MAGAX vs Pengu vs PEPE: Which Meme Coin Could Deliver the Biggest Gains in 2025?

Three meme coins dominate September chatter, but one offers the clearest path to asymmetric upside.

Meme coins remain one of crypto’s most unpredictable yet rewarding niches. September’s market chatter has centered around MAGAX, Pengu, and PEPE—each representing a different stage in the meme-to-earn story. The question is: which one can deliver meaningful returns as 2025 unfolds?

MAGAX: The Meme-to-Earn Challenger With AI Fairness

Turning internet culture into real, trackable rewards.

MAGAX is still in presale, but it’s already positioned as a disruptor. The project introduces a Meme-to-Earn model that uses AI to detect authentic virality across social platforms. Creators and sharers of viral memes are rewarded directly, while bots and fake engagement get filtered out.

• Presale Stage 2: Token price at $0.000293, over 65% already sold.

• Incentives: Staking bonuses + DAO roadmap for future community governance.

• Scarcity: Each stage raises token price, increasing urgency.

The MAGAX presale is live—secure tokens before the next stage price increase.

What sets MAGAX apart is timing. It’s riding both meme coin culture and the AI narrative—two of the hottest crypto themes of 2025. That overlap gives it credibility beyond hype and positions it for outsized ROI projections.

Pengu: The Rising Meme With Breakout Potential

Community-driven energy pushing toward technical resistance.

Pengu has been trending on Intellectia and other outlets this month, with analysts flagging resistance at $0.029. If it clears that level, momentum could push the token higher.

While Pengu doesn’t have the AI utility of MAGAX, its strength is its grassroots community. Meme raids on Telegram and growing social buzz are helping it stay relevant in a crowded field. Traders looking for short-term upside see Pengu as a potential breakout candidate.

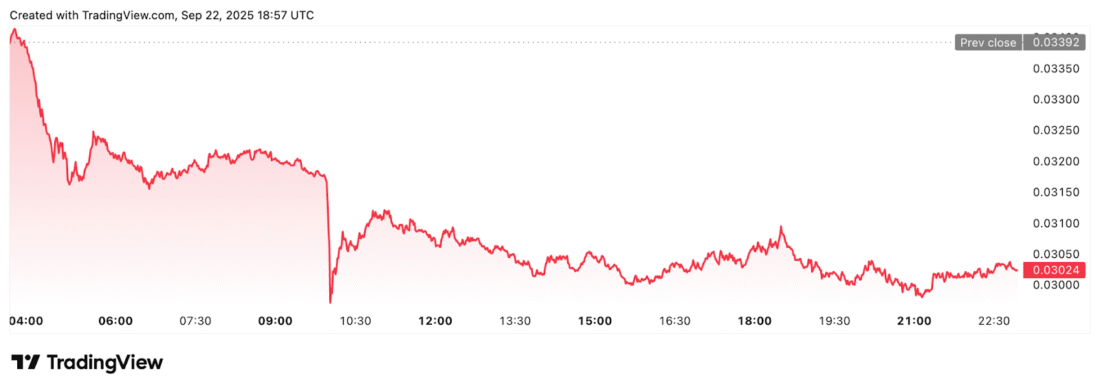

PEPE: The Veteran Meme Under Pressure

Still liquid and recognizable, but struggling to hold momentum.

PEPE made waves earlier this cycle with huge gains, but September has revealed cracks in its price action. Analysts warn that if PEPE fails to hold its support levels, its near-term outlook may weaken.

Despite this, PEPE remains a heavyweight with high liquidity and brand recognition. For conservative traders, it’s a way to stay in the meme conversation without betting on untested projects. But compared to presales like MAGAX, PEPE’s upside looks limited.

Institutions may trade PEPE—but retail investors can capture ground-floor gains with MAGAX.

[https://www.moonshotmagax.com/]

Head-to-Head: What the Comparison Shows

MAGAX leads on asymmetry, Pengu brings short-term hype, PEPE offers stability.

- MAGAX: Dual narrative (meme + AI), presale scarcity, and ROI projections make it the strongest asymmetric bet.

- Pengu: Breakout potential if technical resistance breaks, fueled by community buzz.

- PEPE: Safe, liquid, but upside capped compared to new entrants.

Market Buzz Around Meme Contenders

September chatter shows how narratives shape momentum.

Across social platforms and analyst reports, MAGAX, Pengu, and PEPE have become recurring names in meme-coin discussions. Intellectia’s coverage highlights Pengu’s breakout attempts, while CoinTelegraph continues to spotlight AI-driven projects like MAGAX as key narratives for Q4.

Meanwhile, PEPE remains a staple in daily trading charts, showing its staying power even under pressure. This mix of early-stage hype, established liquidity, and dual narratives explains why all three tokens dominate September conversations, but it also underlines why MAGAX, as a presale with utility, has captured the most speculative excitement.

The Verdict: Why MAGAX Stands Out in September

Presale momentum, AI fairness, and meme culture converge.

MAGAX is more than another meme coin—it’s designed to fix the flaws that made earlier projects unsustainable. By rewarding real meme creators and building in staking and governance, it offers utility alongside hype.

September’s meme coin race shows different flavors of opportunity. Pengu is the high-risk trader’s play, PEPE is the safe veteran, but MAGAX is the one positioned for long-term asymmetric upside.

Don’t wait—explore the MAGAX presale and secure your allocation before the next stage.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post MAGAX vs Pengu vs PEPE: Which Meme Coin Could Deliver the Biggest Gains in 2025? appeared first on Live Bitcoin News.

You May Also Like

Top 4 Tokens Turning IP Rights Into Investable Assets

‘Anti-Innovation’: Experts Slam Nigeria’s ‘Disproportionate’ Capital Requirements for Crypto Firms