Strategy Buys a $100M Bitcoin Dip: Retail Is Doing the Same with Bitcoin Hyper

Michael Saylor’s investment company issued a press release stating it had bought another 850 $BTC for $99.7M, averaging out at $117K per Bitcoin. Today, Strategy holds over $72B in $BTC and shows no signs of slowing down even in a rocky crypto market.

It’s that same investor confidence in Bitcoin that’s seeing a new token – Bitcoin Hyper ($HYPER) – rack up massive funds in its presale. With plans to introduce a revolutionary Layer-2 designed to unleash Bitcoin’s full potential, $HYPER has grabbed the attention of retail investors.

Why is Strategy Buying Bitcoin Now?

Strategy (listed on the Nasdaq as MSTR) stocks hit a five-month low at around $320 in early September, prompting a shift towards $BTC, which is outperforming MSTR. While MSTR has seen a 6.2% decline over the last month, $BTC has seen only a 1.6% loss in the same period.

While retail investors are spooked by the volatile performance of $BTC, following its fall from a recent ATH, institutional investors like Saylor believe the dip is an opportunity to scoop up cheap Bitcoin that will inevitably rise after the current period of volatility is over.

Source: X/@saylor

As we can see, Strategy has an overall purchase history that reflects this attitude. Even during the crypto lull in 2022, Strategy continued dollar-cost averaging its Bitcoin reserves, expecting that the industry would recover. This isn’t the first time Strategy has sold its own stock to purchase $BTC, either.

Bitcoin Hyper is revolutionizing the way we think about Bitcoin by bridging the gap between $BTC as an investment asset and the wider Web3 world. Let’s get into exactly why $HYPER is worth a look.

Bitcoin Hyper – A Solana-Based Layer-2 Bringing Faster Speeds and Lower Fees to Bitcoin

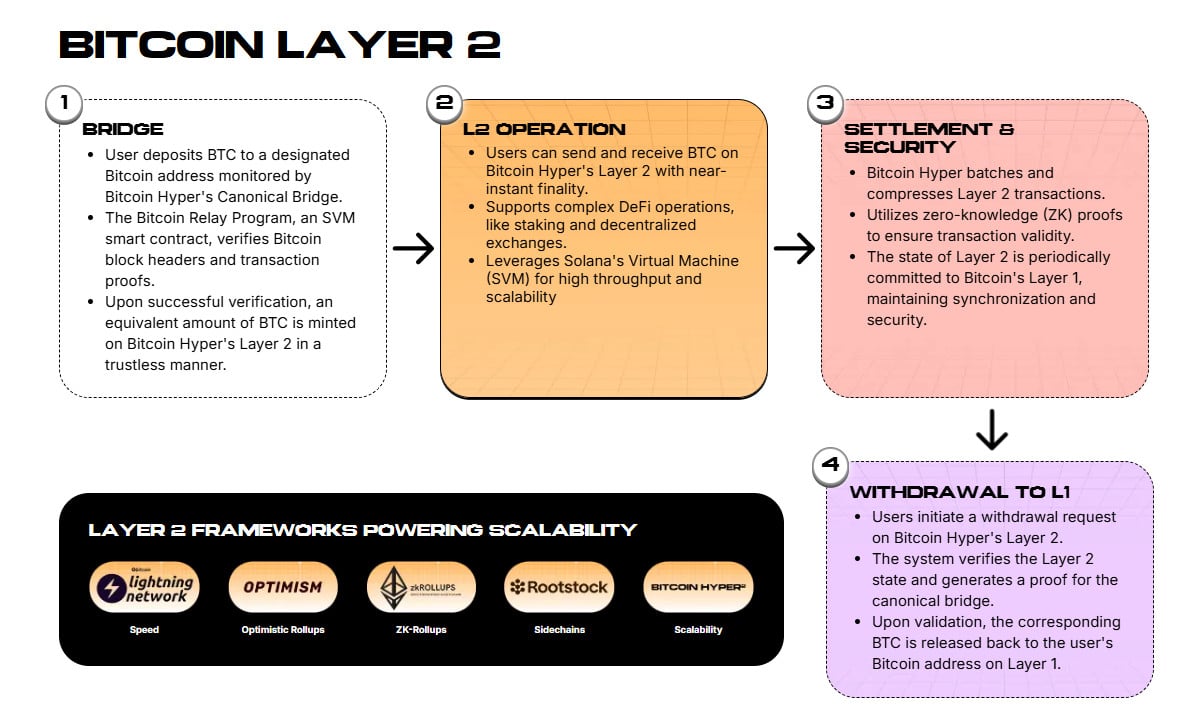

$HYPER is the official token of Bitcoin Hyper, a Layer-2 solution for Bitcoin that will bring the aging Bitcoin network into the modern era. Bitcoin Hyper integrates the Solana Virtual Machine (SVM), which adds all the scalability of Solana to the world’s most valuable cryptocurrency.

Bitcoin is a fantastic investment crypto, which is why Strategy has seen so much success buying it, even through $BTC’s low points. However, Bitcoin is terrible for using on a day-to-day basis – transaction speeds are super slow, while high fees make transacting small amounts pointless.

For a start, better scalability means that transactions on the Bitcoin Hyper network will be cleared faster and incur smaller fees. On top of that, the SVM adds smart contract capabilities, which enables support for a range of dApps offering features like crypto swaps, NFT trading, and other DeFi services.

Holding $HYPER also gives you voting rights on the Bitcoin Hyper DAO, where you can have your say on the future direction of the project.

$HYPER is packed with utility and – being linked to the GOAT of the cryptosphere – it’s packed with the potential to pump, too. The $HYPER presale is already a sign of good things to come, with $17.7M+ raised. Whales have also been circling the presale, forking out the likes of $161.3K and $100.6K in individual purchases.

Ready to join one of the best presales of the year? Purchase your $HYPER today

You May Also Like

Avalanche and Hyperliquid Lead Crypto Rally Post-Fed Rate Cut

Pi Network Accelerates Real World Adoption as Picoin Transitions from Digital Asset to Everyday Payment

The Pi Network ecosystem is once again demonstrating significant progress. While the community initially focused on mining ac