AVAX price eyes all-time low despite Avalanche active users, ETF inflows rise

The AVAX price continued its steep downward trend this week, breaking a crucial support level despite notable positive developments, including soaring ETF inflows and strong network growth.

- AVAX price could crash to a record low after losing a key support.

- The recently launched AVAX ETF added over $1.24 million in assets.

- Avalanche’s active users and transactions have soared recently.

Avalanche (AVAX) token dropped to a low of $10, its lowest level since November 2023. It has crashed by over 80% from its highest level in December 2024.

The ongoing AVAX price crash occurred despite ETF inflows and network growth. Data compiled by SoSoValue shows that the recently launched VanEck Avalanche ETF added over $1.24 million in inflow, bringing the net assets to $3.73 million.

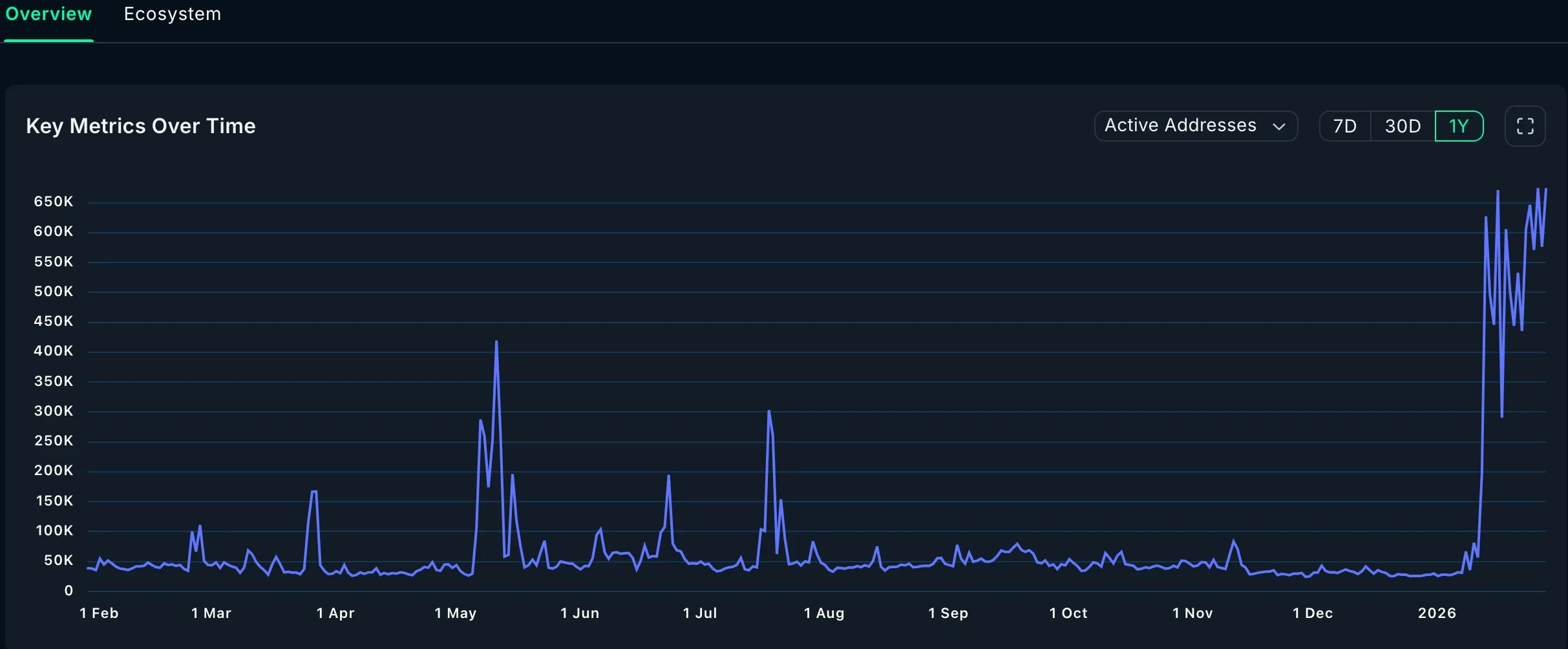

Additional data show that Avalanche’s network is performing well. Its active addresses jumped by 273% in the last 30 days to 1.57 million. Also, the number of active addresses jumped by 3.2% in the last 30 days to nearly 70 million.

Avalanche active addresses | Source: Nansen

Avalanche active addresses | Source: Nansen

This growth has come as the network has become one of the largest players in the real-world asset tokenization industry. Data compiled by RWA show that RWA assets jumped to over $641 million.

This growth occurred as some notable companies, such as Franklin Templeton, Apollo Global, BlackRock, and Janus Henderson, have embraced tokenized funds on Avalanche.

Avalanche is also a major player in the stablecoin industry. Its stablecoin supply jumped to over $2.20 billion, with the number of holders rising to over 3.5 million.

AVAX price technical analysis

The weekly timeframe chart shows that the AVAX price has been in a strong bearish trend in the past few years. It has dropped from a high of $65 in December 2024 to its current price of $10.

The coin has moved below the important support level at $15.11, its lowest level in March and June last year. That price was the lower side of the descending triangle pattern.

Avalanche price has dropped below the 50-week and 100-week Exponential Moving Averages. It has also moved below the Supertrend indicator.

Therefore, the most likely scenario is that the coin continues to rise as sellers target the all-time low of $8.40.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge