Here’s How Much Your $10,000 Will Be If XRP, Cardano, And Paydax Hit $10 This Month

The post Here’s How Much Your $10,000 Will Be If XRP, Cardano, And Paydax Hit $10 This Month appeared first on Coinpedia Fintech News

For crypto investors, figures tell the real story. Imagine investing $10,000 in altcoins that have long been debated in the market, such as XRP and Cardano (ADA), as well as the newcomer Paydax (PDP). Each of these digital assets has its own narrative: XRP fighting regulatory battles, Cardano (ADA) as the dApp innovator, and Paydax (PDP) as the groundbreaking DeFi bank.

Now, crypto analysts have examined what would happen if all three tokens reach the $10 mark this month, and the answer is about potential returns that could reshape portfolios in a short time.

If XRP, Cardano (ADA), And Paydax (PDP) Hit $10: What It Means For Investors

Paydax (PDP) Massively Outshining The Old Guards

The $10 price point carries very different outcomes depending on the token in question. For XRP, reaching $10 would represent a significant leap from its current trading price of $2.78, signaling renewed confidence in Ripple and a massive influx of liquidity into the market. In essence, an investor’s $10,000 could potentially increase to $35,000 if XRP reaches $10 this month.

For Cardano, a climb to $10 from the current trading price of $0.78 suggests a yield of over 16,327%. This means that investors who put $10,000 in Cardano could hold $128,205 if ADA surges to $10 by the end of this month.

| Altcoin | Current Price (Approx.) | Coins Purchased with $10,000 | Target Price | Hypothetical Future Value | ROI Multiplier |

| XRP | $2.78 | 3,597 XRP | $10.00 | $35,971 | 3.6x |

| Cardano (ADA) | $0.78 | 12,820 ADA | $10.00 | $128,205 | 12.8x |

| Paydax (PDP) | $0.015 | 666,667 PDP | $10.00 | $6,666,670 | 667x |

Hypothetical future value of a $10,000 investment in XRP, ADA, and PDP if they were to reach $10 this month.

The biggest upside, however, could come from Paydax (PDP). As an emerging project which boasts numerous real use cases and is still in its early stages, a surge to $10 would mean exponential returns. With a presale price of only $0.015, if you invest $10,000 in Paydax, your investment could grow to $6,666,670 if the PDP token jumps to $10 this month, massively outperforming the other two seasoned altcoins.

Join the Paydax (PDP) Presale at Only $0.015 Today

Beyond Low Entry Price: What Should Investors Expect With Paydax (PDP)?

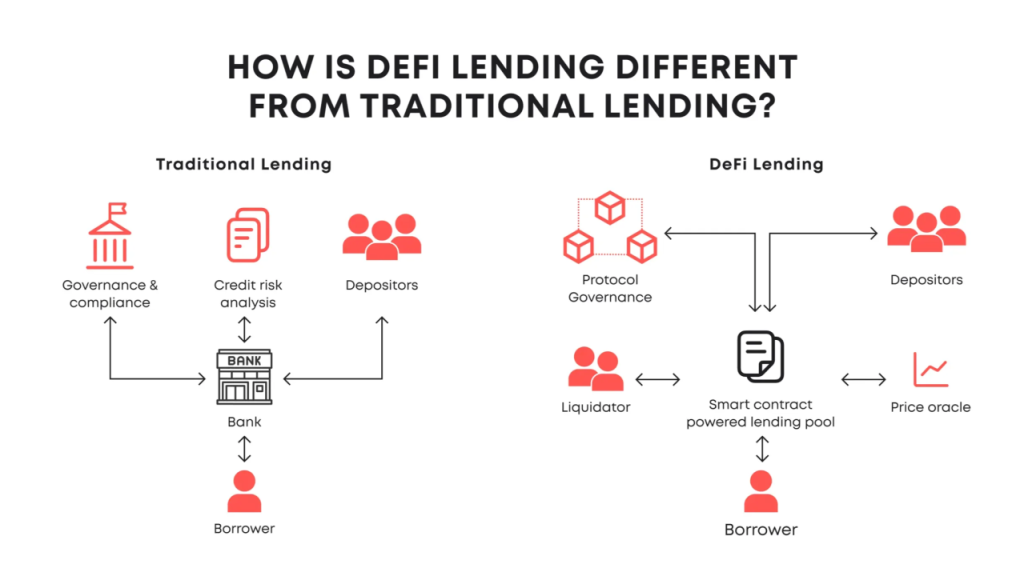

While a current presale price of $0.015 grants an exceptionally high entry leverage, as demonstrated by the table above, Paydax’s value lies beyond its cheap tokens. What sets the groundbreaking platform apart is its secure borrow-lend-insure model, designed to blend traditional financial services with the efficiency of the blockchain, positioning itself as a “borderless bank.”

With Paydax, borrowers and lenders have ultimate control, eliminating interference from intermediaries or banks. Borrowers can now access loans without selling their holdings (including cryptocurrencies and luxury items) and undergoing rigorous checks. All they need to do is provide the asset as collateral and choose LTVs based on their risk profile. Lenders can also yield attractive yields when they fund loans.

APY Rewards

- Up to 6% APY through protocol staking

- Up to 15.2% APY through P2P lending

- Up to 20% APY through Redemption Pool (Insurance)

- Up to 41.25% APY through yield farming

Trust And Transparency As A Core

Transparency and reliability are central to Paydax’s expectation of long-term viability. The Paydax team, including the CEO, CTO, and CMO, is fully audited and doxxed for KYC. This suggests a commitment to regulatory compliance and reduced rug pull risks, which are especially rare and desirable in early-stage presale projects.

Furthermore, Paydax partners with world-class infrastructure providers, including Onfido, Sotheby’s, and Brink’s Custody, to ensure that only legitimate users utilize the platform and that all collateralized physical assets are secure. Not to mention, the DeFi bank utilises trusted oracles, such as Chainlink, to provide users with on-chain prices, allowing them to monitor the real-time value of their assets.

It is worth noting that the Paydax dApp v1.0 is already live, further emphasising the project’s viability.

Final Thoughts: Paydax (PDP) With The Highest Potential, Outperforming XRP And Cardano (ADA)

XRP and Cardano (ADA) have long established their place in the cryptocurrency market, boasting solid communities and proven resilience through multiple market cycles. A surge to $10 for either would be immense, rewarding patient investors. However, when it comes to staggering upside potential, Paydax (PDP) stands in a league of its own.

As an early-stage project with a low entry price and innovative use cases, Paydax (PDP) offers investors something that XRP and Cardano (ADA) can no longer replicate: massive exponential growth from the ground floor. Priced at only $0.015 per PDP token in its ongoing presale, investors can take advantage of the opportunity to acquire the tokens at a low price before the stage-based increases occur. Moreover, with promo code PD80BONUS, savvy investors can enjoy an 80% bonus on tokens, a special offer designed to reward early adopters.

Step Into A Whole New World, Join The Paydax Community:

- Website: https://pdprotocol.com/

- Telegram: https://t.me/PaydaxCommunity

- X (Twitter): https://x.com/Paydaxofficial

- Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models