BlackRock’s Larry Fink Says Bitcoin “Is Not A Bad Asset” For Investors Looking To Diversify

BlackRock CEO Larry Fink says Bitcoin could serve as a portfolio diversifier for investors who are comfortable taking on some risk.

“For those looking to diversify this is not a bad asset,” he said about BTC during a recent interview with 60 Minutes. However, he said, “but I don’t believe that it should be a large component of your portfolio.”

There Is Now A Role For Bitcoin And Crypto, Says BlackRock’s CEO

Fink’s latest remarks are a pivot from his earlier criticism of Bitcoin. The BlackRock CEO acknowledged that he has not always been a fan of Bitcoin and the broader crypto market.

“I did say Bitcoin, because we were talking about Bitcoin then, was the domain of money launderers and thieves,” he said.

“But you know, the markets teach you, you have to always relook at your assumptions,” he added.

Now, Fink believes “there is a role for crypto in the same way there is a role for gold,” and added that digital assets offer investors an “alternative.”

US Dollar Could Lose Reserve Currency Status To Bitcoin

Earlier this year in his 2025 Chairman’s letter, Fink warned that the dollar could lose its status as the world’s reserve currency if the US national debt continues to spiral.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever,” he wrote.

He then noted that “the national debt has grown at three times the pace of GDP since Times Square’s debt clock started ticking in 1989.”

“If the US doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin,” he subsequently warned.

At the start of the year, Fink also predicted that Bitcoin could potentially reach as high as $700K amid the ongoing fears of currency debasement and global economic instability. This was after he had a meeting with a sovereign wealth fund who sought advice on whether to allocate 2% or 5% of its investment portfolio to BTC.

IBIT Continues Inflows Streak As Other Spot Bitcoin ETFs Record Withdraws

BlackRock’s US spot Bitcoin ETF (IBIT), which was launched last year, has led the spot BTC ETF market in inflows since the products’ inception.

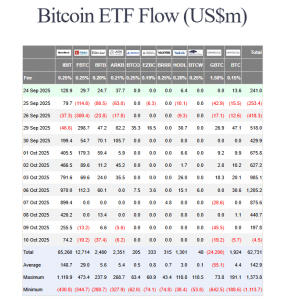

Data from Farside Investors shows that IBIT has seen $65.260 billion in cumulative inflows since it entered the market.

US spot BTC ETF flows (Source: Farside Investors)

The fund is also on a multi-day inflows streak. After recording $74.2 million inflows on Oct. 10, IBIT extended its positive flows streak to nine days. This latest day of net inflows was, however, not enough to cover the outflows seen by the other funds on the day. As such, the US spot Bitcoin ETFs brought an end to their collective inflows streak with $4.5 million net outflows.

Over the past week, IBIT also purchased more than $2.6 billion worth of Bitcoin.

That brought the funds’ total assets under management (AUM) to within reach of $100 billion, according to an X post by Bloomberg ETF analyst Eric Balchunas. However, the recent market pullback negatively impacted the product’s total AUM.

“It’s still inevitable milestone imo but wild just how close it got,” Balchunas wrote. Despite the pullback, IBIT was still able to pass VIG, which the Bloomberg analyst said is “an etf legend” to become the 19th-largest ETF in overall AUM.

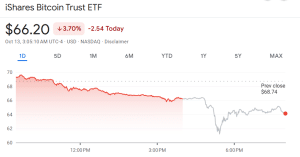

IBIT’s Share Price Retraces, But Still Shows “Utopia-Esque” Returns

Despite the continued dominance, IBIT’s share price did undergo a more than 3% pullback as the broader crypto market suffered $20 billion liquidations last week. Data from Google Finance shows that the recent correction in IBIT’s share price has pushed its weekly performance to over 6% in the red over the past seven days.

IBIT share price (Source: Google Finance)

Even with the recent drop, IBIT’s shares are up more than 76% over the past year.

In an Oct. 11 X post, Balchunas criticised investors for “whining” over IBIT’s recent performance, and said that the fund still shows “utopia-esque returns.”

“Daily price charts are the media’s best friend but an investor’s worst enemy,” he wrote, before telling investors to “zoom out” on the chart to see the bigger picture.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC