Simple signs of trustworthy forex brokers with low spreads for traders in Nigeria

Forex trading has become widespread in Nigeria, where it is especially appealing for new traders. It is a lucrative way to make money online right on your phone or computer. What many people don’t know is that finding an appropriate broker is the key to success. On the flipside, choosing the right broker can sometimes feel like a great challenge, particularly for those who are new to trading.

However, it becomes easier with the proper techniques. This guide will assist you in understanding how to spot safe and honest forex brokers with low spreads so you can protect your money and trade with faith.

Check the Broker’s Regulation in Nigeria

When looking for forex brokers with low spreads, always check if the broker is regulated by a real financial authority in Nigeria or international regulatory bodies around the world. Regulation means that someone is keeping an eye on the broker to make sure they follow certain rules. It is a security for Nigerian investors.

A regulated broker safeguards your money, observes strict rules, and provides you with more peace of mind while trading in Nigeria, even if you are just starting out.

Look for Transparent Spread Information

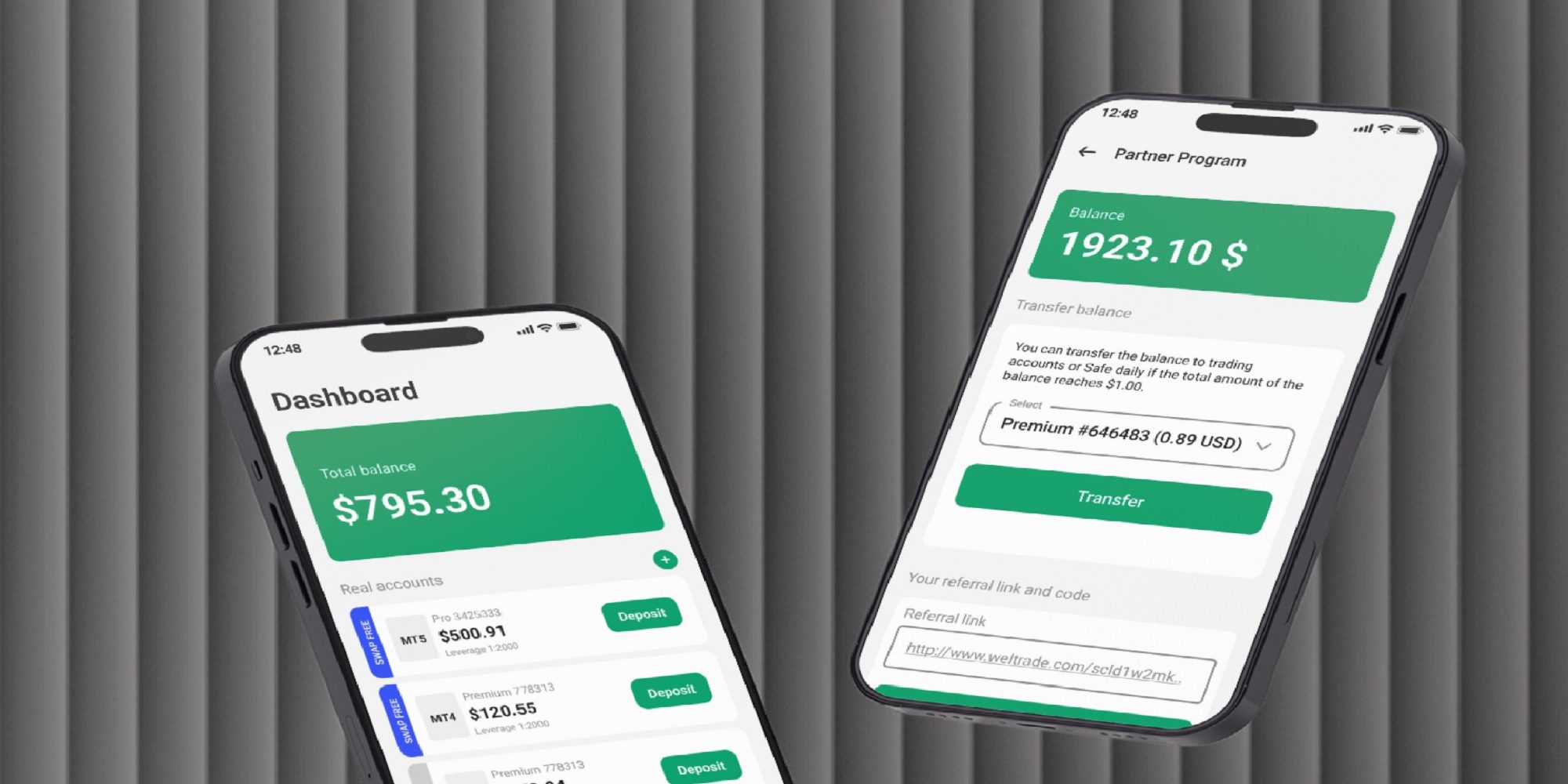

Honest forex brokers with low spreads, like Weltrade, always show their spread costs clearly on their website or trading platform. When you see clear numbers, you know exactly what you will pay each time you open a trade.

If a broker hides this information or makes it hard to understand, it is better to avoid them and choose one that is open and simple.

Confirm Fast and Reliable Trade Execution

Good forex brokers with low spreads should let your trades open quickly and smoothly. Fast execution helps you get the price you want without delays.

When a broker is slow, you may lose money because prices can change quickly. A trustworthy broker will show their execution speed and work hard to give you steady, fast trades every day.

Review Deposit and Withdrawal Options in Nigeria

When choosing a forex broker with low spreads, look for one that makes deposits and withdrawals easy for individuals in Nigeria. Trustworthy brokers support local banks, trusted apps, and offer simple and fast payment options.

Furthermore, fast deposits and quick withdrawals indicate that the broker is concerned about Nigerian traders and wants you to enjoy trouble-free trading without delays or extra stress.

Test the Customer Support Response Time

A trustworthy broker should answer your questions quickly. When evaluating forex brokers with low spreads, consider sending a message to their support team before joining. Or better, make a call and talk to them. You will get a great idea of what their customer support looks like.

A reputable broker with low spreads should answer fast and provide all the information you need to make informed decisions. If they neglect you or take too long to react, it may be a signal that they won’t help you when you or don’t have the low spreads you want to get started with trading.

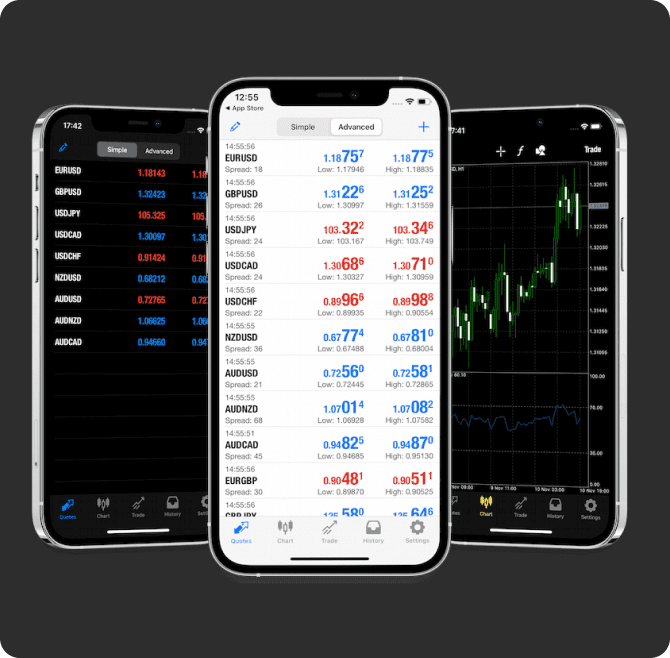

Check Platform Stability During Peak Hours

A stable trading platform is essential when using forex brokers with low spreads. There are some platforms that may freeze or lag during busy trading times. A strong platform should withstand heavy market activity without slowing down.

You should be able to open and close trades swiftly without having to pause for too long for the platform to answer.

Conclusion

When you follow the steps provided above, it becomes easier to locate a trustworthy forex broker with low spreads in Nigeria. Always check for regulation, platform safety, support quality, and real reviews. Whether you are interested in the lowest spread forex broker or prefer forex brokers with low leverage, selecting wisely will enable you to trade safely and safeguard your money as you expand.

5 tips to choose the best forex broker in Nigeria

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

SEC dismisses civil action against Gemini with prejudice