As SOL & ETH Offer Limited Gains, New Investors Seeking Life-Changing Gains Pivot to Digitap – Next 100X Gem?

The post As SOL & ETH Offer Limited Gains, New Investors Seeking Life-Changing Gains Pivot to Digitap – Next 100X Gem? appeared first on Coinpedia Fintech News

The altcoin space is cooling down, and investors are looking for the best crypto to invest in 2025 as volatility tightens its grip on top assets. Solana (SOL) and Ethereum (ETH) have both experienced sharp corrections this week, both losing almost 10%.

Amidst this downfall, one presale project is causing traction: Digitap ($TAP). The world’s first-ever omni-bank, Digitap, merges the pace and creativity of crypto with the stability of traditional finance.

Its live app already offers users one-stop digital and fiat asset management, which alone differentiates it from the rest of the presale tokens. This solid ground is causing hype; it could be one of the best cryptos to invest in this year. In fact, many experts are speculating on a potential 100x move.

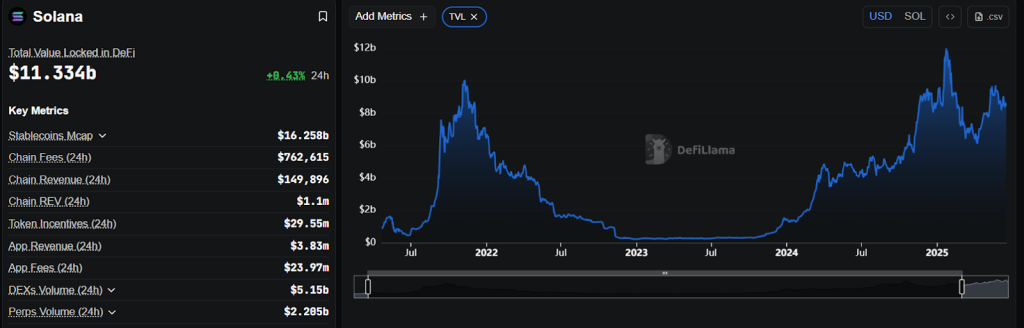

Solana Faces Pullback Despite Strong Network Growth

Solana (SOL) is now at $200, down 10% for the week, with its market cap at roughly $111 billion. Solana, even after the correction, ranks as one of the most active networks with Total Value Locked (TVL) in DeFi at $11.34 billion.

Solana (SOL) Weekly Price Chart | Source: CoinMarketcap

In addition, Solana has edged out Ethereum in terms of DEX trading volume, with $5.15 billion in 24-hour trades beating Ethereum’s $5.75 billion, as per data from DefiLlama.

Solana (SOL) Total Value Locked (TVL) | Source: DefiLlama.

Despite these strong on-chain metrics, Solana’s price is still under pressure. Analyst Crypto Bully believes that SOL may stabilize between $180 and $185, with recovery potentially on the horizon if the wider crypto market steadies.

Solana (SOL) Price Analysis | Source: @BullyDCrypto

If momentum returns, Solana may get back to its earlier all-time highs around $295. And in the bull cycle, it may even target the $500 mark. But it depends on overall market recovery and investor sentiment.

