Bitcoin miners Cipher, Bitdeer, and HIVE narrow hashrate divide

Mid-tier Bitcoin miners are closing the gap on industry leaders in realized hashrate following the 2024 halving.

- Mid-tier miners rapidly expanded after the 2024 halving, closing in on top players.

- Public miners doubled their realized hashrate to 326 EH/s, a one-year record increase.

- Mining sector debt surged to $12.7B amid heavy investment in rigs and AI ventures.

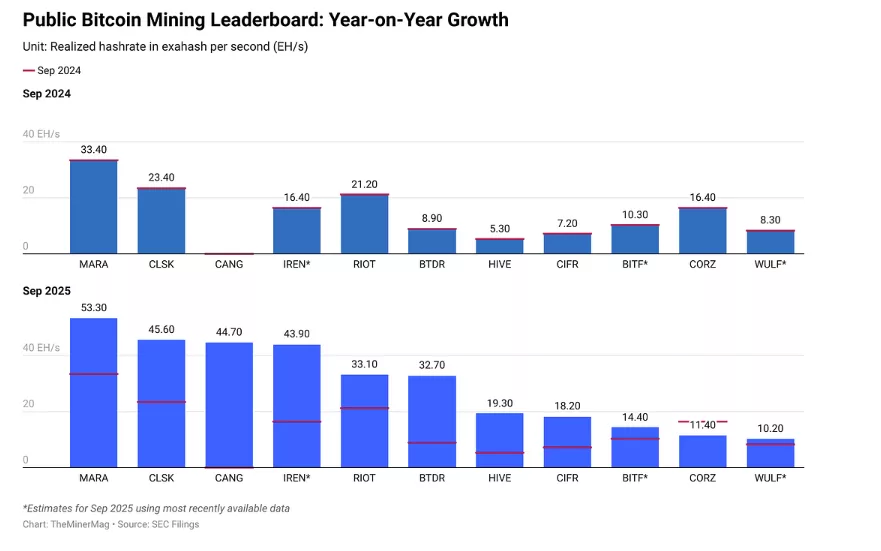

Cipher Mining, Bitdeer and HIVE Digital have quickly expanded their operations after years of infrastructure growth and narrowed the distance to top players like MARA Holdings, CleanSpark and Cango.

The change is a more level playing field in the mining sector. “Their ascent highlights how the middle tier of public miners — once trailing far behind — has rapidly scaled production since the 2024 halving,” The Miner Mag wrote in its latest Miner Weekly newsletter.

Top Bitcoin miners doubled realized hashrate

MARA, CleanSpark and Cango maintained their positions as the three largest public miners. Rivals including IREN, Cipher, Bitdeer and HIVE Digital posted strong year-over-year increases in realized hashrate.

The top public miners reached 326 exahashes per second (EH/s) of realized hashrate in September, more than double the level recorded a year earlier. Collectively, they now account for nearly one-third of Bitcoin’s (BTC) total network hashrate.

Hashrate measures the computational power miners contribute to securing the Bitcoin blockchain. Realized hashrate tracks actual onchain performance, or the rate at which valid blocks are successfully mined.

For publicly traded miners, realized hashrate is a closer indicator of operational efficiency and revenue potential. The metric has become a key measure ahead of third-quarter earnings season.

Mining debt surges to $12.7 billion

Bitcoin miners are taking on record debt levels and also expands into new mining rigs, artificial intelligence infrastructure and other capital-intensive ventures. Total debt across the sector has jumped to $12.7 billion, up from $2.1 billion just 12 months ago.

VanEck research noted that miners must continuously invest in next-generation hardware to maintain their share of Bitcoin’s total hashrate and avoid falling behind competitors.

Some mining companies have turned to AI and high-performance computing workloads to diversify revenue streams. The change comes after dropping margins following the 2024 Bitcoin halving, which reduced block rewards to 3.125 BTC.

The debt increase shows aggressive expansion plans across the industry. Mining companies face pressure to scale operations quickly or risk losing market share to better-capitalized rivals.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Cryptos Signal Divergence Ahead of Fed Rate Decision