The TechBeat: Measuring Non-Linear User Journeys: Rethinking Funnels Metrics in A/B Testing (12/7/2025)

How are you, hacker? 🪐Want to know what's trending right now?: The Techbeat by HackerNoon has got you covered with fresh content from our trending stories of the day! Set email preference here. ## Measuring Non-Linear User Journeys: Rethinking Funnels Metrics in A/B Testing  By @indrivetech [ 7 Min read ] A deep dive into user reorders, hidden behavioral patterns, and how aggregated funnels improve A/B test accuracy in non-linear user journeys Read More.

By @indrivetech [ 7 Min read ] A deep dive into user reorders, hidden behavioral patterns, and how aggregated funnels improve A/B test accuracy in non-linear user journeys Read More.

Agentic UX Over "Chat": How to Design Multi-Agent Systems People Actually Trust

By @designchurchill [ 9 Min read ] Principles for designing agentic UX: verification, transparency, handoffs, and moving beyond chat interfaces. Read More.

How To Get a First Name Domain for Less Than $101

By @cv-domain [ 3 Min read ] Missed out on FirstName.com? .cv domain could be your last real chance to own your name online. Secure it now. Read More.

Code Review Anti-Patterns: How to Stop Nitpicking Syntax and Start Improving Architecture

By @nikitakothari [ 5 Min read ] Code reviews are pricey. Let machines catch style issues so humans can focus on what matters: security, scalability, and architecture. Read More.

Stop Building Your Product for Yourself: Why Most Early-Stage Startups Fail at Marketing

By @manukovska [ 10 Min read ] I've watched 50 startups burn cash on marketing before talking to customers. Here's what actually works: The Mum Test, founder brand building, and hiring doers Read More.

The HackerNoon Newsletter: Brands, Find the Right HackerNoon Services for You (11/12/2025)

By @noonification [ 2 Min read ] 11/12/2025: Top 5 stories on the HackerNoon homepage! Read More.

I Spent 30 Days “Vibe Coding” an MVP — Burned $127, Broke Everything, and Still Found Product-Market

By @renjitphilip [ 15 Min read ] I have recently been diving into the world of vibe coding and I thought of cataloging my experience for the benefit of others. Read More.

What the Recent Amazon and Microsoft Cloud Outages Taught the UK Payments Industry

By @noda [ 4 Min read ] AWS and Azure outages in October 2025 exposed deep systemic risks in UK payments. This article examines cloud dependency and how firms can build true resilience Read More.

Exploiting EIP-7702 Delegation in the Ethernaut Cashback Challenge — A Step-by-Step Writeup

By @hacker39947670 [ 18 Min read ] How to exploit EIP-7702 delegation flaws: A deep dive into the Ethernaut Cashback challenge with bytecode hacks and storage attacks Read More.

Cardano’s 14-Hour Stress Test: How the Network Took a Hit and Healed Itself

By @sundaeswap [ 5 Min read ] This incident was an exception and highlighted areas where Cardano can improve while also demonstrating its strengths. Read More.

When The Oldest Programming Language Outsmarts The Newest AI

By @josecrespophd [ 6 Min read ] C++ was not supposed to come back. Read More.

The Architect’s Handbook to Open Table Formats and Object Storage

By @minio [ 9 Min read ] Learn how Apache Iceberg, Delta Lake, and Apache Hudi pair with object storage to build scalable, open, high-performance data lakehouse architectures. Read More.

Escaping AWS S3: How One Cybersecurity Firm Cut Costs With AIStor

By @minio [ 5 Min read ] A cybersecurity company slashed cloud costs and boosted performance by moving from AWS S3 to MinIO AIStor, gaining speed, resiliency, & scalable on-prem control Read More.

