Crypto market crash leads to $1.2b wipeout, here’s why

The crypto market crash has erased nearly $1.19 billion in liquidations as the overall market cap drops dangerously low near $3.5 trillion. Here’s why major altcoins are falling.

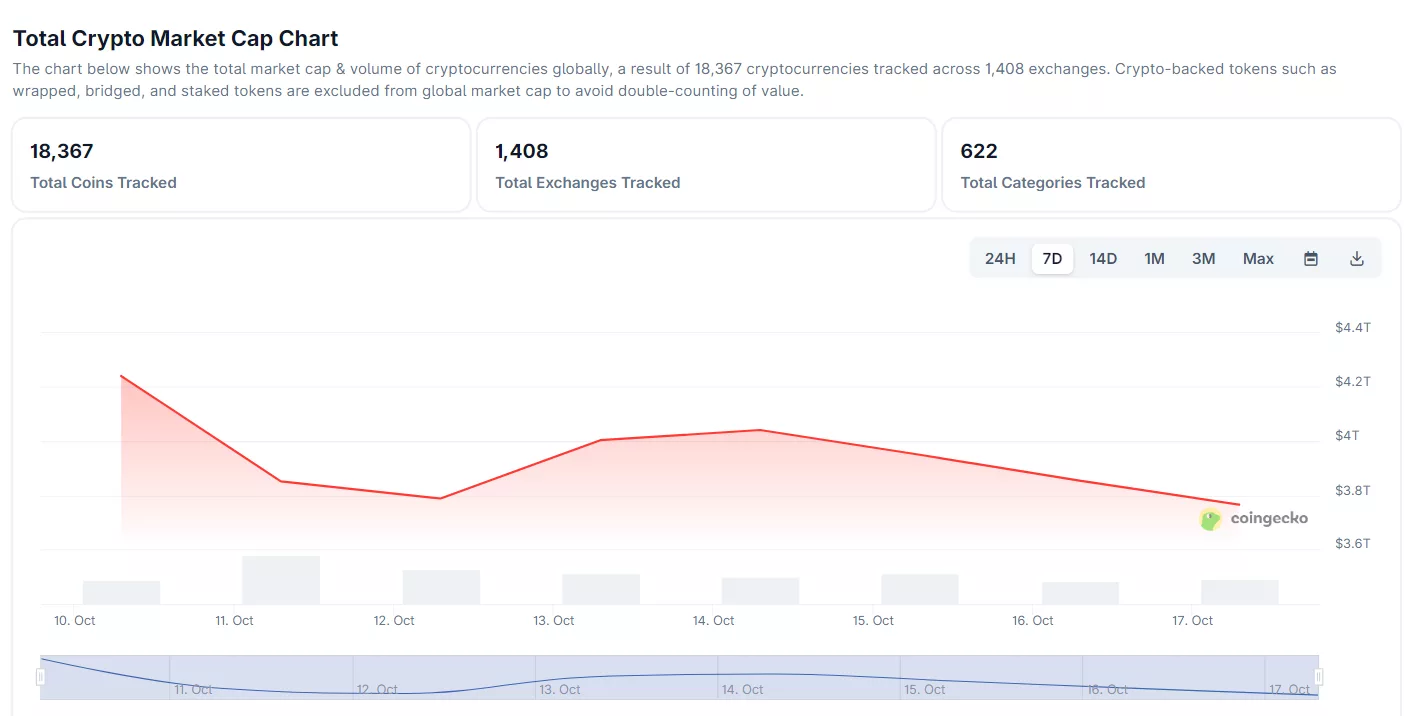

- The crypto market cap has plunged by 7.3% to around $3.6 trillion, triggering a crypto market crash consisting of over $1.2 billion in liquidations within 24 hours.

- Altcoins continue to suffer sharp declines due to cascading liquidations, profit-taking, and macroeconomic uncertainty, with traders increasingly cautious amid delayed rate-cut expectations.

On Oct. 17, the overall crypto market cap plummeted by 7.3% to around $3.6 trillion. The market is in shambles, with the market cap dropping near $3.5 trillion after plunging below $4 trillion just a week ago. The drop is accompanied by a wave of liquidations throughout the day amounting to more than $1.23 billion in the past 24 hours.

The majority of liquidations during this crypto market crash came from long positions at $920 million, while about $309 million were short positions. In the past hour alone, there have been about $118 million in liquidations, with a near-equal divide between long and short positions.

In the past hour, Bitcoin (BTC) remains the asset with the largest liquidations, contributing to $74 million. Meanwhile, Ethereum (ETH) has lost about $26.5 million in liquidations within the past hour. Solana (SOL) and other altcoins have seen smaller losses amounting to $6.91 million and $3.23 million in the same time period.

According to Coinglass, the crypto Fear & Greed Index has fallen into “fear” at 23; however, the meter is edging close to the extreme-fear zone at 22. Traders appear increasingly wary as the market falls deeper into bearish momentum, with various altcoins continuing their decline as the pattern from the previous week persists.

As Bitcoin inches closer near the $106,000 mark, tokens like POL (POL), ASTER (ASTER), PLASMA and HYPE (HYPE) have taken some of the hardest hits from the crypto market crash. According to data from crypto.news, ASTER has continued its downward trend, falling by 16% in the past day. Throughout the week, Aster has plunged more than 32.7% from its previous level as it barely hangs on to the $1 level.

Meanwhile, Polygon’s native token, POL, has exhibited a double-bottom. Its token is currently rising by 3.8% in the past hour; however, it will need to pick up speed to break its downward trend, considering it has been on a 21.4% decline in the past week due to several crypto market crashes.

PLASMA has shown a similar pattern, seeing a 4.9% rise in the past hour after a double-bottom. However, it has been on a much deeper downturn, with the token slipping by 13.9% in the past 24 hours and by more than 43% within the past week. XPL is currently trading at $0.406.

Hyperliquid’s token has stayed relatively stable for the past hour throughout the crypto market crash, remaining at $35.36. Despite this temporary steadiness, the token has fallen by 8.5% in the past 24 hours. In the past week, it has suffered through crypto market crashes that brought down its value by 22.4%.

Here’s why altcoins are falling in the crypto market crash

Altcoins are falling largely due to a combination of the broader bearish market, profit-taking, and cascading liquidations across the crypto sector. Earlier today, Bitcoin dropped below $110,000 and teetered near $105,000 before rebounding slightly to the $106,000 level. In the past 24 hours, BTC has fallen by 4.7%.

Bitcoin’s fall set the tone for other altcoins, considering BTC often acts as a magnet that lifts other tokens up or drags them down. The correlation remains strong because most altcoins still depend on Bitcoin’s performance to attract capital and maintain confidence.

Another key factor behind today’s crypto market crash is the wave of liquidations hitting leveraged positions. Many traders use margin and derivatives to amplify returns, but when prices fall below certain thresholds, exchanges automatically close those positions to prevent losses. This triggers a chain reaction, as forced selling pushes prices lower, which then liquidates more positions.

In addition to technical pressures, macro and regulatory concerns are weighing on sentiment. Investors are increasingly cautious amid expectations that the U.S. Federal Reserve and other central banks may delay interest-rate cuts due to stubborn inflation. Higher rates tend to make speculative assets like crypto less appealing, reducing liquidity across risk markets.

Finally, there appears to be a continuing pattern of market decline after the major crypto market crash on Oct. 10, which erased about $19 billion in forced liquidations from the market. As the loop continues, traders engage in profit-taking. Many are taking the opportunity to lock in gains, as they anticipate a near-term correction before the market can recover properly.

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Orderly Network: Preparing for a big event next week