Bitcoin Flash Crash Overreaction? Analysts Say It’s Time to Buy SOL, ETH, and ADA Again

Bitcoin’s recent flash crash eliminated billions from the market, sending prices below $110,000 and traders into a panic mode. However, analysts now suggest that the response in the market was exaggerated and short-term in nature.

As volatility cools, investors are shifting their focus to assets with good fundamentals. Solana, Ethereum, and Cardano are emerging as some of the leading recovery candidates. Meanwhile, MAGACOIN FINANCE, a fast-growing community-driven project, is attracting interest from investors for its transparency and early-stage rewards.

Bitcoin Volatility Creates Buying Opportunity

Bitcoin’s price crashed from $122,000 to $101,000 after renewed US-China tariff tensions kicked off, sparking selling. The sudden decline wiped out over $19 billion in leveraged positions, in one of the largest liquidation events on record.

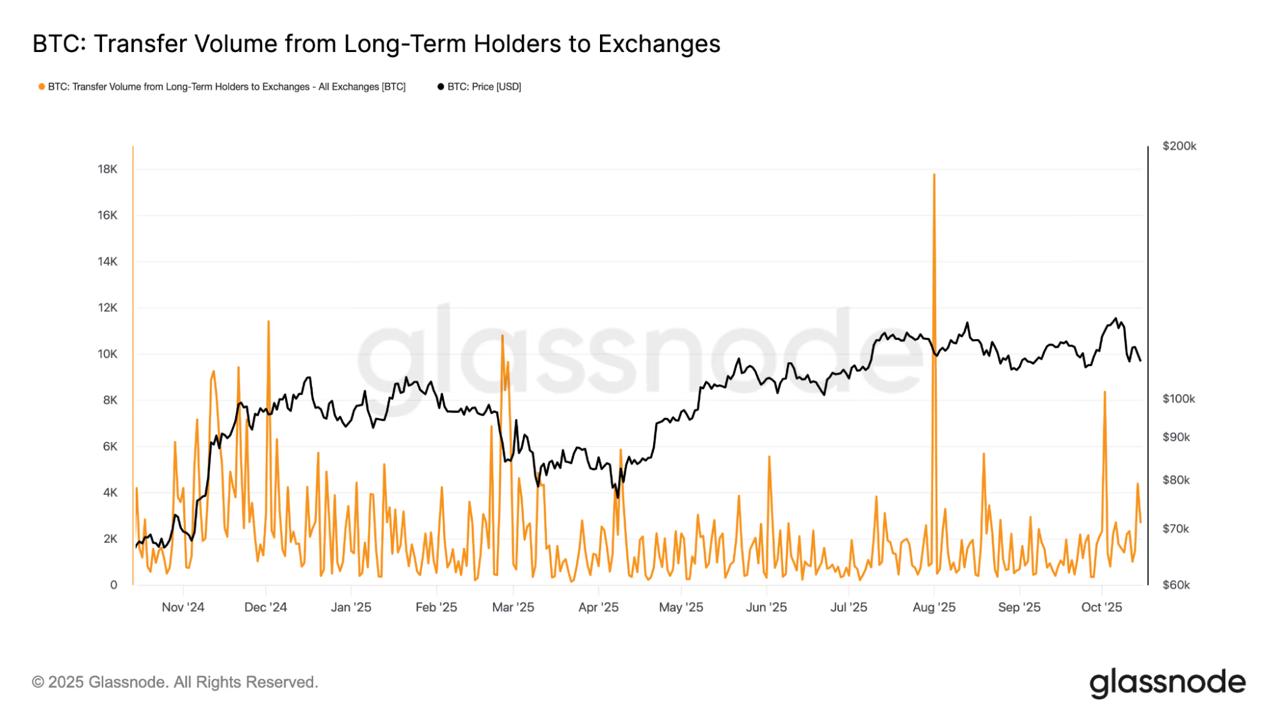

Glassnode data indicates that while the short-term traders exited, institutional buyers started accumulating again near the $110,000 zone. Despite a 9% weekly decline, analysts describe the move as a necessary market reset. ETF inflows have slowed but remain positive, which suggests hesitancy rather than panic.

Source: GlassNode

Analysts also believe Bitcoin can consolidate between $108,000 and $117,000 before another breakout attempt. They added that the flash crash eliminated excess leverage, laying a more stable ground for the next rally.

Solana Adoption Surges Across Crypto Banking

Solana has emerged as a major beneficiary of post-crash rotation. Its decentralized exchange volume reached $6.16 billion in a single day, indicating a strong network demand. Low fees and high transaction speeds keep drawing in startups and financial platforms.

Analysts point out that the growth of Solana’s ecosystem in Asia is fueling institutional adoption. Projects such as Jupiter, Orca, and Raydium are helping to grow Solana’s presence in the crypto banking and B2B payment systems industry. This growing infrastructure adds to its status as a top performer in the next market phase.

