Bitcoin ETF Liquidations Hit $7B: Analysts Highlight Cardano and AVAX as Best Altcoins to Buy

The market faced a wild week after Bitcoin ETF liquidations topped $7 billion, shaking confidence across the board. Yet analysts say this pullback may offer smart entry points into top-performing altcoins like Cardano, Avalanche, and MAGACOIN FINANCE — each seen as safer bets as traders hunt for diversification.

Bitcoin’s Rough Week Shakes Market Confidence

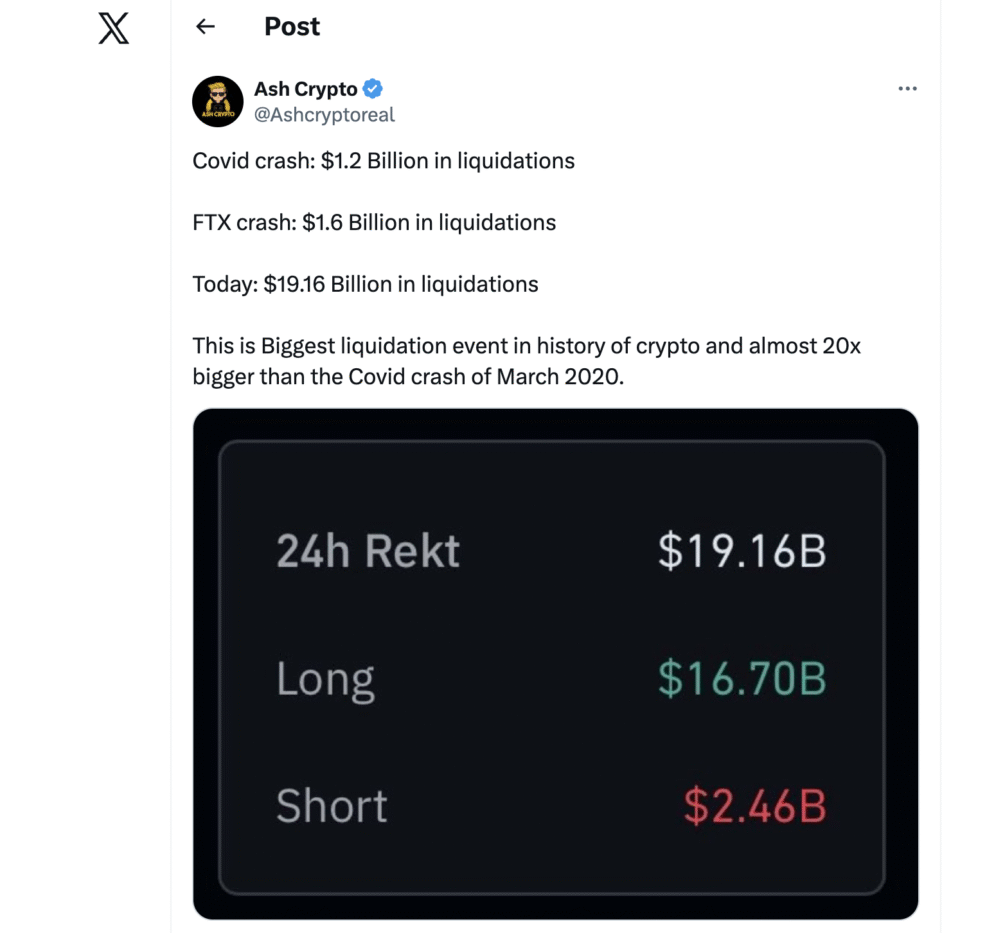

Bitcoin faced its biggest liquidation event ever, with almost $19 billion in leveraged positions wiped out after former U.S. President Donald Trump’s tariff warning on China rattled global markets. The sharp sell-off pushed Bitcoin below $103,000, before a mild rebound to $113,294 later in the day.

