XRP Gets Perpetual Buyer: Axelar’s mXRP Sparks ‘Money Glitch’ Hype

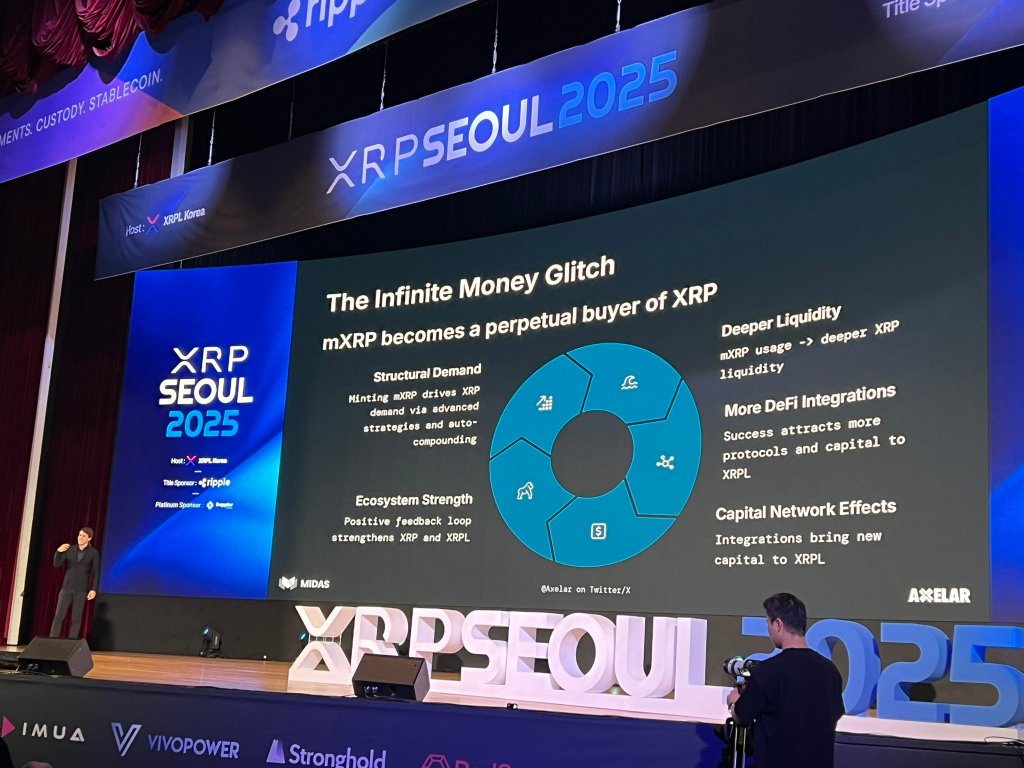

Axelar used the XRP Seoul 2025 stage on September 21 to tease what promoters framed as an “infinite buying power” flywheel for XRP, centered on a new yield-bearing token called mXRP that is designed to become a structural, programmatic buyer of the underlying asset. The pitch—splashed across slides with “The Infinite Money Glitch” tagline—sketched a closed-loop system: minting mXRP would drive XRP purchases, feed auto-compounding strategies, deepen liquidity on XRPL, and attract more DeFi integrations and capital to the network.

In the run-up to the event, Axelar signaled the direction of travel: “A new yield-bearing XRP product is launching, powered by Axelar and the leading EU-regulated tokenization platform. If you are a large holder of XRP, complete the form below to express interest,” the project posted on September 10. On Saturday, the DeFi Business Development (BD) Lead at Axelar Leo Wu summarized the stage message more bluntly: “gmXRP @axelar + @MidasRWA — Infinite buying power for XRP,” alongside photos of the slide deck.

Early reactions inside the XRP community homed in on the promised carry. “mXRP will likely be the biggest catalyst this quarter to drive significant adoption and activity on XRPL. 10% APY on XRP through DeFi yield and by just holding mXRP is massive,” wrote Panos Mekras (co-founder & CEO at Anodos Labs) via X.

