Bank of America (BAC) Stock Soars as Banking Giant Crushes Q3 Earnings

TLDR

- Bank of America reported net income of $8.5 billion or $1.06 per share for Q3, beating Wall Street estimates of 95 cents per share

- The bank raised its Q4 net interest income forecast to $15.6-$15.7 billion, up about 8% from a year earlier

- Investment banking fees jumped 43% to $2 billion, far exceeding earlier forecasts of 10-15% growth

- Net interest income hit a record $15.2 billion in Q3, up 9% year-over-year

- Global dealmaking activity reached $3 trillion in the first nine months of 2025, the highest level since 2021

Bank of America delivered a strong third quarter performance on Wednesday, reporting earnings that topped Wall Street expectations. The bank posted net income of $8.5 billion, or $1.06 per share, for the three months ended September 30.

Analysts had expected earnings of 95 cents per share. The actual results came in well above those forecasts.

This compares to net income of $6.9 billion, or 81 cents per share, during the same period last year. The year-over-year improvement shows solid growth across the board.

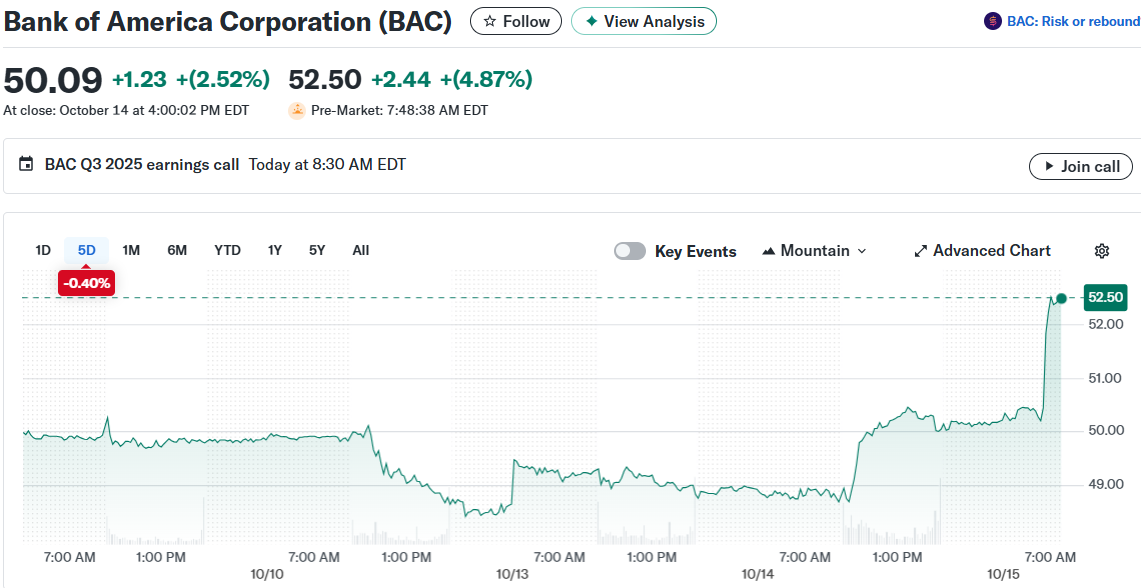

Bank of America Corporation (BAC)

Bank of America Corporation (BAC)

Shares climbed about 4% in premarket trading following the announcement. The stock has underperformed peers and the KBW Bank Index so far in 2025, though.

Investment Banking Delivers Big Beat

The investment banking division carried much of the weight this quarter. Banking fees rose 43% to $2 billion compared to the same period last year.

This growth crushed the bank’s own earlier projections. Executives had forecast only 10-15% growth in this area.

The surge reflects a broader rebound in corporate dealmaking. Companies showed renewed confidence in pursuing large mergers and acquisitions.

Global megadeals hit $1.26 trillion during the quarter. That represents a 40% jump from last year and marks the second-highest third-quarter total on record, according to Dealogic data.

For the first nine months of 2025, total global dealmaking topped $3 trillion. Mergermarket data shows this is the highest level since the pandemic peak in 2021.

JPMorgan Chase and Citigroup also reported better-than-expected profits. Their investment banking units showed similar strength during the quarter.

Net Interest Income Hits New Record

Bank of America’s net interest income reached $15.2 billion in the quarter. This represents a 9% increase from a year earlier.

Net interest income measures the difference between what banks earn on loans and pay out on deposits. It’s a key metric for traditional banking operations.

The bank raised its fourth-quarter outlook based on these results. It now expects Q4 net interest income between $15.6 billion and $15.7 billion.

That’s up about 8% from a year earlier. The previous forecast had set a lower floor for this range.

The Federal Reserve’s 25-basis-point rate cut in September may help drive demand from borrowers. This could provide tailwinds for lending activity in the coming months.

Bank of America had previously indicated it expects record net interest income for the full year 2025. The third quarter results keep the bank on track for that goal.

The post Bank of America (BAC) Stock Soars as Banking Giant Crushes Q3 Earnings appeared first on Blockonomi.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus