The Number of Transactions on the Ethereum Network Has Reached a New ATH

- On January 17, the average number of transactions on the Ethereum network reached 2.43 million.

- This is a new all-time high.

- Fees also fell, to $0.15.

- This indicates growing activity, but also makes Ethereum inflationary.

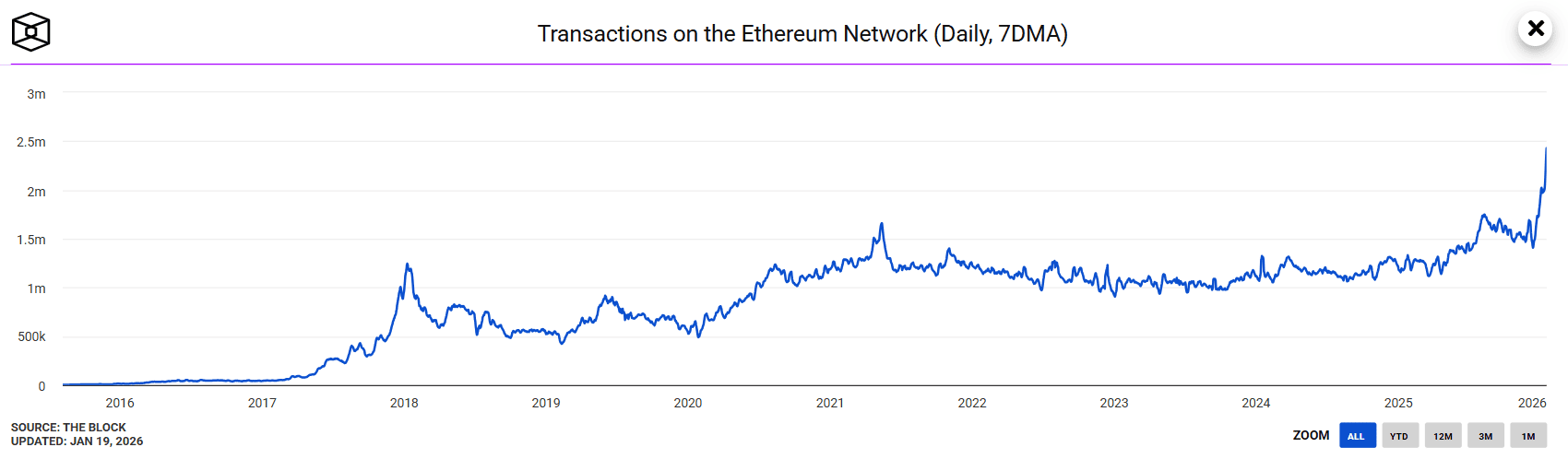

On January 17, 2025, the seven-day moving average (7DMA) of the number of transactions on the Ethereum network reached 2.43 million, according to a dashboard by The Block. This is a new all-time high.

As can be seen in the chart below, the metric has been growing since mid-December 2025, when the Fusaka upgrade was deployed on the mainnet. The previous all-time high was set in May 2021.

7DMA metric of the number of transactions on the Ethereum network. Source: The Block.

7DMA metric of the number of transactions on the Ethereum network. Source: The Block.

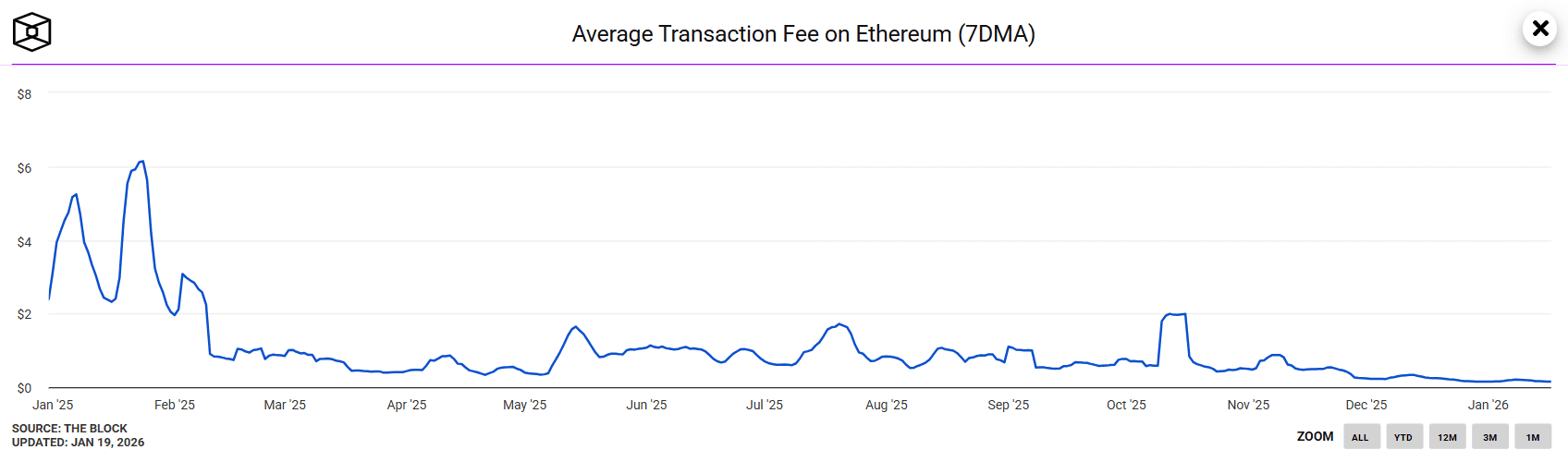

Stable low gas fees contributed to the growth in user activity. The 7DMA for this indicator fell to $0.15 as of January 17.

7DMA metric of gas fees on the Ethereum network. Source: The Block.

7DMA metric of gas fees on the Ethereum network. Source: The Block.

We covered the Fusaka upgrade in more detail in a separate article. The hard fork, among other things, increased blob space and implemented PeerDAS (Peer Data Availability Sampling).

Before that, the network recorded a record daily increase in new wallets.

All this indicates that the ecosystem is showing signs of revival at the fundamental level. The growth in the number of new addresses points to an influx of users, while the expansion of the gas limit reduces the load on the network and makes transaction costs more predictable.

At the same time, the reduction in fees and, consequently, the volume of Ethereum burning negatively affects the deflationary nature of the asset.

In particular, according to the Ultrasound Money portal, the coin supply is growing by 0.8% per year. At the same time, the increase in the volume of assets in staking only exacerbates this trend.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Cryptos Signal Divergence Ahead of Fed Rate Decision