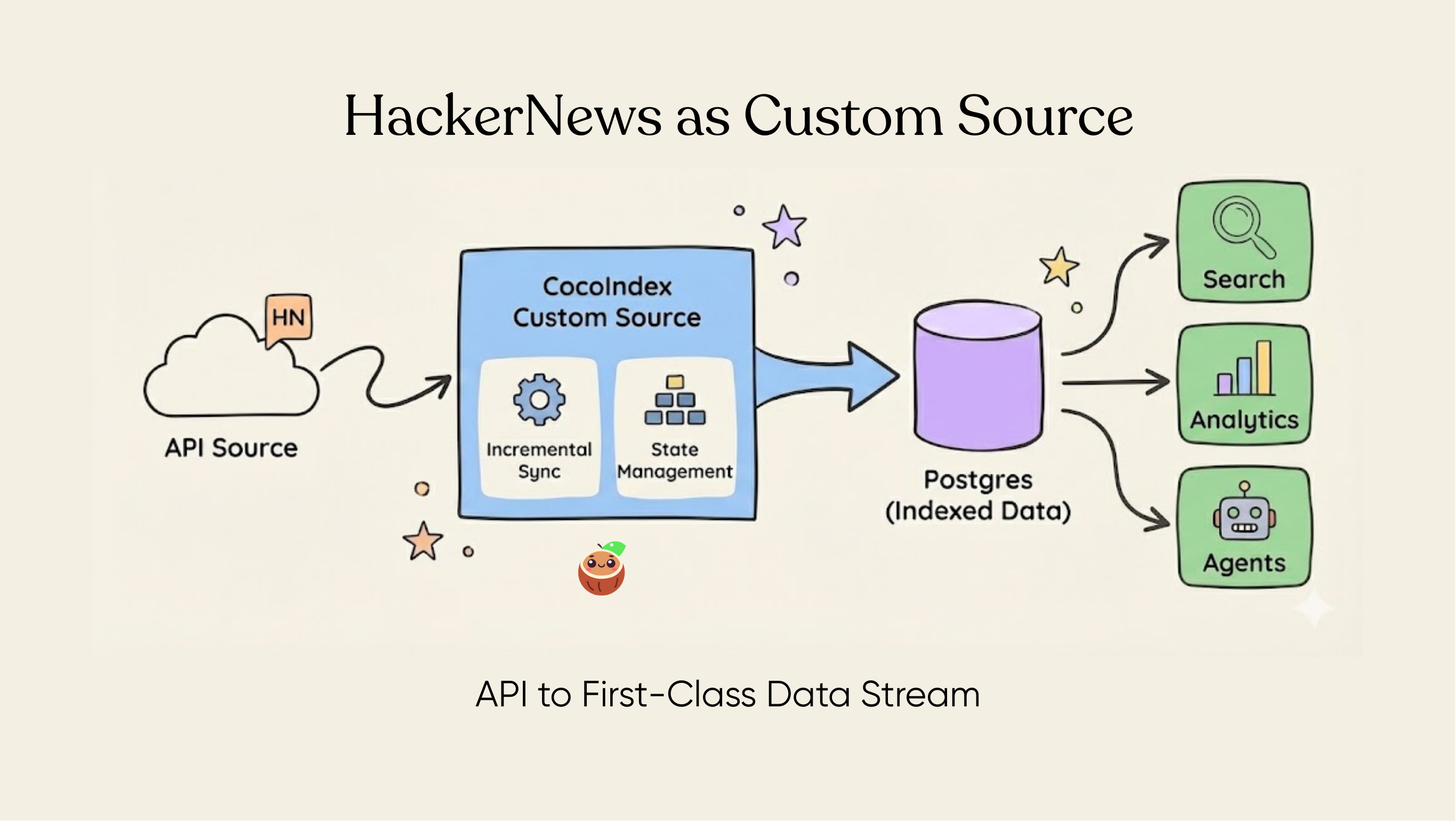

Stateful API-to-Database Synchronization: Implementing Incremental Data Ingestion from REST APIs wit

By @badmonster0 [ 15 Min read ] Stop writing fragile cron scripts. Learn to build stateful, incremental data streams from any REST API using Python and a pull-based CDC model. Read More.

Cosmic Rays vs. Code: How a Solar Flare Knocked the Digital Brains Out of 6,000 Airbus Jets

By @zbruceli [ 14 Min read ] A single 'bit blip' from a solar flare exposed a critical flaw in the Airbus A320's ELAC L104 software, causing a global safety crisis. Read More.

How I Found Sim Racing at Age 60

By @wicked-racing [ 5 Min read ] How a 60-year-old former wannabe rally driver has found new youth through sim racing and the new available technology. Read More.

12 Best Web Scraping APIs in 2025

By @oxylabs [ 11 Min read ] Discover the 12 best web scraping APIs of 2025, comparing performance, pricing, features, & success rates to help teams scale reliable data extraction. Read More.

So You Want to Build a Writing Career?

By @editingprotocol [ 4 Min read ] This comprehensive guide covers everything from finding your voice to mastering SEO. Learn how to turn your writing into a career asset with HackerNoon. Read More.

Cybersecurity’s Global Defenders Converge in Riyadh for Black Hat MEA 2025

By @hackernoonevents [ 3 Min read ] Black Hat MEA 2025 will bring together over 45k attendees, 450 exhibitors, & 300 global speakers from December 2–4 at Riyadh Exhibition and Convention Center Read More.

Why Gemini 3.0 is a Great Builder But Still Needs a Human in the Loop

By @knightbat2040 [ 4 Min read ] Here is the post-mortem on what worked, what failed, and the critical difference between generating code and refactoring systems. Read More. 🧑💻 What happened in your world this week? It's been said that writing can help consolidate technical knowledge, establish credibility, and contribute to emerging community standards. Feeling stuck? We got you covered ⬇️⬇️⬇️ ANSWER THESE GREATEST INTERVIEW QUESTIONS OF ALL TIME We hope you enjoy this worth of free reading material. Feel free to forward this email to a nerdy friend who'll love you for it. See you on Planet Internet! With love, The HackerNoon Team ✌️

You May Also Like

Short-Term Bitcoin Profits Dominate For The First Time Since 2023

OKX founder responds to Moore Threads co-founder 1,500 BTC debt