Dogecoin Price Prediction Points to a Repeat of 2017’s Rally – Here’s Why Maxi Doge Could Shine

Key Points:

Dogecoin’s long consolidation mirrors its 2017 setup, hinting at an impending major breakout.

Dogecoin’s long consolidation mirrors its 2017 setup, hinting at an impending major breakout. Analysts predict $DOGE could surge 250% short term and up to 2,000% long term if the pattern plays out.

Analysts predict $DOGE could surge 250% short term and up to 2,000% long term if the pattern plays out. Maxi Doge could ride the momentum as investors seek the next meme coin linked to Dogecoin’s rally.

Maxi Doge could ride the momentum as investors seek the next meme coin linked to Dogecoin’s rally.

Dogecoin did pretty well to immediately snap back after last Friday’s liquidation event, when at one point it was reeling around $0.1.

It’s currently trading around $0.19, but given that the biggest meme coin in the world has mostly moved sideways ever since its 2021 rally – and considering the long duration of this consolidation zone – speculation is rife about whether the next Dogecoin pump is just around the corner.

Well, there’s no smoke without fire, and there are indeed some strong signs that Dogecoin could be mustering up some appetite for a loud bark.

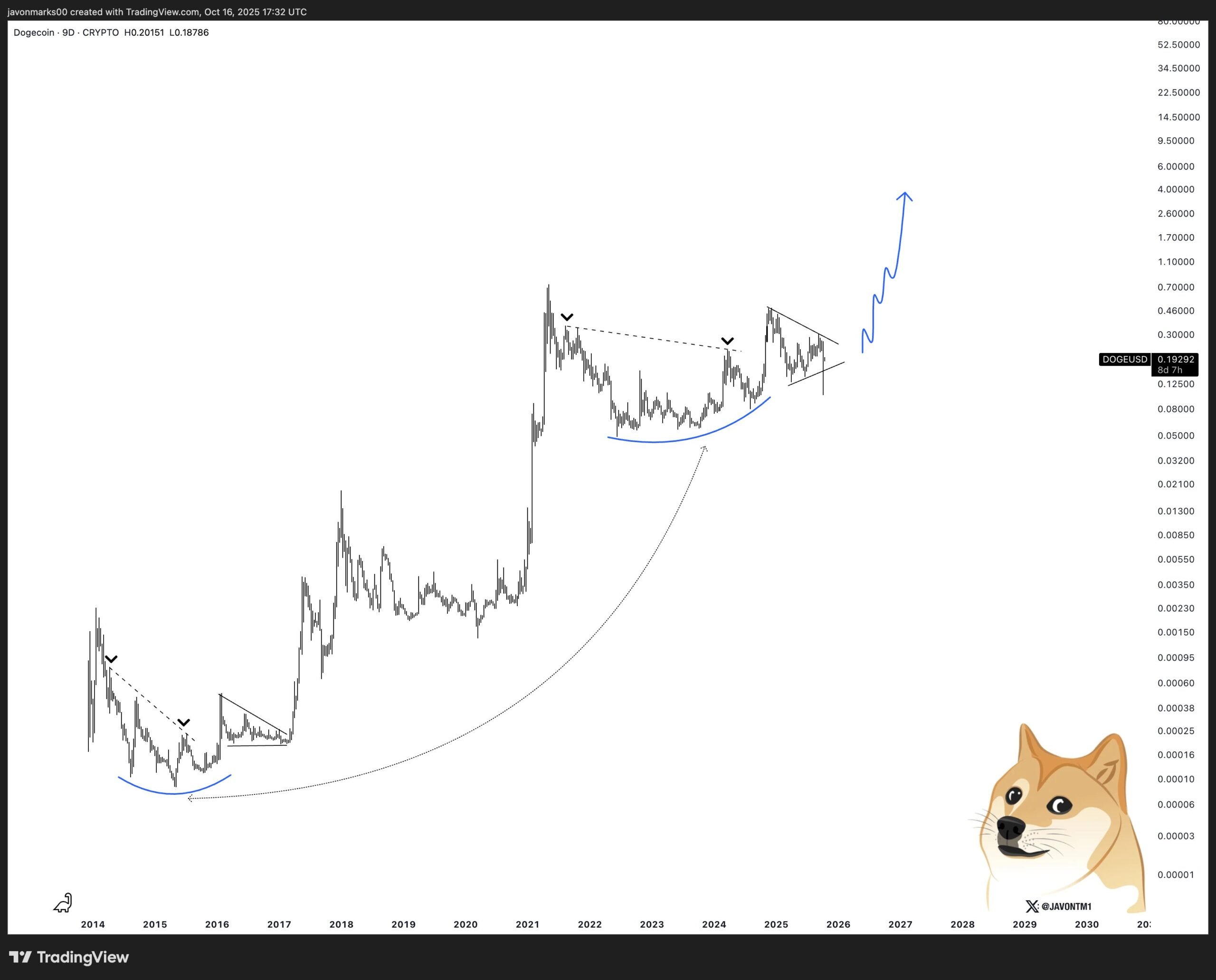

Back then, $DOGE formed a massive cup-shaped base, followed by another consolidation phase – a descending triangle pattern – whose breakout ultimately led to Dogecoin’s first glorious run.

Source: X/@JavonTM1

And almost everything similar seems to be happening right now. We have the massive cup-shaped base, which, even more positively, is a longer one this time around, stretching from May 2022 to around September-October 2024.

Then came a rally, and now the token is consolidating once again in a descending triangle pattern.

Perhaps if it weren’t for Friday’s liquidation event, we could have already seen the breakout. But because of it, the token has once again fallen off after challenging the upper resistance line of the triangle.

Still, if this pattern holds – and there’s a high likelihood it will, given how much time the token has spent creating it – we could be in for a potential 2,000% surge, meaning $DOGE could rally to around $6 in the long run.

All in all, chart patterns and expert analyses suggest that Dogecoin might still have it in it to deliver another parabolic rally. That said, the token’s maturity over the years admittedly makes that a much taller task.

On the other hand, low-cap Doge-themed meme coins face no such limitations. Given their low-priced, under-the-radar nature, even a relatively modest price jump can stand out thanks to the massive percentage gains on offer.

The top contender here? Maxi Doge ($MAXI).

What is Maxi Doge?

Perhaps the biggest attraction point for investors when it comes to Maxi Doge is its absurd yet strangely convincing backstory.

Maxi Doge ($MAXI) is Dogecoin’s distant cousin – but because of Dogecoin’s over-the-top popularity and cutesy vibe, he stole whatever little limelight there was from Maxi’s family, leaving his younger cousin to reel in sadness and loneliness.

Such unfair treatment from his elder brother is exactly what drove Maxi to become the anti-Doge.

Unlike Dogecoin’s cute, fun-loving nature (and that of almost every dog-themed meme coin out there), $MAXI chose the alternative route – to give investors something they’ve never had before: a fierce-looking, return-hungry Shiba Inu.

Maxi’s Master Plan: Go Viral and Leave Dogecoin in the Dust

Of course, Maxi’s mission to overthrow Dogecoin as the best meme coin on the planet is not going to be easy.

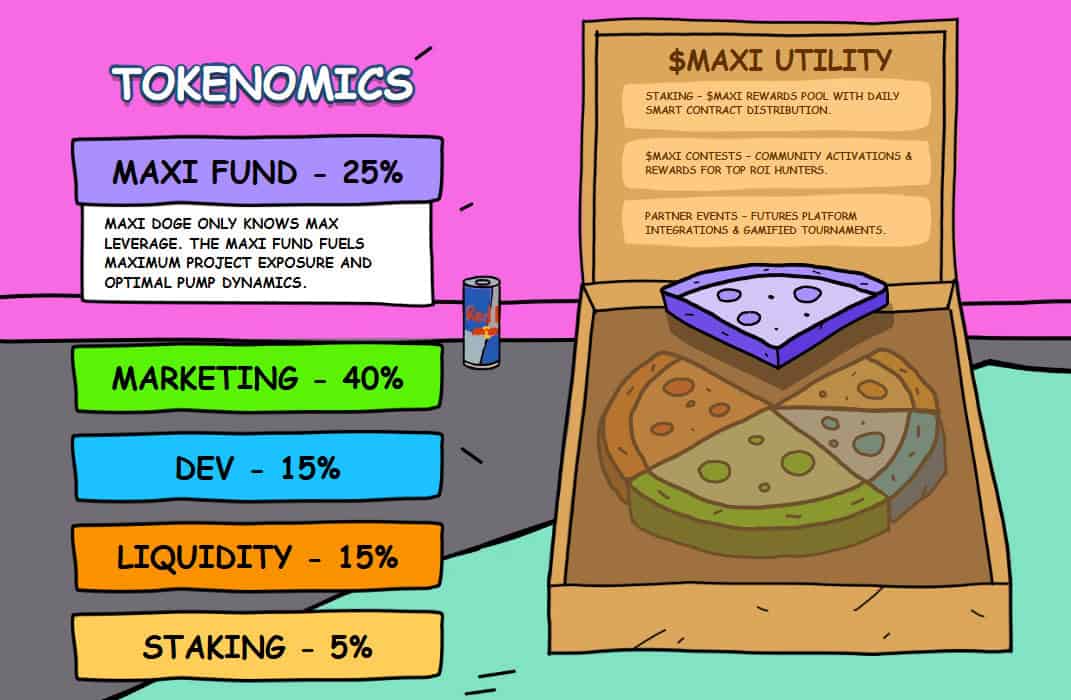

That said, the developers have put in place a rather smart plan, allocating a massive 40% of $MAXI’s total token supply for marketing.

This includes influencer collaborations, social media campaigns, and PR promotions, all geared toward putting Maxi Doge on the meme coin map and ensuring its gym-bro humor reaches far and wide, even outside the crypto landscape.

In addition to CEX and DEX listings, $MAXI also plans to list on futures platforms, further boosting its appeal among degen meme coin traders – who can use $MAXI as the perfect launchpad to crank up leverage and chase whale-like returns.

Why Maxi Doge Is the Best Meme Coin to Buy Right Now

Even though it’s a hate-driven relationship, there’s no denying that $MAXI’s Dogecoin lineage gives it a much-needed edge in this fiercely competitive meme coin space.

As mentioned earlier, Maxi’s absurd mission to take on Dogecoin could be exactly what makes it the next 1000x crypto.

After all, in the wild world of meme coins, the more absurd an idea is, the more likely it is to gather steam and win over the meme coin community.

One $MAXI is priced at just $0.0002635 right now, and the project has already raised over $3.68M from early investors.

Take a look at our step-by-step guide on how to buy Maxi Doge.

Take a look at our step-by-step guide on how to buy Maxi Doge.

Not just raw gains, buying $MAXI will also give you access to weekly trading competitions, leaderboard rewards, and other community-centric events.

Maximize the next Dogecoin pump – grab your $MAXI tokens today.

You May Also Like

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

BlackRock Increases U.S. Stock Exposure Amid AI Surge