Polymarket Founder Shayne Coplan Teases POLY Token, Becomes Youngest Self-Made Billionaire

Polymarket founder and CEO Shayne Coplan has teased the launch of a native POLY token for the predictions platform shortly after being crowned the youngest self-made billionaire.

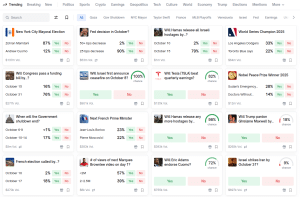

The hint came via a post on X showing ”$POLY” alongside crypto tickers $BTC, $ETH, $BNB, and $SOL, suggesting the platform may enter the market soon.

In his post, the CEO included a snapshot of the current mindshare in the market that showed Polymarket in fifth place behind BTC, BNB, SOL and ETH, but ahead of cryptos including Aster (ASTER) and XRP.

Coplan A Billionaire After NYSE Parent Company Acquires $2B Stake

Coplan’s post comes shortly after news broke that New York Stock Exchange (NYSE) parent, Intercontinental Exchange (ICE), invested $2 billion in Polymarket.

According to an X post by Polymarket, the deal values Polymarket at a $9 billion post-money valuation.

Following the investment, Bloomberg has crowned the CEO as the youngest self-made billionaire and added him to its Billionaires Index.

Coplan, who is now 27 years old, launched Polymarket in June 2020 following a year-long study on how prediction markets could improve decision making.

Through the platform, users are able to place wagers on a variety of outcomes ranging from elections to sports to economic indicators. These wagers can also be made in crypto.

Polymarket home screen (Source: Polymarket)

The platform’s breakout moment came in 2024 during the US presidential election, when users wagered more than $3 billion on potential outcomes. This surge in activity transformed Coplan’s idea from a niche crypto experiment into a global name.

The rise came with some setbacks. In 2022, Polymarket paid a $1.4 million penalty to settle with the US Commodity Futures Trading Commission (CFTC) over allegations that the platform was offering illegal trading. Soon after this settlement, the platform said that it blocked access for US-based users.

A week after the 2024 US election, the FBI raided Coplan’s apartment. But both the US Justice Department and the CFTC went on to drop investigations into the platform.

In July, Polymarket acquired the CFTC-licensed exchange and clearinghouse QCEX, giving it a legal ground to re-enter the US market.

Not The First Time Polymarket Has Considered Offering A Token

This is not the first time that someone associated with Polymarket has hinted that it is considering launching a native token.

The Polymarket X account had reportedly briefly shared a message alluding to a token launch in November last year, saying that the team “predict future drops”

Last month, Polymarket’s parent company Blockratize also submitted a filing to the US Securities and Exchange Commission (SEC) for its latest funding round, revealing “other warrants.”

That move is reminiscent of dYdX’s pre-launch approach, which raised speculation that a native Polymarket token might enter the market soon.

Polymarket Forms Partnerships With MetaMask

Amid its re-entrance into the US market, Polymarket has formed multiple partnerships as part of a broader expansion push.

Earlier this year, the platform partnered with X (formerly Twitter), which is now owned by Tesla and SpaceX founder Elon Musk.

Via that partnership, Polymarket will become the official prediction market partner for X.

More recently, Web3 wallet provider MetaMask said that it will partner with Polymarket later this year to expand its offerings to prediction markets. The upcoming integration will make Polymarket directly available through MetaMask’s wallet, and will give users the ability to buy and sell “shares” to bet on the variety of events available on the platform.

In August, Polymarket also secured an investment from 1789, a venture capital firm with ties to Donald Trump Jr.

While the exact terms of that investment have not been disclosed, Polymarket said that Donald Trump Jr. will join the company as an adviser.

You May Also Like

Thumzup Drops $2M on Dogecoin, Doubles Down With DogeHash Mining Buy

VIRTUAL Weekly Analysis Jan 21