He added that an XRP/mXRP liquidity pool could quickly dominate XRPL volumes and that LPs would “virtually have zero risk and near-zero impermanent loss,” while earning from fees and yield. While those expectations are promotional and unproven, they capture the tenor of sentiment around the launch.

What mXRP Is—And How Axelar And Midas Fit

Based on materials shared publicly, mXRP is presented as a liquid, yield-bearing representation of deposited XRP. Users would deposit XRP and receive mXRP; the mXRP’s value accretes from the strategies run on the pooled collateral.

Event notes circulating on X attribute the product structuring to Midas (a European tokenization platform) and the cross-chain plumbing to Axelar, with a Korean digital-asset manager responsible for operating strategies on the back end. The slide language emphasizes “advanced strategies and auto-compounding,” and frames mXRP as a “perpetual buyer of XRP” that bolsters XRPL liquidity and “ecosystem strength.” These specifics come from the conference stage and social-media reporting; formal documentation has not yet been published.

Axelar’s role in the stack is consistent with its broader integration work on XRPL this year. In June, Axelar announced it had delivered the first cross-chain connectivity for the XRP Ledger EVM Sidechain, enabling wrapped XRP as native gas and wiring XRPL into more than 80 networks and cross-chain apps via Squid. The company has also highlighted “Earn yield onchain… start with XRP and Stellar” in its public messaging—context that helps explain how a yield-bearing XRP wrapper could source liquidity and strategy execution across venues.

Midas, for its part, has been rolling out “Liquid Yield Tokens” backed by baskets of DeFi fund strategies in 2025—an adjacent template that provides a reference point for how tokenized claim-on-yield instruments can be structured under EU oversight. The mXRP wrapper appears to apply that tokenization logic to XRP collateral specifically, with Axelar providing the cross-chain rails.

The core idea behind “infinite buying power” is straightforward: demand to mint mXRP programmatically purchases XRP as base collateral; compounding yields grow the collateral base over time; and integrations that require mXRP/XRP liquidity create additional, recurring order flow.

Advocates argue that this creates a positive feedback loop in which “mXRP usage → deeper XRP liquidity,” and more liquidity invites more integrations, which in turn brings more capital on-chain. “The Infinite Money Glitch… with @MidasRWA mXRP that becomes a ‘perpetual buyer of $XRP,’” one widely shared summary read.

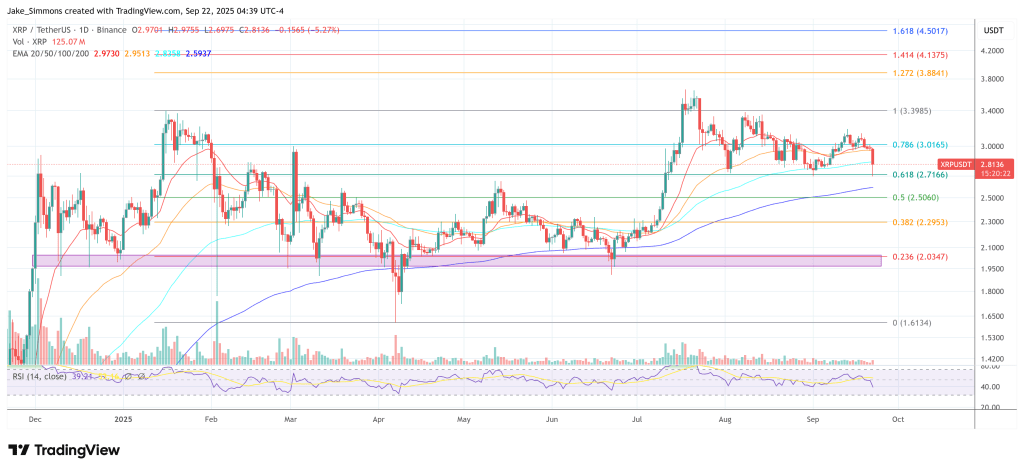

At press time, XRP traded at $2.81.

You May Also Like

When is the flash US S&P Global PMI data and how could it affect EUR/USD?

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus