Cardano’s Midnight Token Hits New All-Time High Amid a 50% Rally

Midnight has extended its sharp rally as strong investor demand pushed the token to a new all-time high. The project associated with Cardano founder Charles Hoskinson continues to attract attention after sustaining upside momentum.

While NIGHT has already delivered outsized gains, technical and macro signals suggest additional upside potential remains.

Midnight Holders Are Watching A New Sunrise

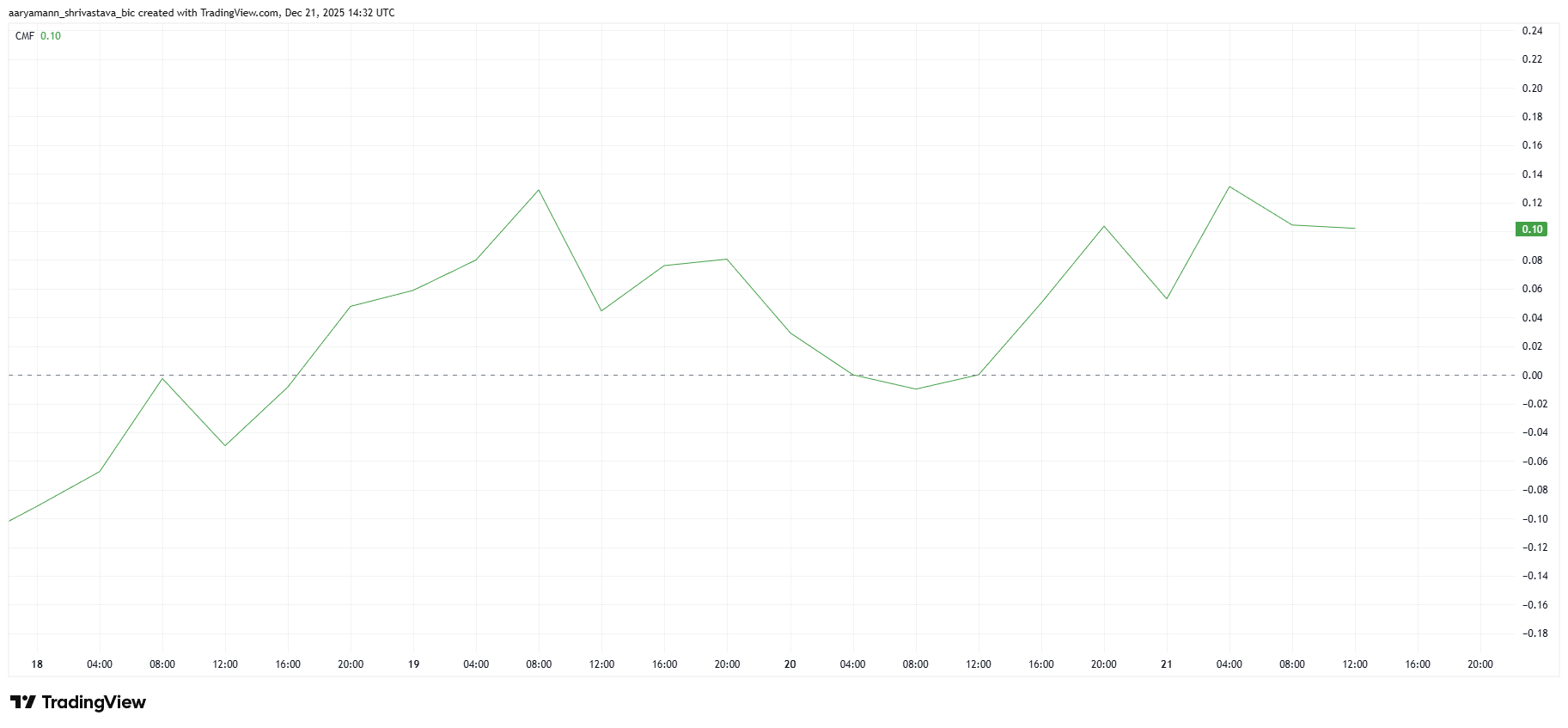

Investor support for NIGHT remains firm. The Chaikin Money Flow sits in positive territory above the zero line, confirming net inflows. Although the indicator dipped slightly over the past 48 hours, capital continues entering the asset, signaling ongoing confidence rather than distribution.

Much of this demand is linked to Midnight’s association with Charles Hoskinson, the founder of Cardano. That connection has boosted credibility and visibility.

In the short term, this narrative-driven interest is likely to keep capital rotating into NIGHT, supporting elevated price levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

NIGHT CMF. Source: TradingView

NIGHT CMF. Source: TradingView

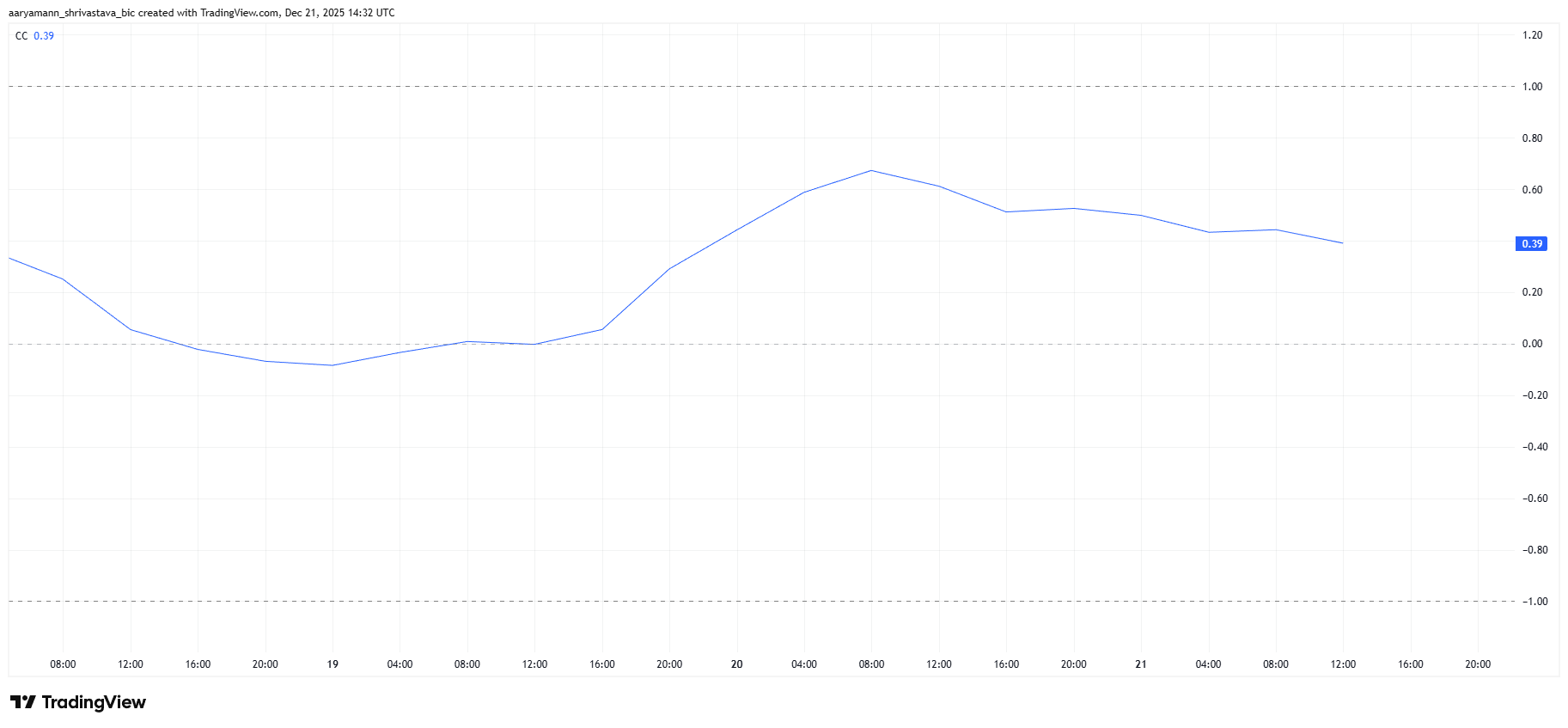

Macro conditions also favor NIGHT’s performance. The token shows a weak correlation with Bitcoin, insulating it from broader market uncertainty. This independence has allowed NIGHT to trend higher even as Bitcoin struggles to regain momentum.

Low correlation often benefits emerging assets during periods of BTC consolidation. With Bitcoin lacking a clear recovery signal, NIGHT’s ability to move on its own fundamentals remains a key advantage. This dynamic could continue supporting relative outperformance in the near term.

NIGHT Correlation To Bitcoin. Source: TradingView

NIGHT Correlation To Bitcoin. Source: TradingView

NIGHT Price Forms New All-Time High

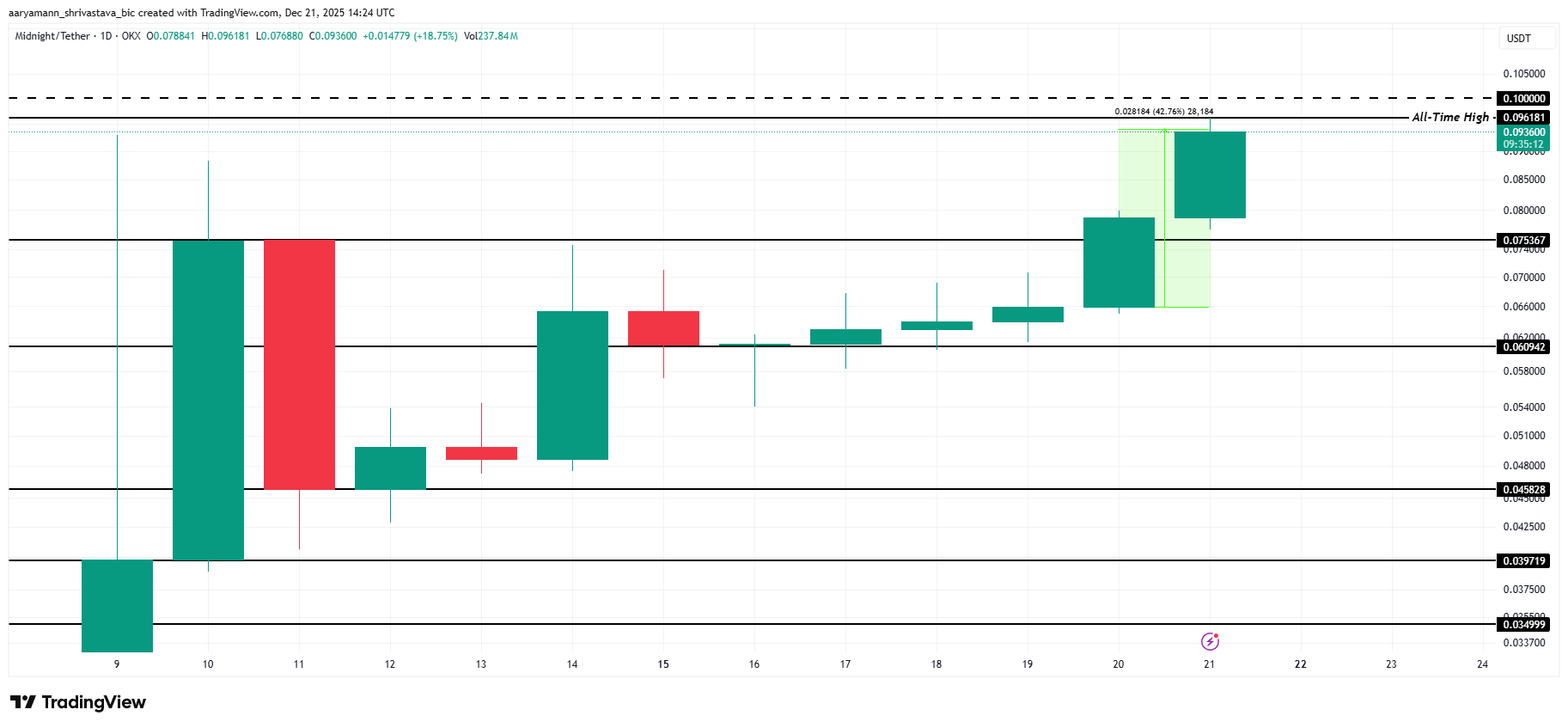

Midnight price surged 42.7% over the past 24 hours, trading near $0.093 at the time of writing. The rally resulted in a new intraday all-time high of $0.096. Momentum remains strong, reflecting aggressive buying and sustained interest following the breakout.

Bullish sentiment and favorable macro conditions support further upside. If current trends persist, NIGHT could push beyond the $0.100 level. Entering the 10-cent range would mark a psychological milestone, potentially drawing additional speculative interest and reinforcing momentum.

NIGHT Price Analysis. Source: TradingView

NIGHT Price Analysis. Source: TradingView

Risks remain if holders begin taking profits. A wave of selling could pull NIGHT back toward the $0.075 support. Losing that level would weaken the bullish structure. Further downside could extend to $0.060, invalidating the current bullish thesis and increasing volatility.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge