Grok’s Bitcoin Price Prediction with Fears of $100K: Traders Rotate to Bitcoin Hyper

KEY POINTS:

Bitcoin has recovered from its lowest recent price but is still in the danger zone.

Bitcoin has recovered from its lowest recent price but is still in the danger zone.

Grok predicts two cases for Bitcoin: rising to $160K or a crash to $100K.

Grok predicts two cases for Bitcoin: rising to $160K or a crash to $100K.

ETFs for Bitcoin are slowing down as a result of the crash.

ETFs for Bitcoin are slowing down as a result of the crash.

Bitcoin Hyper emerges from the market fiasco relatively unscathed as its presale continues to attract investors.

Bitcoin Hyper emerges from the market fiasco relatively unscathed as its presale continues to attract investors.

It looks like Bitcoin is finally stabilizing after one of the roughest weeks for crypto in recent memory. After hitting a new all-time high at around $126K, the value of $BTC dropped to lows of $106K on October 10, causing a wave of liquidations across leveraged crypto positions.

As of writing, Bitcoin is now holding at around $112K and most of the volatility seems to have passed. Now that the dust has settled, we’ve asked Grok for a forecast on Bitcoin to see whether the rumors that Bitcoin could drop to $100K in the near future hold any weight.

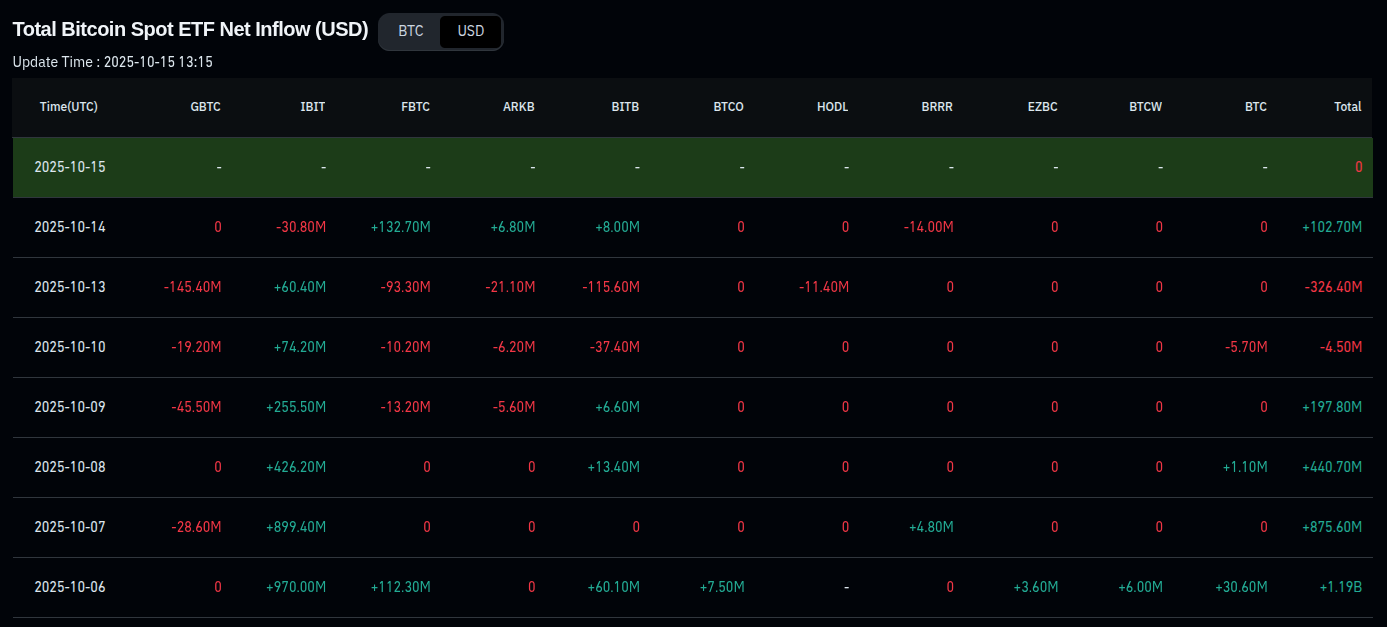

However, Grok also pointed out that the flash crash may have significantly shaken retail and institutional appetite for risk in the crypto market, leading to a bear case of around $100K. The ETF flow figures reflect this – we’ve seen much lower inflows since October 10.

Ali Martinez, on X, pointed out that Bitcoin has a major support level at around $14K. Dropping below this level could knock Bitcoin all the way down to $100K, supporting Grok’s hypothesis.

As a result of these fears, traders are currently looking to rotate out of Bitcoin until the direction of the market is clearer, especially as the full impact of Trump’s China tariffs are yet to be assessed. While Bitcoin should eventually recover, the smart money is on smaller crypto projects set to benefit from Uptober.

Bitcoin Hyper ($HYPER) is the ideal presale to check out while you’re waiting for the market to recover. It plans to bring Bitcoin into the Web3 ecosystem with smart contract support based on Solana. Let’s take a look at why adding Solana could potentially make Bitcoin more resilient against future market crashes.

