

- Expected price range: $0.20-$0.35

2027-2028 Prediction: Accelerated Enterprise Adoption

- Fortune 500 company real-world use cases

- DeFi TVL breakthrough to $300-500 million

- Daily active addresses exceed 100,000

2030 Long-Term Prediction: Privacy Infrastructure

- Market cap reaches $12-14.4 billion

- Becomes standard protocol for privacy DeFi

- Widespread enterprise-level application deployment

- Market cap reaches $7.2-9.6 billion

- Maintains top three position in privacy sector

Key Factors Affecting NIGHT Price

Token Unlock Schedule

- December 2025-December 2026: 25% unlock every 3 months

- Total: 4.5 billion tokens

- Potential impact: Each unlock may bring short-term selling pressure

- 1-year cliff (until end of 2026)

- Followed by 4-year linear vesting

- This design reduces short-term pressure

Ecosystem Development Milestones

- Expected to catalyze 20-40% price increase

- Attracts Cardano SPO participation

- Increases network decentralization

- Integration with other blockchains

- Expands application scenarios

Macro Market Factors

- Bitcoin price trends

- Regulatory policy changes

- Institutional capital inflows

- Global digital privacy legislation

- Enterprise data protection needs

- Decentralized Identity (DID) development

Trading NIGHT on MEXC: Optimal Timing and Strategies

Why Choose MEXC for Trading NIGHT?

- Minimal Slippage: Deep liquidity pools ensure large trades execute at optimal prices

- Zero-Fee Trading: Visit MEXC zero-fee page for latest offers

- 100% Reserves: Check Proof of Reserve for fund security

- 24/7 Customer Support: Resolve trading issues anytime

Trading Strategy Recommendations

Short-Term Trading Strategy (1-3 Months)

- When RSI below 30 (oversold territory)

- Price approaching support at $0.020-$0.025

- Short-term pullbacks after major positive news

- When RSI above 70 (overbought territory)

- Price approaching resistance at $0.050-$0.080

- Reaching preset profit targets

- No single trade exceeding 5% of total capital

- Set stop-loss 10-15% below entry price

- Use MEXC's stop-limit order features

Medium-Term Holding Strategy (6-12 Months)

- Build position in batches, reduce average cost

- Buy 3-5 times in $0.020-$0.035 range

- Use MEXC's DCA feature for automatic execution

- First Target: $0.080 (breakeven zone)

- Second Target: $0.120 (Q1 2026 federated mainnet launch)

- Final Target: $0.200 (end of 2026)

Long-Term Investment Strategy (2-5 Years)

- Midnight technological innovation (zk-SNARKs + compliance)

- Cardano ecosystem support ($400M+ treasury)

- Privacy market growth potential (projected $100 billion)

- Allocate NIGHT as 5-10% of investment portfolio

- Hold long-term until 2028-2030

- Regularly reinvest profits on MEXC

Risk Warnings and Investment Advice

Major Risk Factors

- Extreme Volatility

- Day-one 77.92% drop illustrates risk

- Price instability normal for new projects

- Token Unlock Pressure

- 4.5 billion tokens unlocking gradually in 2026

- May bring cyclical selling pressure

- Competitive Risk

- Monero and Zcash already captured market share

- Other new privacy projects may compete

- Regulatory Uncertainty

- Countries have varying attitudes toward privacy coins

- May face regulatory restrictions

Investment Recommendations

- Understand blockchain privacy technology

- Can tolerate high volatility

- Have 3-5 year investment horizon

- Believe in Cardano ecosystem long-term value

- Seeking stable returns

- Cannot bear 50%+ drawdowns

- Need short-term liquidity

- Unfamiliar with crypto markets

- Conservative investors: 2-3% of portfolio

- Balanced investors: 5-8% of portfolio

- Aggressive investors: 10-15% of portfolio

How to Start Trading NIGHT on MEXC

Quick Start 5 Steps

MEXC Advanced Trading Features

Market Sentiment and Community Analysis

Current Market Sentiment (December 2025)

- Cautiously Optimistic: 55% investors bullish long-term

- Wait-and-See: 30% investors waiting for more data

- Pessimistic: 15% investors concerned about further declines

Community Development Indicators

- Twitter Followers: ~150,000

- Discord Members: ~80,000

- GitHub Activity: Continuously updated

- Partners: 100+ ecosystem projects

Conclusion: NIGHT's Investment Value

Frequently Asked Questions (FAQs)

Is NIGHT token worth buying now?

How much could NIGHT reach by 2030?

What advantages does NIGHT have over Monero and Zcash?

Which exchange is best for trading NIGHT?

Will NIGHT token unlocks cause price drops?

How to reduce risk when investing in NIGHT?

