BlackRock’s IBIT Bitcoin ETF Shows “Utopia-Esque” Returns Even After Flash Crash: Bloomberg

BlackRock’s spot Bitcoin ETF (exchange-traded fund) IBIT is showing “utopia-esque” returns even after the $19 billion crypto market flash crash.

That’s according to Bloomberg Intelligence ETF analyst Eric Balchunas, who noted the fund has surged 76% in the past year despite the recent slump. It’s also up 37% in the past six months.

According to data from Google Finance, IBIT’s price fell over 3% on Oct. 10 and another 3% in after-hours trading in response to US President Donald Trump announcing additional tariffs of 100% on China’s exports.

IBIT price (Source: Google Finance)

Investors Should “Zoom Out” To See IBIT’s True Performance

IBIT is designed to track the price of the leading crypto, Bitcoin (BTC), while also providing investors with a regulated way to buy the digital asset.

Commenting on IBIT’s performance since its inception last year, Balchunas said that the fund has shown stellar returns.

He criticized investors for all of the “angst and whining” around the ETF’s performance following the latest crypto market correction that wiped out over $19 billion in trades in a matter of hours.

During that correction, Bitcoin plummeted below the $120K mark and trades at $111,338.31 as of 12:32 a.m. EST, CoinMarketCap data shows. Like IBIT, BTC is up more than 77% over the past year.

“Daily charts are the media’s best friend but an investor’s worst enemy,” Balchunas said, before telling his over 370.8K followers to “zoom out” when they look at the fund’s performance in order to see the bigger picture.

IBIT was closing on $100 billion in assets under management milestone before the flash crash with about $99.5 billion in funds.

“It’s still inevitable milestone imo but wild just how close it got,” Balchunas wrote. “Two steps forward, one step back in effect.”

IBIT Pulls In Capital As Other US Spot Bitcoin ETFs Bled On Friday

IBIT has been the spot Bitcoin ETF of choice for US investors, and has seen the majority of cumulative inflows since the funds hit the market last year.

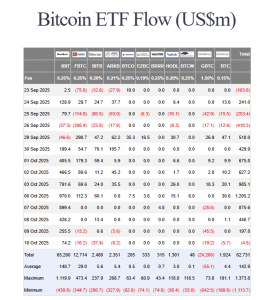

Data from Farside Investors shows that IBIT has seen $65.260 billion in cumulative inflows as of Oct. 10, with Bitcoin’s appreciation adding about $34 billion to the ETF’s AUM. The next-biggest is Fidelity’s FBTC, which has seen $12.714 billion in cumulative inflows.

US spot Bitcoin ETF flows (Source: Farside Investors)

IBIT is also on a nine-day inflow’s streak. This is after the investment product pulled in another $74.2 million on Friday, while the other funds either recorded outflows or no new flows on the day.

Since Sept. 30, IBIT has seen over $4.4 billion added to its reserves. Its best day during this period was on Oct. 6, when investors added $970 million to the product’s reserves.

You May Also Like

The Channel Factories We’ve Been Waiting For

‘Sinners’ Earns 16 Oscar Nominations, Shattering All-Time Record