Marcos orders DILG, PNP to track down Sarah Discaya over P96-M ghost project

MANILA, Philippines – President Ferdinand Marcos Jr. said on Friday, December 5, that he has ordered the Department of the Interior and Local Government (DILG) and the Philippine National Police (PNP) to track down controversial contractor Sarah Discaya and others allegedly involved in a ghost project in Davao Occidental.

Discaya and nine others are set to faces cases for alleged malversation of public funds and alleged violation of section 3(e) of Republic Act No. 3019 or the Anti-Graft and Corrupt Practices Act over irregularities in the said project in Barangay Culaman in Jose Abad Santos town in Davao Occidental.

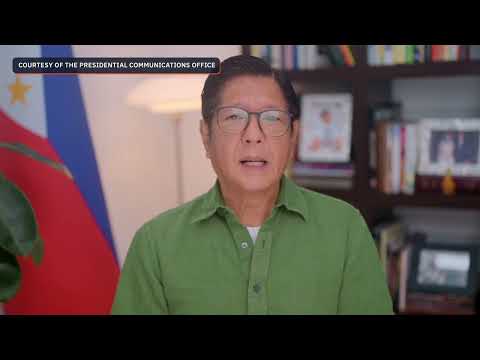

“I have directed [the] DILG and the PNP to ensure that they know the whereabouts of Discaya at no’ng iba pa para paglabas ng arrest warrant ay maaresto na sila kaagad (and the others so they will be immediately arrested once the warrants are out),” the President said in a video message uploaded on Friday.

Citing the Ombudsman’s findings, Marcos said the project never commenced despite being tagged as accomplished in 2022. This was discovered during the PNP Criminal Investigation and Detection Group’s inspection on September 25.

“Kinumpirma ng mga indigenous peoples at barangay official sa kanilang joint affidavit na walang naganap na implementasyon ng proyekto (Indigenous peoples and barangay officials confirmed in their joint affidavit that the project was never implemented),” Marcos said.

Shortly after the President’s announcement, Assistant Ombudsman Mico Clavano said the Office of the Ombudsman directed the filing of the said criminal charges against Discaya, Ma. Roma Angeline Rimando of St. Timothy Construction Corporation, and the following officials of the Department of Public Works and Highways (DPWH) Davao Occidental District Engineering Office:

- District Engineer Rodrigo Larete

- Assistant District Engineer Michael Awa

- Several section chiefs, project engineers, and inspectors

As in the first case involving resigned lawmaker Zaldy Co, the Ombudsman also recommended no bail for the malversation case.

There’s also a twin administrative case attached to the criminal cases filed against the DPWH officials. Clavano said the officials are preventively suspended for six months due to grave misconduct and serious dishonesty cases.

Meanwhile, the criminal cases will be filed with the Digos City Regional Trial Court. Apart from the Sandiganbayan, the Ombudsman may also file cases with the lower courts — depending on the nature of the cases and the salary grade level of those involved.

Under Republic Act No. 10660, RTCs have jurisdiction over graft cases that do not indicate the damage to the government, or when the amount of damage is not more than P1 million. Also, graft cases against public officers with salary grades lower than Salary Grade 27 belong to the lower courts, based on Batas Pambansa Bilang 129 or the Judiciary Reorganization Act. – Rappler.com

You May Also Like

Robinhood Expands to Indonesia via Acquisitions of Buana Capital and PT Pedagang Aset Kripto

Jerome Powell’s Press Conference: Crucial Insights Unveiled for the Market’s Future