- Diversify investments, don't go all-in

- Set stop-losses to protect principal

- Only invest what you can afford to lose

- Trade on liquid exchanges like MEXC

- Hold long-term, avoid short-term trading

Disclaimer

- Conduct independent research and due diligence

- Assess personal risk tolerance

- Consult professional financial advisors

- Only invest capital you can afford to lose

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Midnight

View More

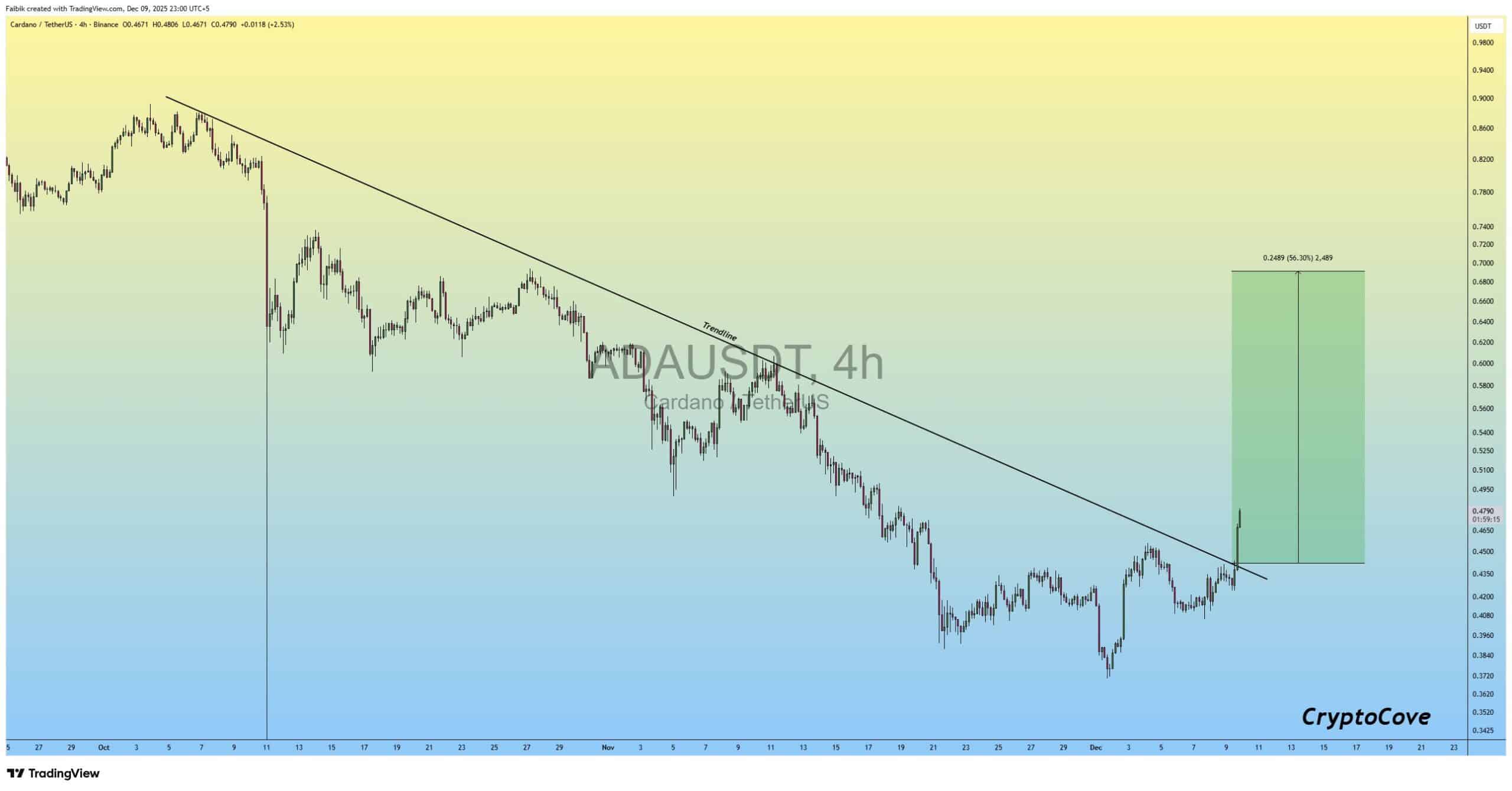

Cardano Price Prediction: Is ADA Breakout Signaling a Strong Reversal Amid NIGHT Token Buzz?

Cardano (ADA) Price Rally Sparks Optimism After NIGHT Token Launch on Binance

Binance CEO’s Account Hacked: An Altcoin Was Promoted! Price Pump and Dump Occurred! – CZ Warned!

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading