Will Traders Buy the Dip? Key Signals and Indicators to Watch

Ether has entered a new phase of market activity as futures dynamics shift. After a prolonged period of selling pressure from derivatives traders, Ether’s net taker volume has turned positive, signaling renewed conviction among market participants. The move comes as Ether remains perched above key psychological support near 3,000 and liquidity clusters begin to redraw at higher levels. Analysts say the development could foreshadow a broader liquidity-driven move, contingent on how futures positioning evolves in the coming sessions.

Key takeaways

- Ether net taker volume reached roughly 390 million since Jan. 6, the largest buy imbalance since January 2023.

- Since 2023, positive taker volume has aligned with range bottoms and the continuation of uptrends.

- Ether holds above the 3,000 support level despite a negative CVD, indicating absorption by larger players.

- The shift suggests a structural change in futures demand, possibly preceding multi-week trend expansions.

Tickers mentioned: $ETH

Sentiment: Bullish

Price impact: Positive. The positive taker volume signals renewed buy-side conviction that could support a move higher if the trend persists.

Trading idea (Not Financial Advice): Hold. Monitor price action near the 3,000 support and the upper liquidity bands for signs of a breakout or a deeper pullback.

Market context: The development aligns with a broader rotation in crypto markets from pure sell-side pressure toward liquidity-driven upswings and renewed futures interest.

Ether’s Net Taker Volume has registered roughly 390 million in positive imbalance since Jan. 6, marking its strongest buy-side dominance since January 2023. The metric measures whether traders are aggressively buying at market prices or selling into bids; a positive reading signals conviction about the asset’s longer-term value. The latest reading suggests renewed demand from futures participants after a prolonged period of seller pressure.

Ether Net Taker Volume. Source: CryptoQuantHistorically, sustained positive flips in Net Taker Volume since 2020 have tended to coincide with bottoming ranges or early uptrends rather than local tops. A positive reading generally reflects a broader set of traders positioning for a continuation of the trend, sometimes ahead of the price action that confirms the move. In the current cycle, the shift away from sell-side dominance appears to reflect a structural rebalancing in futures demand rather than a fleeting squeeze.

In the longer run, the signal could be meaningful for market entrants watching for a durable shift in sentiment, though participants should remain mindful of broader macro movements and the evolving regulatory environment.

Ether chases underlying liquidity

CryptoQuant data noted that while Ether traded near 3,000, cumulative volume delta remained negative at -3,676 ETH on Jan. 19, signaling near-term selling pressure. Despite this, the 30-day correlation between price and CVD sits around 0.62, suggesting price action continues to be supported by available liquidity. This divergence points to a corrective phase, with short-term traders booking profits while larger participants gradually reposition to keep Ether around the 3,000 level.

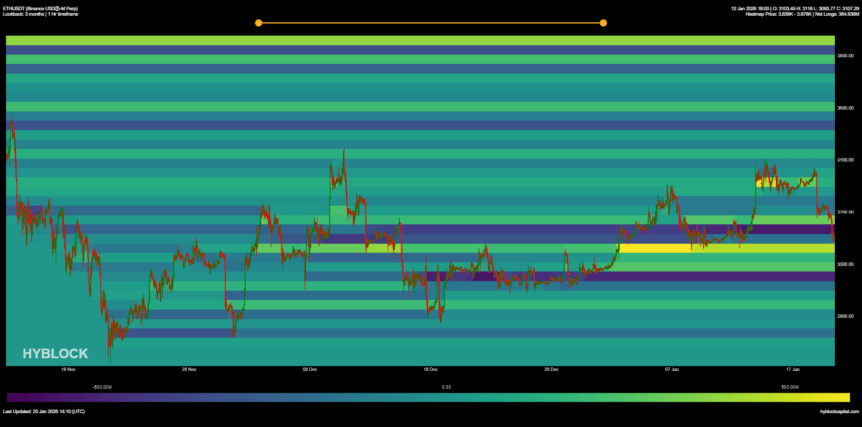

Ether net long position concentration. Source: Hyblock

Ether net long position concentration. Source: Hyblock

The broader technical landscape remains constructive as long as daily closes hold above the 3,000 threshold. The five-month point of control sits between roughly 3,050 and 3,140, anchoring near-term action and providing a reference for potential upside if liquidity rebalances in favor of buyers. Hyblock data also points to roughly 540 million in net long exposure near 3,100, with another sizable liquidity cluster below 3,000, implying the market could oscillate within this range as demand shifts.

This article was originally published as Will Traders Buy the Dip? Key Signals and Indicators to Watch on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Qatar wealth fund commits $25bn to Goldman investments