Uniswap (UNI) Stabilizes at Key Support as Traders Watch for Trend Reversal

Following the intense selloff, the token has begun consolidating within a major demand zone, where buyers are attempting to reassert control. The recent rebound from oversold conditions has reignited cautious optimism among traders who are closely watching for signals of a broader market reversal.

Accumulation Forms Around Key Support Zone

In a recent post on X, analyst Yakov shared their perspective on Uniswap’s evolving setup, noting that their dollar-cost-averaged (DCA) entry sits around $7.90. According to Yakov, the coin’s sharp decline has brought the price into a significant horizontal support zone that has historically acted as a strong demand area. The current consolidation within this zone is notable, as price has repeatedly tested and held the same levels despite ongoing volatility.

Source: X

Within this support band, the coin has begun forming a sequence of higher lows and higher highs, a subtle yet encouraging signal that buying pressure is beginning to offset prior selling momentum. This accumulation pattern suggests that short-term participants are defending the area aggressively, while longer-term holders may be absorbing supply from capitulating traders. If these higher lows continue to form, it would mark a technical foundation for a potential recovery trend.

Market Data Reflects Cautious Rebuilding

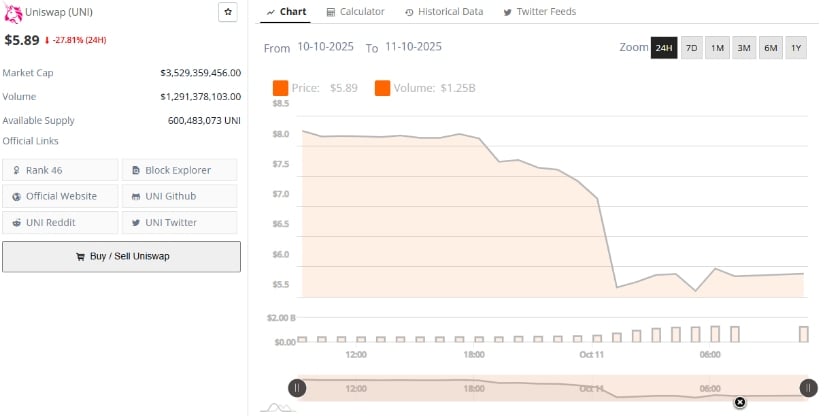

According to BraveNewCoin data, Uniswap is currently priced around $5.89, marking a 27.8% decline in the past 24 hours. The sharp drop reflects both broader market stress and localized volatility tied to heavy liquidations.

Despite the correction, market capitalization remains at $3.52 billion, supported by a robust daily trading volume of $1.29 billion, which underscores that liquidity and participation have not disappeared.

Source: BraveNewCoin

This resilience in trading activity is particularly important for a governance token like the token, which underpins the decentralized exchange (DEX) ecosystem on Ethereum. Even as speculative sentiment fluctuates, the coin’s protocol usage, governance proposals, and fee generation continue to anchor its intrinsic value.

Historically, periods of heavy drawdown have coincided with high participation and later recovery, providing long-term traders an opportunity to accumulate positions at discounted levels.

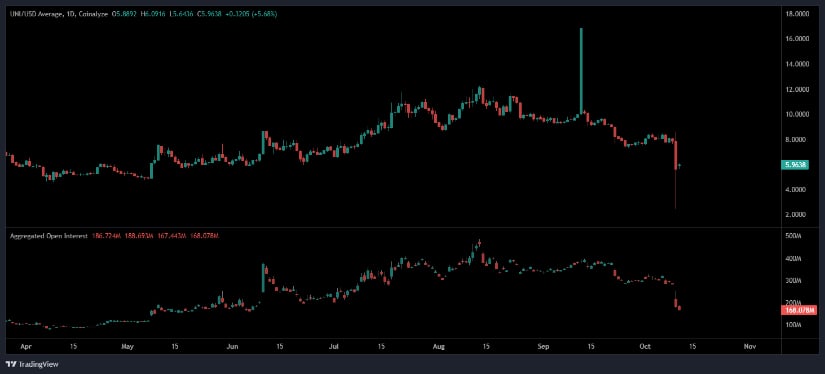

Open Interest Data Signals a Market Reset

From a derivatives standpoint, open interest has seen a substantial reset in recent days, with total exposure dropping to approximately $168 million. This decline reflects the clearing out of overleveraged positions following the sharp correction. Such contractions in open interest often indicate a “cleansing phase,” where speculative excess is flushed out, creating a cleaner base for future moves.

Source: Open Interest

The drop in leverage is generally seen as a healthy sign for market structure, reducing the risk of cascading liquidations if volatility returns. With less speculative capital in play, short-term price swings may become less erratic, allowing organic demand and spot volume to drive direction. Traders view this kind of environment as an opportunity for more sustainable growth rather than leverage-fueled spikes.

You May Also Like

Anchorage Digital applies for a Fed master account; what is it?

Could Ripple’s XRP Replace SWIFT? New Signals Hint at Potential Financial Power Shift