2025’s Best Crypto Presale Ends This Quarter: Bitcoin Hyper Nears $23M Raised

Bitcoin is the world’s leading cryptocurrency. With a market cap in the trillions and unmatched global brand recognition, it remains the undisputed leader of the digital asset revolution.

Yet, despite its dominance, Bitcoin faces significant challenges that hinder its ability to advance into the next phase of blockchain innovation. These issues have shifted from minor annoyances to serious limitations, highlighting the need for a solution.

Transaction Speed and Scalability

At the base layer, Bitcoin processes only 3-7 transactions per second (TPS). This is significantly lower than modern blockchains like Solana or Avalanche, which handle thousands.

During periods of high demand, Bitcoin’s network often slows further, with confirmation times stretching and fees surging to painful levels. For everyday users, this makes sending small transactions or micro-payments impractical.

Lack of Smart Contract Flexibility

Bitcoin was created as a peer-to-peer electronic cash and a store of value. Its scripting language is intentionally limited to ensure network security simplicity.

Instead, they migrate to Ethereum ($92B DeFi TVL), Solana ($12.5B DeFi TVL), or other chains, taking innovation and liquidity with them.

Modern Demands, Legacy Infrastructure

Users demand ultra-fast settlement, scalable financial apps, and cross-chain interoperability from modern, payment-ready blockchains. Bitcoin, while unmatched in security and decentralization, struggles to support these use cases.

The consequences are visible:

- Sending less than $1 worth of BTC may cost more in fees than the transaction itself. Notoriously, during a period of severe congestion in 2021, transaction fees reached over $59.

- During NFT booms or market surges, Bitcoin transactions clog while competitors handle surges seamlessly.

- Bitcoin is secure and trusted – but it isn’t ready for DeFi and the broader crypto economy that has evolved over the decades since Bitcoin was launched.

That’s the gap Bitcoin Hyper aims to fill.

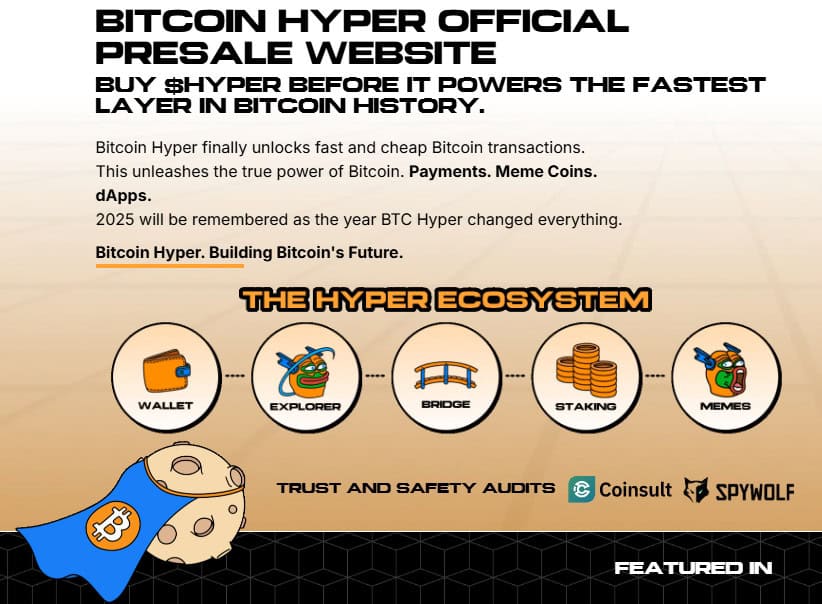

Bitcoin Hyper’s Utility

Bitcoin Hyper ($HYPER) is a Layer-2 network built on Bitcoin, designed to bring scalability, programmability, and speed to the world’s largest cryptocurrency. By combining Bitcoin’s security with modern blockchain architecture, Hyper offers a way to unlock new utility without compromising Bitcoin’s core principles.