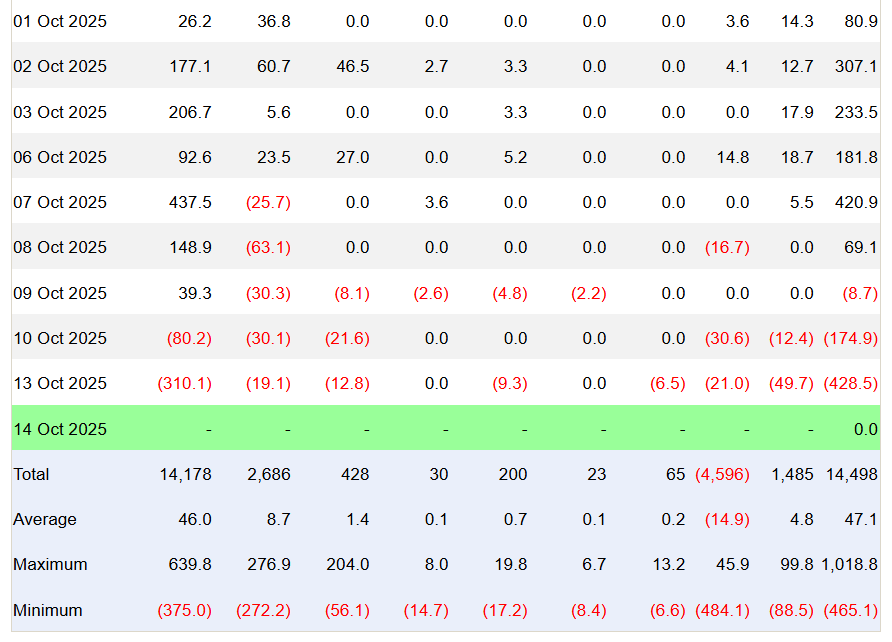

Ethereum Struggles to Hold Support as ETF Outflows Weigh

On the other hand, Ethereum (ETH) is subject to the same trend. The top altcoin exchanges hands at $4,110, also almost 10% lower week-on-week, with increased pressure from institutional outflows.

Ethereum (ETH) Weekly Price Chart | Source: CoinMarketcap

According to the analyst TedPillows, ETH’s nearest support is around $3,800, and a break below this could see the price slip into $3,400- $3,600 area. The market correction in this backdrop follows a rush of profit-taking and rising uncertainty on global economic developments.

U.S. spot Ethereum ETFs saw $428.5 million of outflows on October 13, the steepest since early September, according to Farside Investors data. BlackRock’s ETHA alone had $310.1 million taken out in one day, indicating changing sentiment among investors.

U.S. Spot Ethereum ETFs Data | Source: Farside Investors

The latest reversal came after President Donald Trump announced 100% tariffs on Chinese imports, which set off what market trackers referred to as the biggest liquidation event in crypto history.

All this has left many investors hesitant about short-term prospects for top altcoins such as Solana and Ethereum. While both initiatives have solid ecosystems and innovation pipelines, their short-term upside seems limited as general market volatility sets in.

Digitap’s Unique Omni-Banking Solution for a Volatile Market

Digitap differs from a sea of new crypto projects by having an omnibanking solution that offers an integrated system of finance in which crypto meets fiat under one platform.

It interoperates between DeFi and conventional banking networks to facilitate real-time cross-border payments, multi-currency holding wallets, and automated exchanges.

In times of increased market volatility, like the present market scenario, Digitap is the ideal sanctuary.

Since the app also allows users to move assets into more stable fiat holdings swiftly, investors can safeguard their assets during periods of erratic crypto price fluctuations. That kind of versatility is just the reason why Digitap is among the top altcoins to buy today.

The project’s app is already active in both the Google Play Store and Apple App Store, allowing users to register, spend via Visa cards, and make transfers. These functions are uncommon in start-of-stage crypto projects. It focuses on security in multi-signature wallets and KYC/KYB verifications to ensure user comfort and compliance.

Digitap’s 124% Staking Rewards Attract Early Investors Ahead of Launch

Digitap presale performance indicates growing confidence in its utility-driven approach. The project has already managed to rake in more than $700,000, selling nearly 60 million $TAP tokens in Stage 3 already, which is now over 40% sold out.

The $TAP token currently sells at $0.0194 after a 22% price leap from $0.0154 in Stage 2. So far, the price of $TAP has increased by over 50% in the presale. And this could be one reason why investors have been flocking to the presale before the price jumps another 38% to $0.0268 in Stage 4.

Early investors like the strong tokenomics. The staking program of Digitap provides 124% APR to the early investors and also provides 100% APR after launch with zero inflationary risk.

The project roadmap also includes major future milestones such as CEX and DEX listings, merchant onboarding, and payroll systems based on AI. All such integrations are planned to turn Digitap into an end-to-end financial solution for businesses and individuals all across the world.

Moreover, the app’s availability prior to the token release makes Digitap stand out among most presales, which provides it with some credibility. This readiness could make it one of the best cryptos to invest in 2025 for investors seeking innovation and utility.

Add to that the latest price forecasts of a potential 100x price pump post-launch, and it starts to make sense why Digitap ($TAP) is all over the headlines.

Digitap Emerges as a Safe Haven in a Volatile Market

While Solana and Ethereum still have foundational roles to play, their present shortcomings have left room for new-gen projects like Digitap to attract attention. Digitap’s live omni-bank application, open tokenomics, and stable fiat conversion option provide an over-the-counter safety net, something that old altcoins don’t.

In times of uncertainty, the feature makes Digitap a useful hedge and growth prospect. Also, Digitap seems to have positioned itself as a potential 100x player with its functional product and increasing presale success.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Strategic Move Sparks Market Analysis