Ethereum Whale Alert — BitMine Snaps Up $961M in ETH While Analysts Call DOT a Hidden Gem Buy

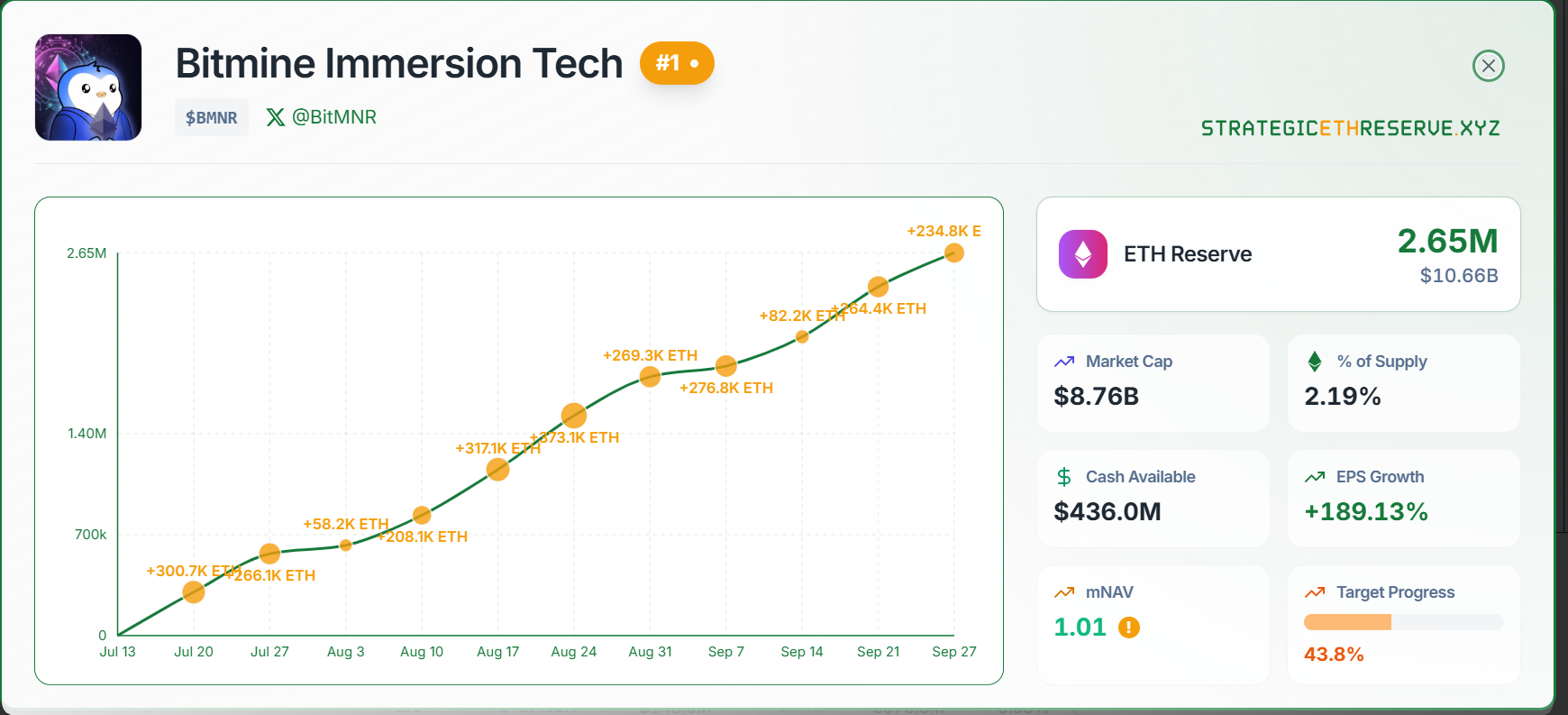

The crypto market continues to see bold movements from whales that signal faith in the long-term growth of the sector. Ethereum is back in the headlines again, with BitMine Immersion confirming a whopping $961 million ETH acquisition in its latest weekly update. This acquisition brings its total Ethereum holdings to more than 2.65 million coins, valued at over $10.8 billion.

Analysts are also drawing attention to opportunities outside of Ethereum. Polkadot (DOT) is now increasingly considered a hidden gem, with its strong fundamentals and technological advantage. Alongside DOT, MAGACOIN FINANCE is attracting whale attention, wallet growth, and retail momentum, making it another hidden gem within the current market cycle.

Ethereum Whale Activity Signals Confidence

BitMine’s recent purchase of 234,846 ETH speaks to its rapid pace of accumulation. With 2.65 million ETH secured, the company now owns approximately 2.2% of the total circulating supply of Ethereum. Such a stake exhibits unmatched conviction in the role of Ethereum as the backbone of decentralized finance and enterprise adoption.

Source: SER Data

Institutional support is pushing BitMine’s influence even further. Support comes from firms such as Ark Invest, Founders Fund, and Pantera Capital. This level of institutional involvement is indicative that Ethereum continues to dominate conversations in both the financial and technological sectors.

BitMine has set a bold goal of owning 5% of Ethereum’s supply (around 6 million coins). Achieving this would further enhance its status as the world’s largest Ethereum treasury holder. Its strategy also indicates Ethereum will continue to be the blockchain of choice for institutional portfolios in the years to come.

Ethereum’s track record for 100% uptime, developer leadership, and unparalleled liquidity keeps it at the centre of the crypto economy. By gradually accumulating ETH, BitMine is signalling that long-term fundamentals supersede short-term volatility in deciding crypto’s future trajectory.

DOT Positioned for the Next Breakout

Polkadot is one of the hidden gems taking a meaningful approach to interoperability. Its parachain architecture enables different blockchains to communicate seamlessly, addressing one of the biggest challenges in the industry. This functionality makes DOT a next-generation platform for real-world use cases.

The ecosystem is still growing with important developments such as Moonbeam, Acala, and others that have built upon solutions in DeFi and NFTs. These parachains benefit from Polkadot’s shared security model, which provides them with a secure foundation while fostering innovation throughout the network.

Polkadot’s technology is rapidly evolving. Upcoming upgrades like Polkadot 2.0 and scaling elasticity will increase efficiency and throughput. These changes directly contribute to scalability, making DOT more appealing for enterprise and institutional adoption.

Analysts consider DOT’s current price undervalued relative to its long-term potential. Projections show $10 to $15 is attainable during the next bull run. With an increase in adoption and institutional interest, Polkadot is well-positioned to be a top performer.

MAGACOIN FINANCE — A New Hidden Gem

MAGACOIN FINANCE is emerging as another hidden gem alongside DOT, offering significant potential in the current market cycle. Analysts forecast a 1,100% ROI before year-end, making it one of the most promising breakout candidates.

Wallet counts are rising steadily, which reflects stronger retail participation. Adoption momentum is accelerating across Telegram groups, Reddit discussions, and crypto media platforms. These signals show that awareness is spreading beyond early adopters and into broader investor circles.

Equally important is the whale accumulation linked to MAGACOIN FINANCE. Some large holders who previously concentrated on established assets like Ethereum are now diversifying into this project. This behavior suggests high conviction and strengthens the case for its growth potential.

Three Hidden Drivers of Market Growth

Ethereum’s massive whale activity reinforces the asset’s long-term value and shows that institutional investors remain committed to blockchain adoption. Polkadot’s expanding ecosystem and groundbreaking interoperability features highlight its potential as a next-generation platform. Together, these assets confirm that market leaders and hidden gems can coexist in shaping the future.

MAGACOIN FINANCE adds another layer to this landscape. Its rising wallet adoption, projected 1,100% ROI, and whale accumulation create strong conditions for rapid growth. For investors seeking exposure to emerging opportunities, MAGACOIN FINANCE stands out as a hidden gem alongside DOT in the current market cycle.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

The post Ethereum Whale Alert — BitMine Snaps Up $961M in ETH While Analysts Call DOT a Hidden Gem Buy appeared first on Blockonomi.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Crucial ETH Unstaking Period: Vitalik Buterin’s Unwavering Defense for Network Security