Ethereum Strengthens Developer and Institutional Backing

Ethereum remains a cornerstone of blockchain innovation despite its 8% decline in a week. BitMine Immersion Technologies just added $417 million worth of ETH to the treasury, bringing holdings to more than three million coins.

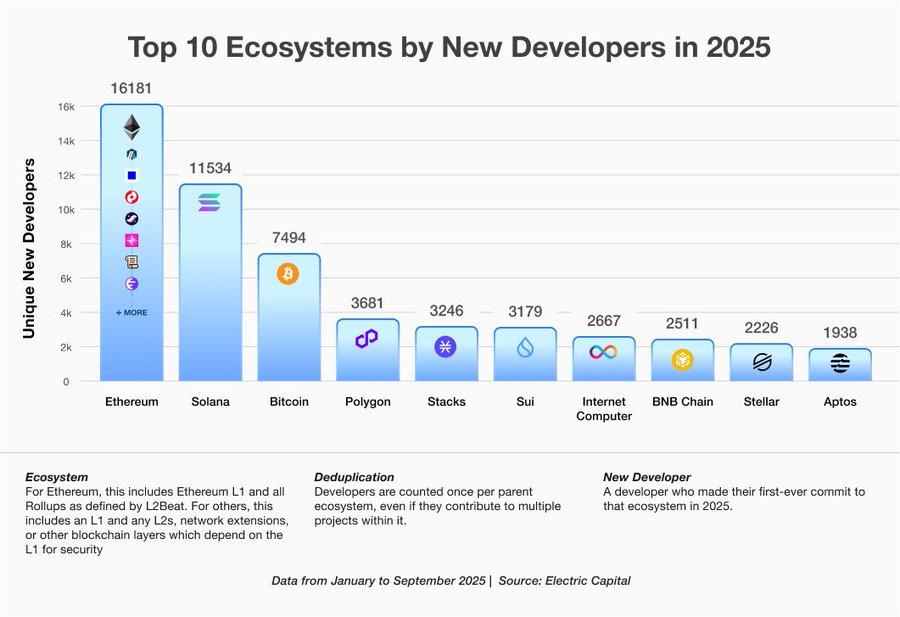

Data from Electric Capital indicates that Ethereum added over 16,000 new developers during 2025, as it continues to lead the pack in terms of blockchain development. Analysts point to Ethereum’s leading role in DeFi and increasing appetite for Ethereum among institutional investors. The expansion of the network in layer 2 and the depth of liquidity continue to attract capital even in volatile conditions.

Source:X

Cardano Nears Hydra Upgrade Amid Oversold Signals

Cardano is preparing for two major ecosystem upgrades that aim to improve its scalability and governance capabilities. The Hydra scaling solution is continuously developing and promises to have faster transaction throughput and better network performance. Analysts believe Hydra will increase the efficiency of Cardano and make it suitable for large-scale adoption.

At the same time, excitement is building around the Chang Hard Fork. Two weeks ago, the upgrade took a huge step closer with the release of Node 9.1.0, a version that a group of ecosystems called Intersect described as the last step towards enabling on-chain decision-making. The update introduced the Conway genesis file, a critical component for initiating the Chang Hard Fork and ushering in Cardano’s decentralized governance era. Together, Hydra and Chang represent a defining stage in the evolution of Cardon.

MAGACOIN FINANCE Rewards Investors with PATRIOT50X Bonus

Beyond major altcoins, MAGACOIN FINANCE continues to gain traction as one of the fastest-growing community projects in the market. Developers credit the project’s rise to transparent audits, consistent communication, and an engaged investor base.

To celebrate its expanding community, MAGACOIN FINANCE announced a limited-time 50% investor bonus redeemable with the promo code PATRIOT50X. The reward highlights the project’s commitment to early supporters and reflects growing optimism among retail participants.

Analysts say MAGACOIN FINANCE’s proactive approach and investor incentives align with rising confidence in well-structured altcoin projects during this consolidation phase.

Conclusion

Analysts view the Bitcoin flash crash as a short-term reset rather than a long-term reversal. Institutional buying remains steady, and retail confidence is beginning to recover.

As Solana’s adoption expands, Ethereum’s developer base strengthens, and Cardano’s upgrades near completion, analysts foresee renewed growth across the market. With MAGACOIN FINANCE’s community rewards adding enthusiasm, investors are again positioning for an altcoin-led rebound.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin Flash Crash Overreaction? Analysts Say It’s Time to Buy SOL, ETH, and ADA Again appeared first on Coindoo.

You May Also Like

Trump calls US Olympian 'a real loser' for saying he represents what’s 'good about the US'

Fed Decides On Interest Rates Today—Here’s What To Watch For