Best Meme Coins to Buy as PENGU, TURBO, BRETT Hit Top Gainers

The market is regaining its footing as crypto and equities rebound together after a wave of volatility. Investors appear increasingly confident as global risk sentiment steadies, helped by major indices flashing early signs of recovery.

Renewed optimism is also being fueled by macro clarity, allowing traders to reassess the week’s heavier news with a calmer lens. This shift comes as traders begin scouting the best meme coins to buy, especially with several smaller caps showing early strength.

The broader rebound suggests a market that is learning to absorb shocks more efficiently, even when headlines spark short-lived selloffs. Rising momentum in Bitcoin and Ethereum adds weight to the recovery narrative, pulling sentiment in a more constructive direction.

Top Meme Coins to Buy Lead Market Rebound as Risk Appetite Returns

Meanwhile, outsized gains in select altcoins hint that risk appetite is quietly returning beneath the surface. The stabilization is particularly notable given how heavily recent macro concerns dominated the conversation just 24 hours ago.

With traditional markets also bouncing, the correlation between crypto and equities appears to be working in favor of digital assets.

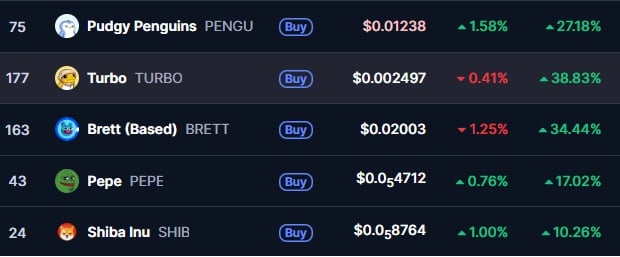

Source – CoinMarketCap

This renewed strength is especially visible in the top daily gainers, where some of the best meme coins to buy are posting sharp recoveries and drawing fresh trader interest.

Pudgy Penguins (PENGU)

Pudgy Penguins is gaining attention after a 27% daily rise, though it remains down over 23% this month and below its prior billion-dollar valuation. The project stands out by acting less like a typical meme coin and more like a growing brand with real intellectual property goals.

Instead of relying solely on community hype or basic utility, the team is building an IP ecosystem that spans games, physical merchandise, books, and high-profile collaborations such as Kung Fu Panda and NASCAR.

Market data shows top holders adding positions, new wallets deploying capital, and sentiment turning positive as volume rises. With global brand growth, mobile-game recognition, and an expanding community, $PENGU is positioning itself as a distinctive and potentially durable meme-driven IP play.

Brett (Based) (BRETT)

Brett on Base is surging as one of the strongest performers in the market, jumping from a $150 million market cap to $200 million in just a couple of hours. Its 30% daily gain pushes it past Toshi, making it the largest meme coin on the Base chain at the moment.

Despite broader meme sector weakness, $BRETT is still outperforming nearly all competitors and currently ranks among the top meme gainers across all chains. The rally follows its new listing on MuteSwap, though the magnitude of the pump suggests aggressive dip-buying played a larger role.

Many traders see $BRETT’s rebound aligning with Bitcoin’s recent shift out of a multi-week downtrend, fueling speculation of a broader market breakout. Community sentiment on social platforms also highlights $BRETT’s strong distribution profile and growing status as a potential blue-chip meme coin.

Turbo (TURBO)

Turbo has delivered one of its strongest rallies in months, soaring more than 64% on the week and over 40% in just the past 24 hours. Trading volume exploded with a 500% surge, mirroring the kind of activity last seen during its major run last summer.

The move stands out because it wasn’t part of a broader market surge. Fresh wallet accumulation has intensified, with seven new wallets purchasing more than $4 million worth of Turbo and exchange balances dropping by roughly 40%.

Technical structure has flipped bullish, and if market sentiment holds, the token may soon attempt another push toward the $0.003 range. This impressive performance has traders scouting $TURBO as one of the best meme coins to buy.

Shiba Inu (SHIB)

Shiba Inu is showing renewed strength as key support levels continue to hold while burn activity accelerates sharply. Recent data highlights a remarkable 1,700% surge in token burns, with more than 37 million SHIB removed from circulation in the past day alone.

Despite earlier softness in price action, Shiba Inu bounced strongly from recent lows, breaking above several resistance levels and trading around the $0.0000870 range. Technical indicators show the token pushing out of a tight consolidation zone.

Although current burn volumes aren’t enough to drive immediate price transformation, they reinforce a deflationary trend that supports long-term value. With supply gradually shrinking and overall sentiment strengthening, $SHIB continues to attract attention as market conditions improve.

Pepe (PEPE)

Pepe has seen a strong 24-hour surge, highlighted by a series of bullish hourly candles that pushed the price up from its recent lows. The token has historically performed best when the broader crypto market is rising, and today’s gains align with BTC and ETH showing solid momentum.

Despite trading far below its previous highs, Pepe continues to demonstrate resilience as one of the stronger meme coins. Support remains firm around the $0.0000040 range, giving holders a level that has repeatedly acted as a springboard for short-term recoveries.

Recent community activity and fresh social engagement have also helped boost sentiment around the token. If macro conditions strengthen further, $PEPE could be positioned for another notable upswing in the coming weeks.

Bitcoin Hyper (HYPER)

Beyond established meme coins, a rising meme coin presale is also gaining interest as its funding approaches $29 million. Bitcoin Hyper has become a standout project due to its ambitious goal of delivering the fastest Bitcoin layer-2 chain built for speed, scalability, and true utility.

Its appeal stems not only from hype but from a clear technological purpose: enabling fast, inexpensive Bitcoin transactions that unlock payments, DeFi tools, and even meme coin ecosystems.

Source – Borch Crypto YouTube Channel

The project’s design allows users to bridge Bitcoin into a high-performance layer powered by Solana’s virtual machine, making advanced DeFi operations possible while maintaining decentralization, positioning it as one of the best meme coins to buy now.

Its tokenomics emphasize community rewards, marketing expansion, and continued L2 advancement. With the presale nearing its final phase, growing participation signals rising confidence in its long-term potential. To take part in the $HYPER token presale, visit bitcoinhyper.com.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

OSL Hong Kong Lists XRP for Professional Investors Amid Signs of Sustained Market Interest

Will XRP Price Increase In September 2025?