Dogecoin Momentum Slows At Resistance As Investors Search For The Next Meme Coin With 25x Potential

Dogecoin is making headlines with the launch of the first DOGE ETF, but another top crypto project is quietly gaining traction.

As the REX-Osprey ETF boosts Dogecoin’s visibility on Wall Street, Rollblock is drawing attention in GameFi – with a major launch date announcement just days away.

Backed by real utility, a deflationary model, and over 50,000 investors, Rollblock is emerging as the next big crypto play, with many eyeing a 25x return before year-end.

The First Dogecoin ETF Goes Live – When Will DOGE Push Past $1?

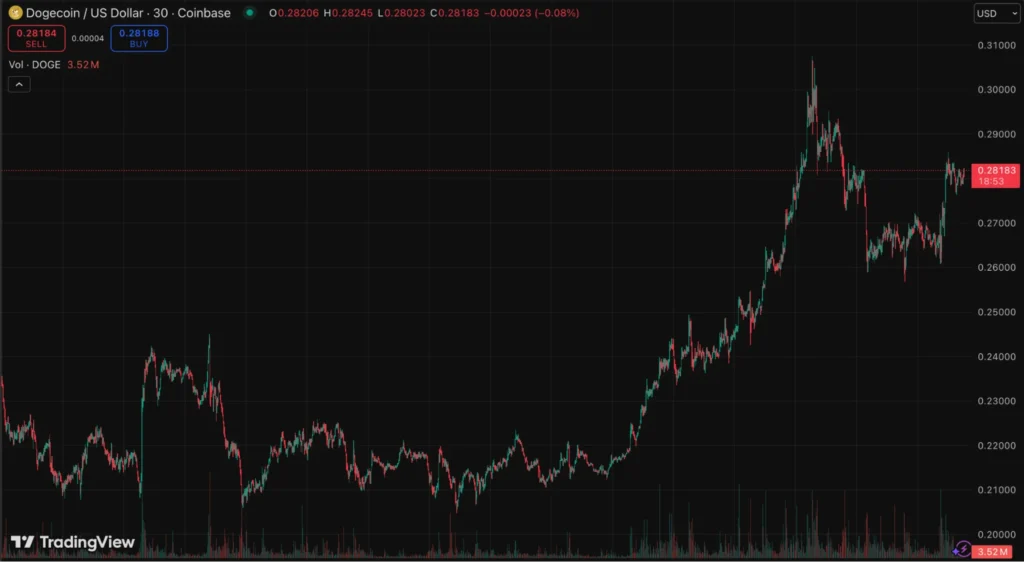

Wall Street just got a DOGE button. The first Dogecoin ETF ($DOJE) has officially launched in the U.S., sending DOGE up 12% in two days and opening the door for institutional capital in meme coins.

Launched by REX Shares and Osprey Funds, the REX-Osprey ETF is the first regulated fund focused solely on DOGE. Approved under the Investment Company Act of 1940, it avoided the slower 1933 securities process.

Analysts say this changes Dogecoin’s narrative from meme to maturing digital asset. Crypto trading influencer SMC Kapil DEV called it “Wall Street’s first memecoin ETF,” while ETF Store’s Nate Geraci said the next few months will be “wild” as investor interest spikes.

Rollblock Enters the $450 Billion Market With a Boom

Fraud continues to affect the online gaming industry. Between 2023 and 2024, reported cases jumped over 60%, and 2025 could see even more.

Rollblock offers a clear solution. With 12,000+ AI-powered games deployed on the Ethereum blockchain, the platform removes manipulation entirely. Every result is verified by smart contracts, ensuring full transparency.

It also solves the problem of slow transactions. With support for over 20 top cryptocurrencies, users can deposit and withdraw in seconds, streamlining the experience.

At the centre of this ecosystem is RBLK – Rollblock’s native token. Beyond payments, RBLK supports a deflationary, revenue-sharing model that benefits long-term holders. Up to 30% of platform revenue is allocated to repurchasing tokens.

Of that, 60% is burned, while 40% is distributed to stakers, creating passive income and one of the most attractive APYs in GameFi. Here are more reasons why Rollblock is the best crypto to buy now:

- Licensed under the Anjouan Gaming Authority and audited by SolidProof

- Offering services to thousands of players daily

- Adding new Web3 games and features regularly

Can Rollblock Outperform Dogecoin in 2025?

Experts believe Rollblock could outperform Dogecoin due to its strong fundamentals and rising presence in the Web3 gaming space.

As GameFi expands, Rollblock’s utility may drive greater adoption. RBLK is projected to hit $1 in 2025 – a potential 100x return from early crypto prices. If that happens, Rollblock will probably outperform Dogecoin this year.

| Aspect | Rollblock (RBLK) | Dogecoin (DOGE) |

| Price | $0.068 | $0.29 |

| Utility | GameFi platform with 12,000+ AI-powered games and staking crypto | Meme coin with tipping use case, limited real-world application |

| Adoption | 50,000+ early investors, $15M+ in wagers, growing GameFi ecosystem | First DOGE ETF launched, strong social media backing |

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

United States Building Permits Change dipped from previous -2.8% to -3.7% in August