Bitcoin Hyper – A Solana-Based Layer-2 Bringing Faster Speeds and Lower Fees to Bitcoin

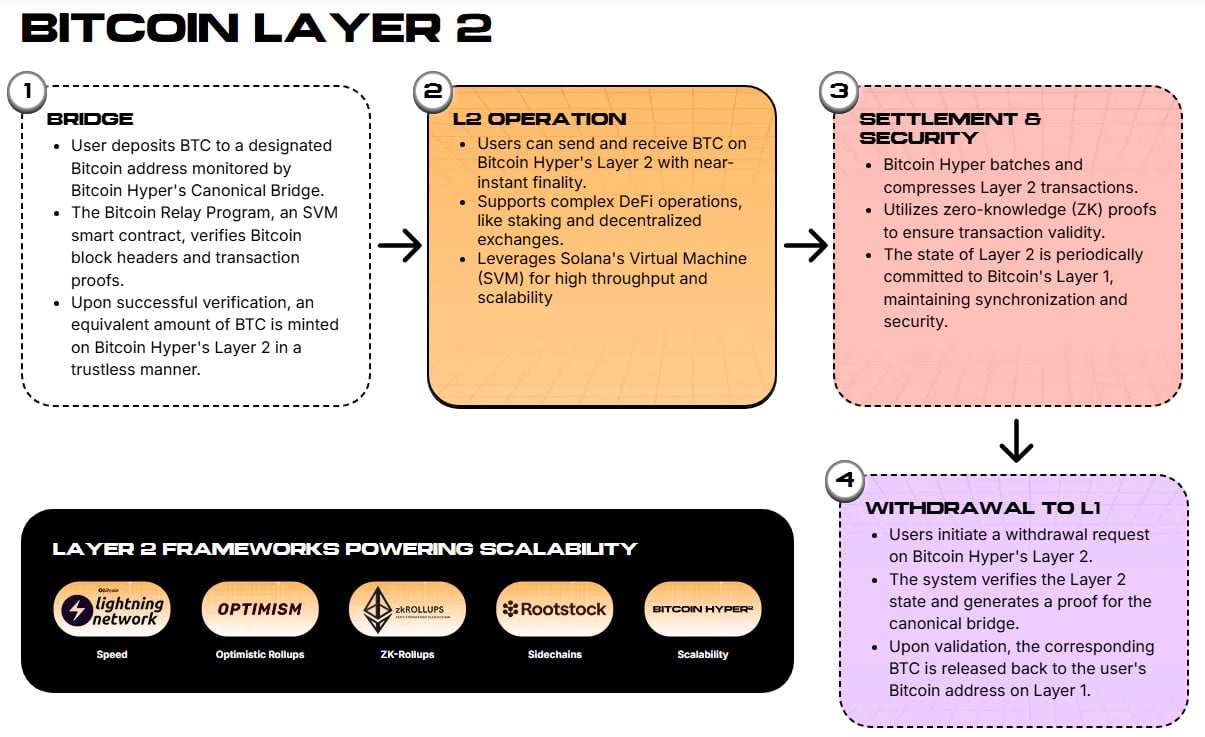

Bitcoin Hyper ($HYPER) could be the answer to all of Bitcoin’s growing problems. It’s the official token of the Bitcoin Hyper network, a Layer-2 solution for Bitcoin that will integrate the Solana Virtual Machine (SVM) to add additional scalability and Web3 capabilities to the Bitcoin ecosystem.

The recent Bitcoin pullback shows that $BTC’s primary value is as an investment asset. When the markets are spooked, Bitcoin drops and it has a harder time recovering compared to crypto assets with value based on utility as well as investment, such as Ethereum and Solana.

Transferring your $BTC between the networks will be easy. You deposit your Bitcoin onto the Canonical Bridge address on the Layer-1, which holds it in custody for you. An equivalent amount of wrapped $BTC will then be minted and deposited in your account on the Layer-2, which you can use to swap crypto and NFTs or run dApps.

The $HYPER token lets you get the most value out of using the Bitcoin Hyper network. Holding it will reduce the fees you pay when you swap crypto or run dApps on Bitcoin Hyper, making the most of your $BTC. It will also unlock access to exclusive features on smart contracts running on the Bitcoin Hyper network.

Access to the Bitcoin DAO is also limited to $HYPER holders, so if you want to have a say in the future of the network or vote on upcoming proposals, you’ll need a healthy stack of $HYPER.

All of these utility features for the Bitcoin Hyper network are why the $HYPER presale has been so successful. It has raised $23.7M+ in token sales so far, but you can still buy in cheaply at only $0.013115. Buying now also nets you up to 50% in staking rewards per annum on any tokens from the presale.

Take a look at our step-by-step guide to buying $HYPER to find out how.

Another thing to consider is $HYPER’s long-term potential. With 30% of it total token supply allocated to development, we have high hopes that this Layer-2 solution to Bitcoin’s pain points will make good on its promises – and then some.

As with most presales, though, the price increases in stages, while the APY lowers as more holders stake their tokens. So the clock is ticking if you want to buy in at $HYPER’s current early-bird price.

Be part of the future of Bitcoin – purchase $HYPER today.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator