Coinbase Buys Echo Crowdfunding Platform for $375M — Boosting Crypto Funding

- Coinbase acquires Echo for $375 million to enhance onchain community funding capabilities.

- Echo, founded by crypto trader Jordan Fish (Cobie), enables early-stage project investments and private funding rounds.

- The platform has already facilitated over $51 million in funding across 131 deals, including for the stablecoin Ethena.

- Echo will operate as a standalone platform while integrating Coinbase’s infrastructure, expanding access to crypto and traditional assets.

- The acquisition signifies a potential revival of public token sales, reminiscent of the ICO era, with new platforms leading the resurgence.

Coinbase Invests in Community-Centric Funding

Major US cryptocurrency exchange Coinbase announced a substantial $375 million acquisition of Echo, a blockchain platform designed to facilitate community-driven capital formation. The deal, revealed on Tuesday, underscores Coinbase’s strategic focus on transforming how projects and startups raise funds through decentralized means.

The acquisition followed Coinbase’s recent movement into broader crypto engagement, including sending $25 million in USDC to Cobie’s wallet to fund an NFT and revive his popular UpOnly podcast. Inspired by Echo’s focus on early-stage funding, Coinbase seeks to deepen its involvement in the community finance ecosystem.

Source: CobieGroundbreaking Projects and Platform Expansion

Founded less than two years ago by Crypto trader Jordan Fish, also known as Cobie, Echo launched in beta in April 2024 with a mission to democratize access to private funding rounds. In just eight months, the platform has successfully closed 131 deals, raising over $51 million to support projects like Ethena, a decentralized dollar protocol behind the fast-growing stablecoin USDe (USDE).

Cobie highlights Ethena as the pioneer project to fundraise through Echo, emphasizing the platform’s role in early-stage investing within the DeFi sphere.

In May, Echo introduced Sonar, a tool enabling founders to host self-managed public token sales across multiple blockchains, including Solana, Base, and Cardano, giving projects more control over their fundraising processes.

Future Prospects: Standalone and Integrated

Post-acquisition, Echo will operate as an independent platform under its existing brand, with plans to incorporate Coinbase’s infrastructure. Cobie stated that the Sonar product will be integrated into Coinbase, allowing founders to reach investors more directly. Additionally, Coinbase aims to enable broader access to tokenized securities and real-world assets, leveraging Echo’s infrastructure to expand beyond crypto token sales.

Source: Cobie

Source: Cobie

Coinbase outlined its vision: “Integrating Echo’s tools will help us enable more direct community participation, joining projects with capital, entirely onchain.” The company further announced that they plan to expand support to tokenized securities and traditional assets, leveraging Echo’s robust infrastructure.

Is the Crypto Community Seeing a Revival of ICOs?

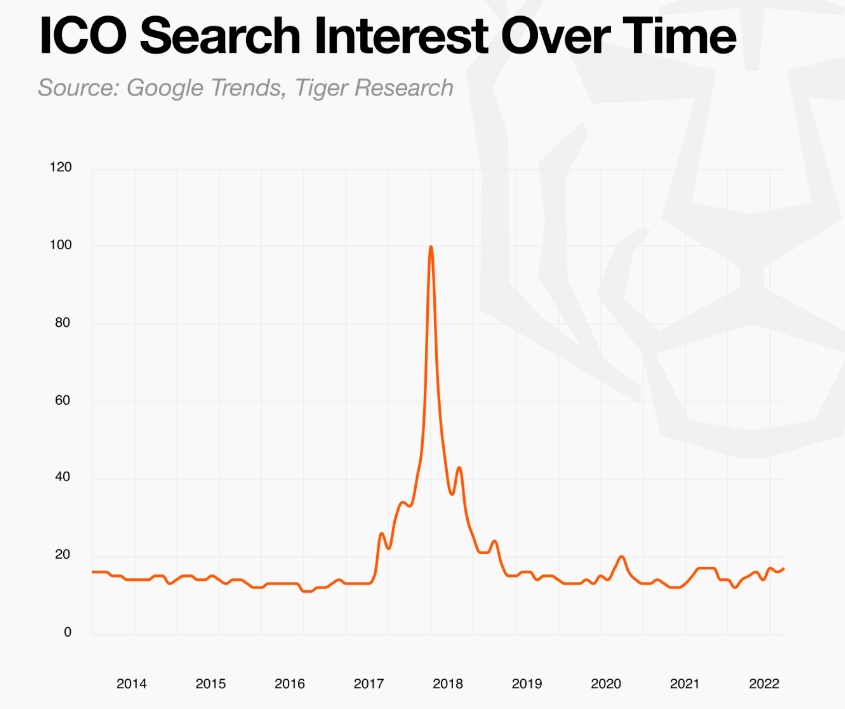

The acquisition signifies a rekindling of interest in community-funded crypto projects—echoing the ICO boom of 2017. Industry reports indicate a rising trend of public sales via launchpads like Sonar, Kaito, and Buidlpad, signaling a shift back toward transparent and community-driven fundraising.

While the ICO craze faced decline amid scandals and fraud, recent developments suggest a more structured revival, with projects seeking early user engagement and liquidity through public token launches.

Source: Tiger Research

Source: Tiger Research

The trend toward public sale platforms could endure as they fill a vital role in early adoption and liquidity provision, despite potential short-term hype fluctuations. Notably, some influential figures linked to former U.S. political leadership have called for a revival of ICOs to reshape crypto fundraising approaches.

As the industry evolves, Coinbase’s strategic moves suggest a future where public and private funding mechanisms become more integrated and accessible, fostering innovation within the crypto markets.

This article was originally published as Coinbase Buys Echo Crowdfunding Platform for $375M — Boosting Crypto Funding on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Federal Reserve Announces Rate Cut Amid Shifting Economic Risks