Buterin Justifies Long Ethereum Unstaking Process Amid Criticism Over 43-Day Delays

Vitalik Buterin defended the 43-day Ethereum unstaking delays amid growing industry criticism over trapped validator funds.

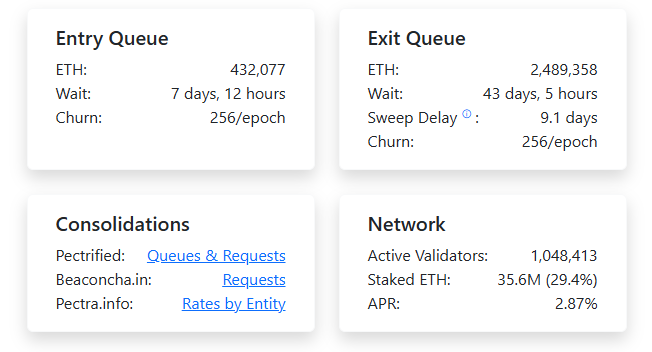

Currently, 2,489,358 ETH sits in the exit queue facing a 43-day wait, while 35.6 million ETH are staked across 1,048,413 active validators earning 2.87% APR, as per ValidatorQueue’s data.

Buterin responded to developer Robert Sags’ criticism that withdrawal delays exceed traditional banking timeframes and harm user experience for retail investors.

“It’s more like a soldier deciding to quit the army. Staking is about taking on a solemn duty to defend the chain,” Buterin wrote on X, emphasizing that “friction in quitting is part of the deal.”

Ethereum Validator Queue (Source: ValidatorQueue)

Ethereum Validator Queue (Source: ValidatorQueue)

Developer Tensions Over User Experience

The exchange highlighted growing tensions between Ethereum’s technical design priorities and mainstream user expectations for digital asset liquidity.

Sags criticized the disconnect between wallet messaging that promotes “easy yield” and the reality of unpredictable withdrawal delays that can trap funds when users need them most.

“What about the average user who is suffering with the delay and needs to pay bills?” Sags questioned, arguing that clearer disclosure about redemption periods would help users make informed decisions.

Buterin acknowledged these UX concerns, admitting the Ethereum Foundation “needs to be more active at the UX layer” and has been working to address usability issues over recent months.

The Ethereum founder argued that reducing exit delays would make the chain “much less trustworthy from the PoV of any node that does not go online very frequently,” positioning the delays as essential for maintaining network stability.

Queue Dynamics Create Market Tension

The current validator queue mechanics operate through strict churn limits of 256 validators per epoch, creating bottlenecks when exit demand surges beyond the network’s processing capacity.

Recent market data shows the exit queue peaked at over 1 million ETH worth approximately $5 billion in late August, before settling to current levels, still requiring 43 days to clear completely.

Meanwhile, the entry queue containing 432,077 ETH faces just a 7-day wait, creating an asymmetric dynamic that traps more supply than it releases in the short term.

This imbalance has created what analysts describe as artificial supply shortages, with previous Cryptonews reports highlighting how 833,000 ETH trapped in queues reduced available trading supply.

The 9.1-day sweep delay adds additional friction to the exit process, meaning validators face multiple layers of waiting even after initiating unstaking requests.

Exchange flow data reveals these queue dynamics are reducing sell pressure, with Bitcoin and Ethereum inflows hitting 1-year lows as larger holders avoid moving assets to trading platforms.

Staking demand has continued growing despite the exit delays, with the queue reaching $3.7 billion in early September, its highest level since the Shanghai upgrade enabled withdrawals in 2023.

Security Versus Liquidity Trade-offs Spark Broader Debate

Notably, the unstaking controversy is a fundamental tension between blockchain security models and modern financial expectations for asset liquidity.

Buterin’s military analogy reflects Ethereum’s proof-of-stake design philosophy, where validator commitments must be sticky enough to prevent coordinated attacks or mass exodus events that could destabilize consensus.

Critics argue this creates a dangerous precedent where large holders face material liquidity constraints, potentially amplifying sell pressure when exits do occur or forcing investors toward liquid staking derivatives.

The debate has sparked discussions about potential protocol modifications, including proposals for faster validator key switching that would allow repositioning without full exits.

One X user suggested implementing “a faster process to unstake and restake with different clients that’s not adding to the queue” to improve client diversity without compromising security guarantees.

Buterin responded favorably to a “switch your keys” function where validators would remain vulnerable to slashing from old keys temporarily while continuing to stake, describing it as something that “would only help, and would not hurt any guarantees.”

However, any changes to the current queue system would require broad consensus among Ethereum developers and stakeholders, given the security implications of reducing validator commitment friction.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Husky Inu (HINU) Completes Move To $0.00020688