High-Performance Architecture

At its core, Bitcoin Hyper leverages the Solana Virtual Machine (SVM) to achieve lightning-fast throughput and efficient smart contract execution. This allows developers to deploy decentralized applications (dApps), token standards, and financial services directly on a Bitcoin-anchored ecosystem.

Canonical Bridge and Zero-Knowledge Proofs

Hyper uses a canonical bridge that allows users to lock $BTC on the main chain and mint a wrapped version for use on Layer-2. This approach ensures Bitcoin remains the settlement layer while Hyper handles scalable transaction activity.

Token Utility and Governance

The native token, $HYPER, powers the network. It is used for:

- Paying transaction fees

- Staking and securing the Layer-2

- Governance and protocol upgrades

- Incentivizing ecosystem growth through rewards and grants

Early phases of Hyper feature aggressive staking rewards to attract liquidity and ensure strong adoption.

Unlocking New Use Cases

With these tools, Bitcoin Hyper unlocks a range of possibilities:

- Fast, cheap Bitcoin payments: BTC can move instantly across the Layer-2, enabling micropayments, remittances, and gaming use cases.

- DeFi on Bitcoin: Lending, borrowing, decentralized exchanges, and liquidity pools can operate natively in the Hyper ecosystem.

- NFTs and tokenized assets: Creators and enterprises can mint digital assets while remaining tied to the Bitcoin blockchain.

- Interoperable apps: Developers can build composable apps within Hyper’s environment, replicating the SVM’s versatility while remaining anchored to Bitcoin’s security.

Bitcoin Hyper’s most significant potential lies in the opportunity to further increase Bitcoin’s dominance. If Hyper succeeds, developers and capital that normally migrate to other blockchains could remain within the Bitcoin ecosystem.

Presale, Tokenomics, and Potential

Bitcoin Hyper isn’t waiting around. With the presale well-advanced, the next evolution of Bitcoin is nearly ready to launch.

Presale Progress

The Bitcoin Hyper presale launched in May 2025 and gained momentum quickly. The project has raised nearly $23M, placing it among the year’s best crypto presales.

Tokenomics Breakdown

Bitcoin Hyper features a total supply of 21B $HYPER tokens, distributed as follows:

- Development and Layer-2 growth: 30%

- Treasury and reserves: 25%

- Marketing and ecosystem outreach: 20%

- Rewards and staking incentives: 15%

- Liquidity and exchange listings: 10%

The tokenomics ensures sufficient funding for long-term development while also promoting aggressive marketing during the critical presale stages and providing deep liquidity upon launch.

Beyond the project itself, there are plenty of reasons to drive demand for $HYPER:

- Transaction fees: Every dApp and transaction on Hyper can be paid in $HYPER, anchoring utility demand.

- Staking yields: Early staking rewards are among the most competitive in the market – currently at 51% – designed to bootstrap adoption.

- Listings: Planned CEX and DEX listings post-presale will open the token to wider liquidity and speculation.

Longer-term projections (2025–2030) range from $0.50 to $1.20, assuming sustained adoption, ecosystem growth, and continued Bitcoin bull cycles. To gain the best position, learn how to buy Bitcoin Hyper with our guide.

Has Bitcoin’s Next Era Arrived?

Bitcoin Hyper arrives at a critical moment. Bitcoin dominates as a store of value but struggles to meet the demands of modern blockchain adoption.

Hyper solves that problem by fusing Bitcoin’s security with the SVM’s scalability and programmability. Bitcoin Hyper could transform Bitcoin from a secure but slow asset into the backbone of a thriving, fast, and versatile blockchain ecosystem.

With nearly $23M already raised in its presale, strong tokenomics, and a bold technological vision, Bitcoin Hyper is positioning itself not just as another token launch, but as a genuine attempt to reimagine Bitcoin’s future.

As always, do your own research. This isn’t financial advice.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation