The strong U.S. economy in 2025, driven by robust holiday spending and 3% GDP growth, is positively impacting cryptocurrency markets by enhancing investor confidence and reducing regulatory fears under Treasury Secretary Scott Bessent’s pro-crypto stance.

-

U.S. GDP projected at 3% for 2025 year-end, signaling stability for crypto assets amid holiday consumer boom.

-

Holiday spending up significantly, contributing nearly 70% to GDP and supporting crypto adoption through increased digital payment trends.

-

Trade agreements with China maintain market steadiness, with soybean compliance at one-third, indirectly bolstering global crypto trade confidence per Federal Reserve estimates.

Discover how the robust U.S. economy in 2025 fuels cryptocurrency growth via holiday spending and stable trade—explore investment opportunities now for long-term gains.

What is the impact of the strong US economy on cryptocurrency in 2025?

The strong US economy in 2025 is providing a bullish backdrop for cryptocurrency markets, with Treasury Secretary Scott Bessent highlighting robust holiday spending and projected 3% GDP growth despite challenges like the government shutdown. This economic resilience encourages investor optimism in digital assets, as stable macroeconomic conditions often correlate with increased crypto adoption and price stability. Consumer confidence, though mixed, supports the use of cryptocurrencies for transactions during peak shopping seasons.

How does holiday spending drive cryptocurrency growth?

Holiday spending is a cornerstone of the U.S. economy, accounting for nearly 70% of GDP according to the Bureau of Economic Analysis (BEA). In 2025, Treasury Secretary Scott Bessent noted on Face the Nation that the season has been “very strong,” predicting a solid year-end with 3% real GDP growth. This surge in consumer activity directly benefits cryptocurrencies, as more individuals turn to digital wallets and blockchain-based payments for secure, efficient transactions during high-volume shopping periods.

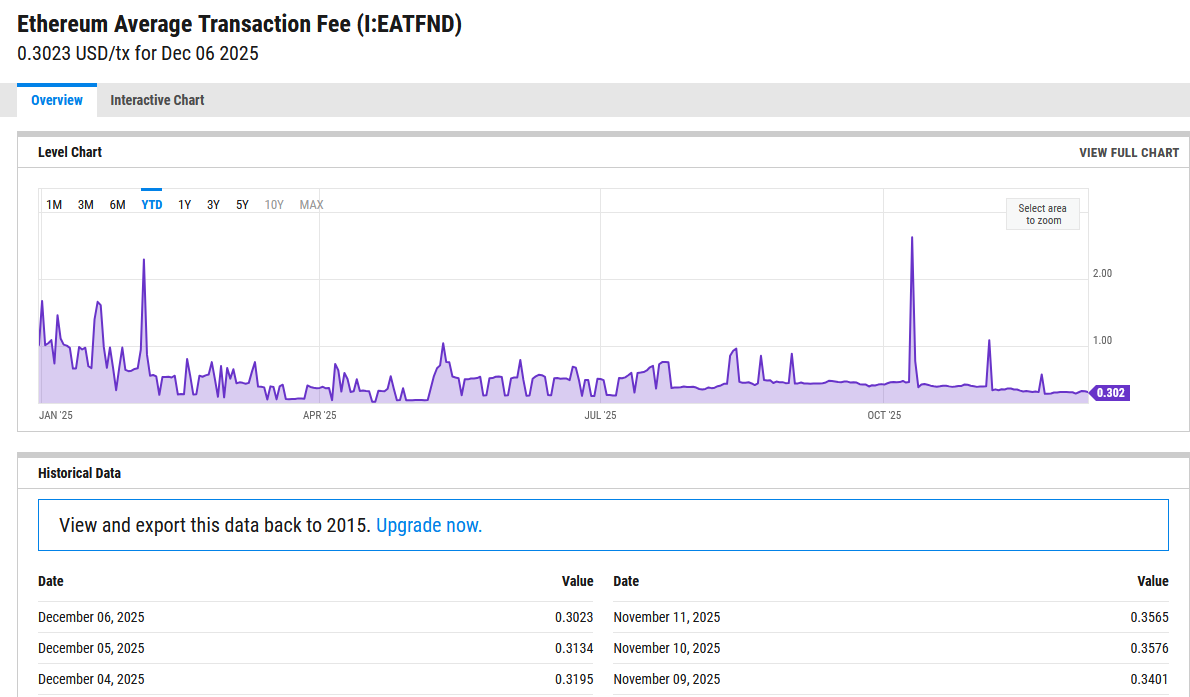

The BEA reported a 0.6% year-over-year GDP drop from January to March 2025, followed by a 3.8% increase in the second quarter. Initial third-quarter estimates from the Federal Reserve Bank of Atlanta point to 3.5% growth, set for official release by December 23. These figures underscore economic momentum that spills over into crypto markets, where investor sentiment often mirrors broader stability. For instance, platforms like Bitcoin and Ethereum see heightened trading volumes during economic upswings, as per data from major exchanges.

However, challenges persist. The University of Michigan’s consumer sentiment index rose 4.5% to 53.3 in December 2025 from November but remains 28% below last year’s levels. Inflation, at 3% year-over-year in September per delayed government reports, has raised food costs by 3.1%, pressuring households. President Donald Trump has downplayed affordability concerns, calling it a “Democrat scam” in a cabinet meeting. Bessent echoed this, attributing inflation to prior administration policies and media narratives, stating, “The American people don’t know how good they have it,” and forecasting prosperity in the coming year.

Recent polls show two-thirds of registered voters dissatisfied with the administration’s economic handling, yet crypto enthusiasts view these developments as opportunities. A stable economy under pro-crypto leadership like Bessent’s—known for advocating regulatory clarity—could accelerate institutional adoption. Experts from the Coin Center, a leading blockchain policy group, emphasize that economic growth fosters innovation in digital finance, potentially integrating crypto more deeply into everyday spending.

Frequently Asked Questions

What does Treasury Secretary Scott Bessent’s economic outlook mean for Bitcoin prices in 2025?

Treasury Secretary Scott Bessent’s prediction of 3% GDP growth and strong holiday spending signals stability that typically boosts Bitcoin prices by attracting institutional investors seeking safe-haven assets amid controlled inflation. This outlook, combined with pro-crypto policies, could drive BTC toward new highs, as historical data shows crypto rallying during U.S. economic recoveries.

How are U.S.-China trade agreements affecting cryptocurrency markets this year?

U.S.-China trade agreements are stabilizing global markets, indirectly supporting cryptocurrency by ensuring consistent commodity flows like soybeans, which underpin economic confidence. U.S. Trade Representative Jamieson Greer confirmed China’s compliance on Fox News, noting one-third fulfillment of obligations, fostering an environment where crypto traders anticipate fewer disruptions and potential growth in cross-border digital asset use.

Key Takeaways

- Economic Resilience Boosts Crypto: 3% projected GDP growth in 2025 enhances investor trust, potentially increasing cryptocurrency valuations as seen in past bull runs.

- Holiday Spending as Catalyst: Consumer activity driving 70% of GDP highlights rising crypto payment adoption, with platforms reporting higher transaction volumes during peak seasons.

- Trade Stability Insight: Ongoing monitoring of China commitments ensures market predictability, advising investors to watch for regulatory advancements in digital assets.

Conclusion

The strong US economy in 2025, fueled by holiday spending and steady GDP growth, alongside stable U.S.-China trade agreements, positions cryptocurrency for continued expansion under Treasury Secretary Scott Bessent’s guidance. As inflation eases and consumer sentiment improves, digital assets stand to benefit from heightened adoption and innovation. Investors should monitor upcoming BEA releases and policy updates to capitalize on this promising trajectory toward broader economic prosperity.

Source: https://en.coinotag.com/us-treasury-predicts-3-gdp-growth-as-holiday-spending-bolsters-economy-amid-china-trade-monitoring