Cardano (ADA) Set for Short-Term Drop, But ATH Coming in December?

TL;DR

- Analyst Sssebi sees ADA dipping to $0.70–$0.75 before rebounding toward $1.00 and higher by Christmas.

- Whale addresses moved 160M ADA recently, dropping holdings from 5.6B to 5.44B, while demand held steady.

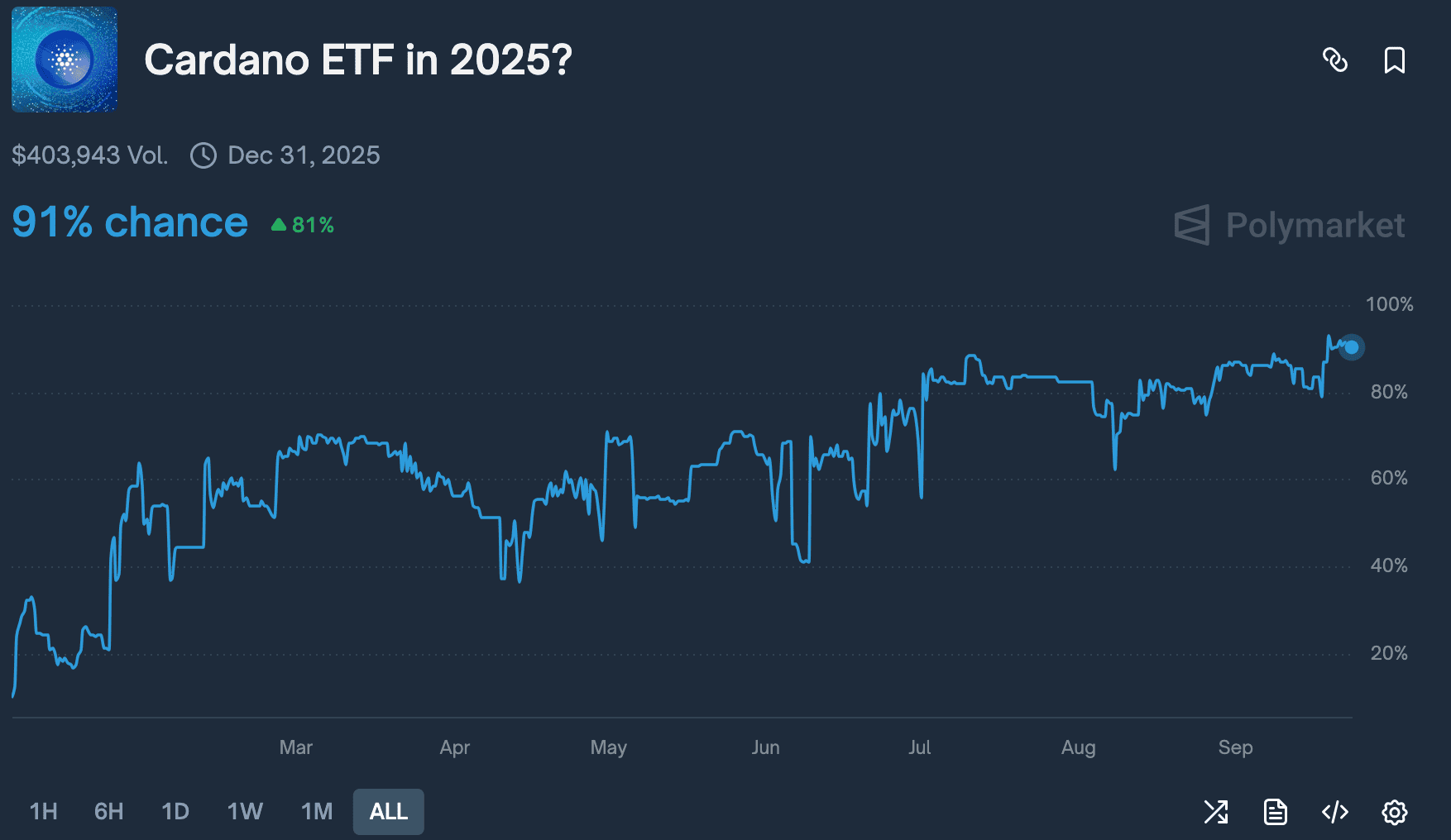

- Cardano surpassed 114M transactions, with ETF approval odds climbing to 91%, boosting investor interest in ADA.

Analyst Sees Pullback Before Rally

Cardano (ADA) is trading around $0.82 with a 24-hour volume of $1.8 billion. The token gained slightly today but remains down 5% this week.

Crypto analyst Sssebi expects a pullback before recovery, writing,

Their projection points to a decline toward the $0.70–$0.75 zone before regaining strength. The 4-hour chart outlines a rebound toward $1.00, setting up for a possible year-end rally.

In addition, volume levels have stayed steady, showing no signs of major accumulation or liquidation. The Relative Strength Index (RSI) is moving toward oversold conditions, a reading often associated with price support in the near term.

Source: Sssebi/X

Source: Sssebi/X

If ADA follows the projected pattern, holding support near the $0.70 area will be important before a recovery. A successful rebound could provide the base for momentum into late Q4, with the analyst pointing to the possibility of a new all-time high in December.

Whale Activity Recorded on the Network

On-chain data shows movement from large ADA holders. Analyst Ali Martinez reported that addresses holding between 1 million and 10 million ADA transferred about 160 million tokens over the past four days. Their combined balance dropped from 5.6 billion to 5.44 billion ADA.

Earlier this month, over 530 million ADA was moved in a two-day span. Despite these transfers, the price has remained stable, suggesting steady demand is meeting the supply.

Transaction Growth and ETF Outlook

Cardano’s mainnet has now processed more than 114 million transactions, according to TapTools. This reflects ongoing network activity across applications and user interactions.

Institutional exposure may also expand. WisdomTree registered its CoinDesk 20 Fund in Delaware, which will include ADA alongside other major assets such as Bitcoin, Ethereum, Solana, and XRP. Market trackers show the approval odds for a US Cardano ETF rising to 91%, around the highest level so far.

Source: Polymarket

Source: Polymarket

The post Cardano (ADA) Set for Short-Term Drop, But ATH Coming in December? appeared first on CryptoPotato.

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility