Bitcoin Cool Off is Normal, Claims Analyst: US to Push BTC Higher?

Bitcoin (BTC) holds prices near $89,000 as analysts argue the current pullback remains within the boundaries of a healthy cycle correction rather than a full-blown crypto winter.

Bloomberg ETF analyst Eric Balchunas said in a post on X that Bitcoin only gave up the excess created last year after a +122% rise. He added that even if 2025 closes flat or slightly lower, the asset will still maintain its average annual gain of 50%.

“Assets are allowed to cool off once in a while, even stocks. People overanalyzing it IMO,” Balchunas said.

Balchunas also rejected claims that Bitcoin resembles the tulip bubble. He said that tulips collapsed after a three‑year mania, while Bitcoin survived over six major crashes, regulatory pressure, exchange failures, halvings, and global shocks across 17 years.

He added that endurance alone sets Bitcoin apart while arguing that many non‑productive assets retain value, from gold to rare art, and that Bitcoin fits that category without relying on euphoria alone.

US Activity Pressures Bitcoin in December

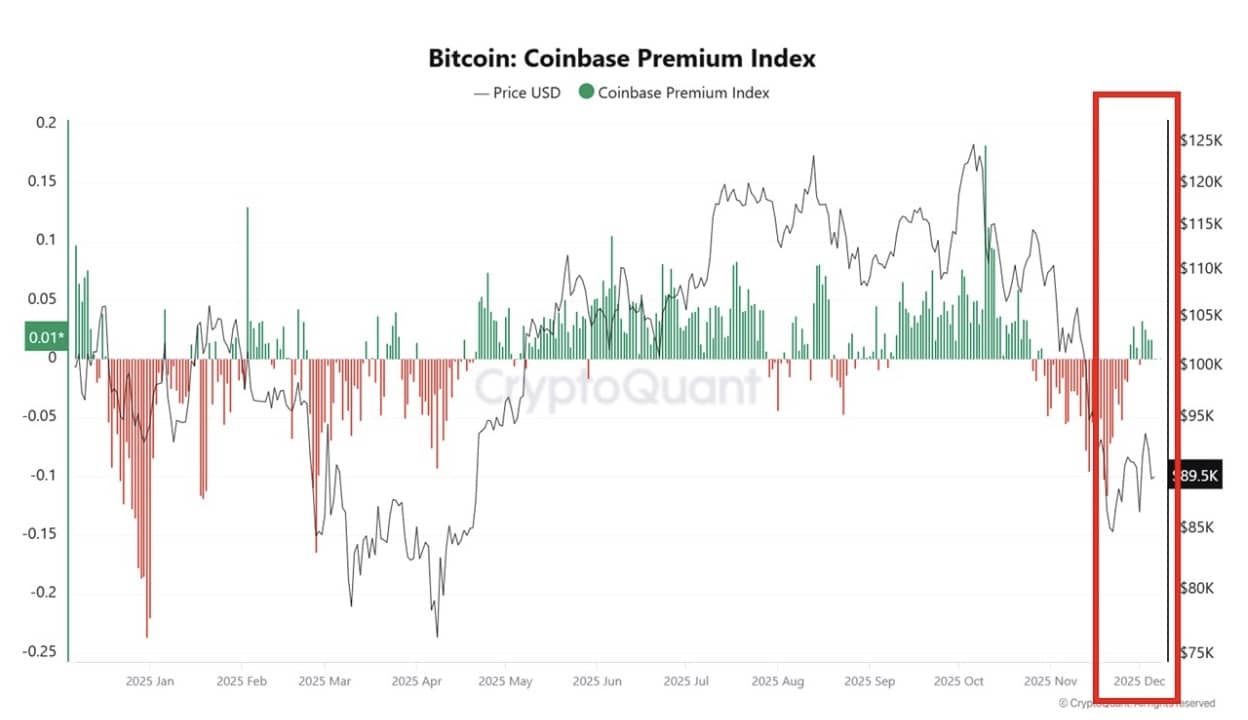

CryptoQuant’s Coinbase Premium Index shows that the recent Bitcoin price crash came mainly from US‑driven selling as December opened. The premium sank into negative territory in late November and early December, which is historically a period of portfolio rebalancing and tax‑loss moves by US institutions.

The pattern fits previous cycles where December premium weakness either paused rallies or exposed stress phases. The difference this year came from a rapid rebound, i.e., the premium returned to positive territory within days.

Coinbase Premium Index for Bitcoin | Source: CryptoQuant

CryptoQuant said that this transition often means that selling pressure has run its course, allowing US demand to reappear. Whether Bitcoin stabilizes or falls again now depends mainly on US liquidity, derivatives behavior, and incoming flows.

Futures Reset Signals Derivative Cooling

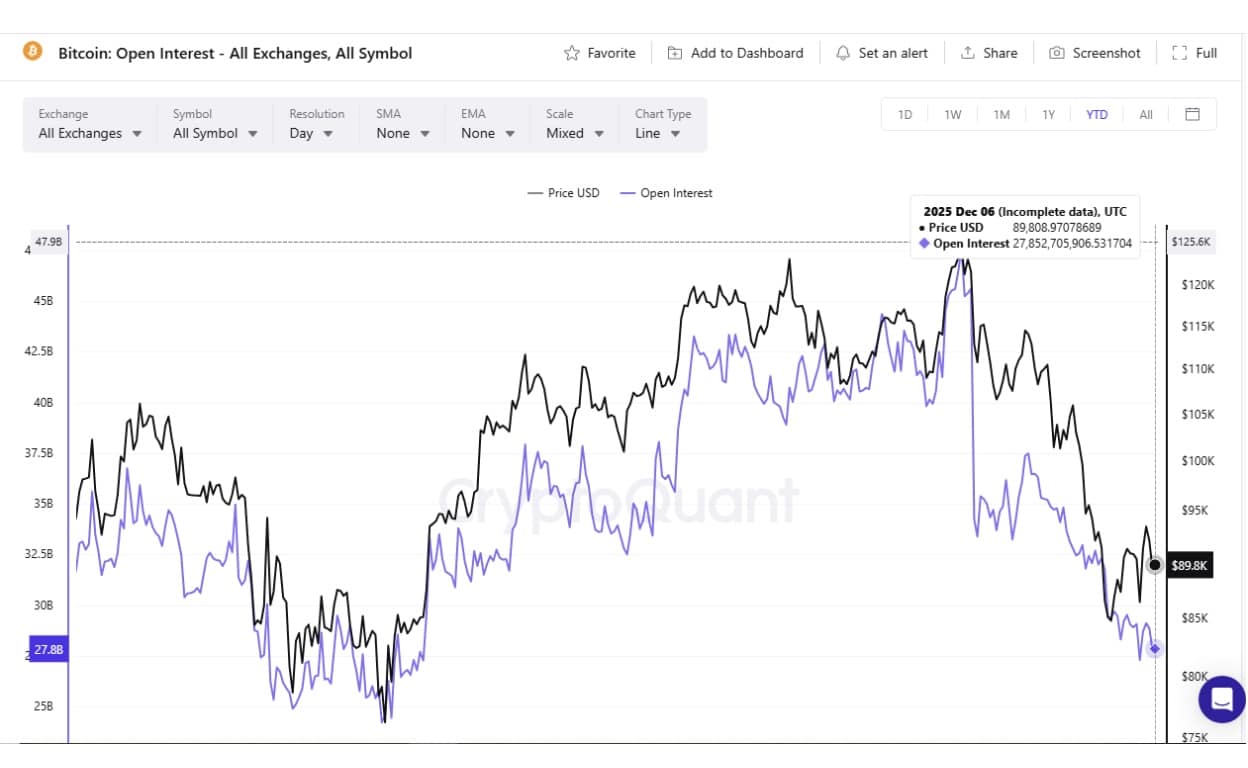

Another CryptoQuant analyst, Carmelo Alemán, pointed to the drop in Open Interest (OI) across all exchanges. He said that price and OI moved lower simultaneously. This is not a sign of spot selling, but of futures closure, Alemán said.

Lower OI clears excess leverage from the system and reduces fake momentum created by short‑term derivatives. He argued that this phase reflects a reset and not the onset of a bearish market, similar to what Balchunas claimed earlier today.

Bitcoin OI chart | Source: CryptoQuant

Alemán also added that price gains paired with rising OI usually represent fragile leverage‑driven rallies that lack real demand.

nextThe post Bitcoin Cool Off is Normal, Claims Analyst: US to Push BTC Higher? appeared first on Coinspeaker.

You May Also Like

When A Scam Sounds Too Real: Victim Ignores Cops And Loses Thousands At Crypto ATM

Adoption Leads Traders to Snorter Token