Analysts say the liquidation wave began when traders reacted to renewed trade war fears. Over $16 billion of those losses came from long positions, marking the largest dollar-value liquidation in crypto history. For comparison, the 2020 COVID crash saw $1.2 billion liquidated, and the FTX collapse just $1.6 billion.

Despite the panic, inflows into Bitcoin ETFs remained strong during the week. $2.71 billion poured in, with BlackRock’s IBIT leading daily inflows. The data suggests long-term holders remain confident, treating the dip as an accumulation zone. Bitcoin ETFs now manage nearly $159 billion, about 7% of the entire Bitcoin market cap.

Key Takeaways from Bitcoin’s $7B ETF Liquidations

- Over $19 billion in total crypto liquidations recorded — the biggest ever.

- Bitcoin ETFs still gained $2.71 billion in inflows this week.

- Analysts see the pullback as a reset before another round of accumulation.

Cardano Shows Buyer Interest Despite Whale Selling

Cardano (ADA) continues to attract attention from both whales and retail traders. After dropping close to 20% in 24 hours, data shows large holders increased their positions by roughly 140 million ADA, worth nearly $90 million.

This steady accumulation shows that many traders still view Cardano as one of the best altcoins to buy during market dips. Some whales took profits earlier in the week, releasing 40 million ADA, but newer entrants quickly absorbed the supply.

Analysts point to Cardano’s upcoming ETF discussions and inclusion in the S&P Dow Jones Crypto Index as reasons for renewed optimism. Despite short-term pressure, ADA’s fundamentals remain steady, supported by active developers and the upcoming Hydra scaling update set for late 2025.

If buyers sustain interest around the $0.64–$0.68 range, analysts say ADA could stabilize before testing higher levels near $0.80. For many, Cardano remains a preferred hedge in this volatile market — one that combines research-driven development with long-term credibility.

Avalanche Finds Stability Around $28

Avalanche (AVAX) has managed to stay afloat despite the broader market crash. Trading near $28, the asset shows signs of steady activity, with $693 million in daily trading volume and a market cap of nearly $12 billion.

While volatility remains, analysts note that AVAX continues to attract institutional interest thanks to new developments like StableFlow, a cross-chain stablecoin bridge. Futures open interest remains elevated, meaning traders are active and liquidity remains healthy.

Market watchers describe Avalanche as one of the best altcoins to buy for those seeking exposure to scalable blockchain infrastructure without overreliance on speculative hype. The focus on practical interoperability solutions and developer adoption gives AVAX long-term staying power.

As traders rotate from Bitcoin into altcoins, Avalanche’s balance between utility and market maturity makes it a go-to asset for portfolio diversification. A sustained move above $29 could signal renewed strength.

MAGACOIN FINANCE: The Quiet Altcoin Pick Gaining Attention

Analysts have started adding MAGACOIN FINANCE to their list of best altcoins to buy during the current volatility. Unlike most assets that follow Bitcoin’s dips, MAGACOIN’s price increases every hour, showing rare stability.

Many traders see it as a safe haven amid uncertainty, an undervalued pick that acts as both hedge and diversification tool. Its consistent growth pattern, even during broad market declines, makes it a strategic choice for those seeking a steady altcoin position. Curious investors can learn more or join the project through these links.

How Traders Can Position Now

With Bitcoin liquidations shaking out leveraged players, disciplined traders are re-entering the market quietly. The focus has shifted toward solid altcoins like Cardano, Avalanche, and MAGACOIN FINANCE, which offer diversification and more predictable growth.

Those looking to rebalance portfolios should act before market sentiment flips again — early positioning often makes the difference. Visit magacoinfinance.com to explore this rising altcoin while prices remain stable:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

The post Bitcoin ETF Liquidations Hit $7B: Analysts Highlight Cardano and AVAX as Best Altcoins to Buy appeared first on Blockonomi.

You May Also Like

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC

Bitcoin Cash’s rally faces KEY test – Can BCH hold above $500?