Polkadot Levels Up With Runtime Upgrade Focused on Real Apps

- Polkadot has announced a runtime upgrade that will boost speed for apps, confirm transactions faster and ease development on the network.

- Parity Technologies, the for-profit behind the network, recorded a net profit in Q4 last year for the first time, boosted by the return of founder Gavin Wood.

Polkadot has announced a new upgrade to its mainnet which includes faster app execution and native smart contracts. The network says it has “levelled up” and that its interface will now feel closer to Web2 while retaining its Web3 decentralization.

The upgrade will make Polkadot a “faster, simpler, more usable network designed for real apps,” it stated on social media. Apps deployed on the network will now feel faster while transactions finality will be quicker. The upgrade also makes it easier to build apps on the network, allowing developers to concentrate on the products and not the protocol engineering.

One of the most significant upgrades, according to the network, is that it now supports native smart contracts. Polkadot operates a mainnet, known as the Relay Chain, and side networks, known as parachains. The Relay Chain does not support smart contracts and dApps; it’s only used for shared security and consensus. Previously, developers had to deploy their smart contracts on parachains like Astar and Moonbeam, as our guide explains.

The Second Age of Polkadot

In addition to faster apps and smart contracts, the upgrade promises to reduce delays and the steps required to perform basic actions on the network. The app ecosystem will also be easier to explore, while developers will no longer face long iteration cycles with their apps. Ultimately, all these improvements are geared toward offering an experience closer to Web2, but underpinned by Web3 technology.

DOT, the native token, will also experience a “significantly lower token inflation,” the project says, adding:

The upgrade is the first step in what the network has described as ‘the Second Age of Polkadot.’ As founder Gavin Wood recently explained, the network has long been focused on proving capabilities and improving architecture. This year, it’s shifting to creativity and applications.

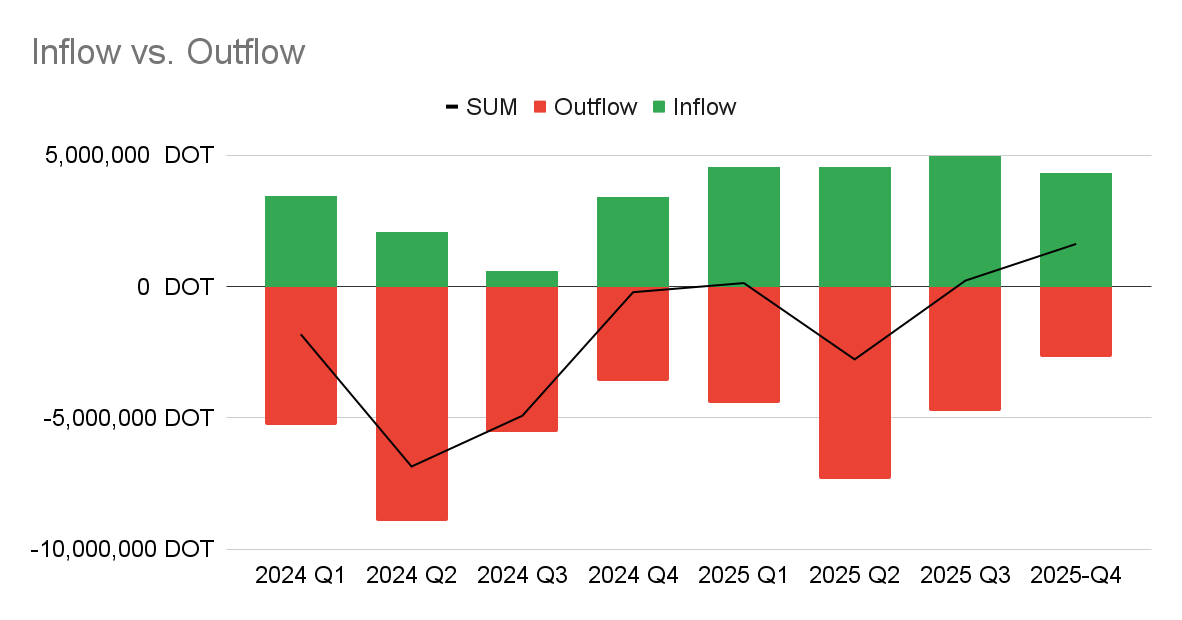

Meanwhile, Parity Technologies, the company that has been developing Polkadot, revealed recently that it had turned a profit for the first time since it started going public with its financials three years ago. After a bruising second quarter last year, the company turned its fortunes around in the third quarter and brought in $4.1 million in the fourth quarter.

Image Courtesy of The Polkadot Forum.

Image Courtesy of The Polkadot Forum.

The turnaround has been attributed to the return of Wood as the Parity Tech CEO, a role he retook in August. He has since doubled down on a lean budget to cut the lavish spending that saw the company splash $87 million in 2024, with $37 million going to advertising. This included spending $5 million to pay social media influencers and $180,000 to stick the network’s logo on private jets in Europe to target high-net-worth individuals.

DOT trades at $1.9 at press time, gaining nearly 2% as trading volume surged 40% to $137 million. Despite the recovery, it’s still in the red on the weekly chart, and after losing the $2 support, analysts say the token’s momentum has been taken over by the bears and could dip further before the end of the week.

However, if it breaks out of a descending wedge pattern it has been stuck in since November, it could trigger bullish momentum, one analyst points out.

Image courtesy of Whales Crypto on X. ]]>

Image courtesy of Whales Crypto on X. ]]>You May Also Like

Spot silver falls below the $100 mark

Solana network saw its active addresses more than double to over 5 million in January, with daily transaction volume jumping to 87 million.