Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million

The post Crypto ETF News: Bitcoin and Ethereum ETFs Bleed $244 Million appeared first on Coinpedia Fintech News

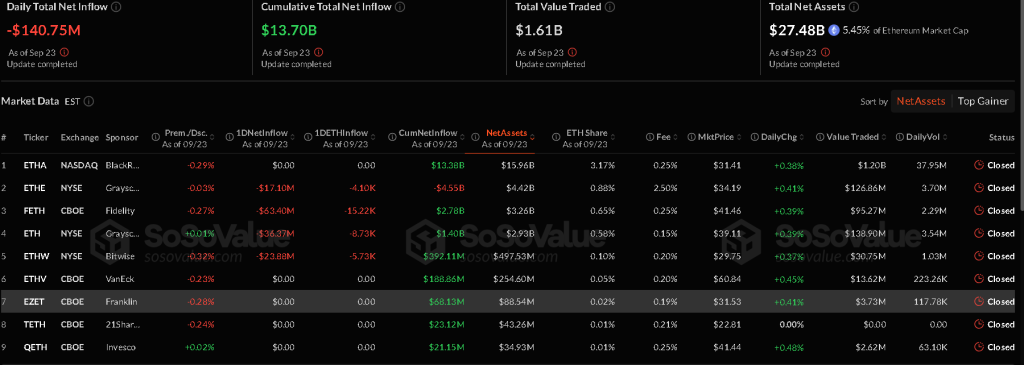

On September 23, both spot Bitcoin and Ethereum ETFs recorded a second straight day of net outflows. Data from SoSoValue shows Bitcoin ETFs lost $103.61 million, while Ethereum ETFs saw outflows of $140.75 million.

Bitcoin ETF Breakdown

Bitcoin ETFs posted a total outflow of $103.61 million. Fidelity’s FBTC led withdrawals at $75.56 million. Ark & 21Shares’ ARKB followed with $27.85 million, and Bitwise’s BITB shed $12.76 million.

Only two products managed to attract inflows. Invesco’s BTCO added $10.02 million, while BlackRock’s IBIT brought in $2.54 million.

Trading activity in Bitcoin ETFs reached $3.16 billion, with total net assets of $147.17 billion, representing about 6.6% of Bitcoin’s market cap. This reflected a decline from the prior day.

Ethereum ETF Breakdown

Ethereum ETFs recorded heavier outflows at $140.75 million. Fidelity’s FETH led selling pressure with $63.40 million. Grayscale’s ETH fund withdrew $36.37 million, followed by Bitwise’s ETHW at $23.88 million and Grayscale’s ETHE at $17.10 million.

None of the nine Ethereum ETFs reported inflows. Total trading volume dropped to $1.61 billion, while net assets fell to $27.48 billion, equal to 5.45% of Ethereum’s market cap.

Source: SoSoValue

- Also Read :

- Crypto Market Update LIVE : Federal Reserve News, Nvidia Stock, Bitcoin Price Today, Trump UN Speech , ASTER Coin

- ,

Market Context

Bitcoin is trading at around $112,348, signalling a 3.4% drop compared to a week ago. Its market cap is also experiencing a dip, and fell to $2.238 trillion today, along with its daily trading volume, which descended to $48.874 billion.

Ethereum is priced at around $4,155.29, with a market cap of $502.099 billion. Its trading volume marked a sharp decrease of $38.585 billion, reflecting a slow market sentiment.

Despite dominating the crypto market, both Bitcoin and Ethereum are showing negative momentum in ETF flows and trading activity. Analysts expect Ethereum to face short-term bearish pressure through late September, while Bitcoin is forecast to stabilize in the $112,000–$119,000 range.

This downturn has led market watchers to label the current pullback “Red September 2025.”

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Both Bitcoin and Ethereum ETFs have seen two consecutive days of net outflows, with Bitcoin ETFs losing $103.61M and Ethereum ETFs seeing $140.75M in withdrawals.

Bitcoin is trading at around $112,348 and is expected to stabilize, while Ethereum, priced at $4,155.29, is forecast to face short-term bearish pressure.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Where to Buy BFS Crypto? Arkham Abandons the CEX Model, North Korean Malware Targets Traders, and DeepSnitch AI’s Moonshot Launch Is About to Come and Go in Early 2026