Grok Predicts Bitcoin Price as Viral $HYPER Presale Hits $25.3M

Quick Facts:

1️⃣ Bitcoin has been struggling to defend $110K since the deleveraging event of Oct 10, but the price correction is short-term, says Grok AI.

2️⃣ Once $BTC breaks the resistance at $110K and then at $115K, the path will clear for bigger surges before the year’s end, potentially setting a new all-time high in November.

3️⃣ But Bitcoin’s upcoming Layer-2 solution Bitcoin Hyper offers a smarter bet, if the growing presale FOMO is any sign.

Grok has high hopes for Bitcoin, despite the recent price correction that pushed the coin below $110K.

Tapping into the macroeconomic backdrop turning green, $BTC has its eyes set on a steady climb over the coming weeks. The recently announced Fed interest rate cuts and easing trade tensions between the US and China could propel the crypto forward, as more capital flows into the market.

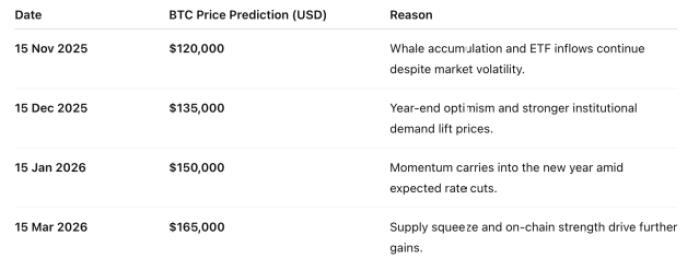

Here’s a summary of Grok’s short-term Bitcoin price prediction:

With no major macro shocks in sight, Bitcoin is expected to rebound soon.

The signs are already here. On-chain data shows that whales are stacking up on Bitcoin undeterred by the market volatility, while companies like Strategy and American Corporation continue to buy the dip.

According to Grok, Bitcoin will be increasingly seen as a strategic asset, not just by companies, but also by governments.

While metals like gold are static stores of value, Bitcoin generates value through blockchain innovation and crypto-fintech integrations. Macroeconomists like Lyn Alden share this outlook, describing $BTC as gold with the upside of a tech stock.

However, based on past patterns, short-term dips are also on the cards. This year, five of the six FOMC meetings have coincided with Bitcoin downturns, while only one has led to a rally, as crypto analyst Ali Martinez pointed out in a recent post.

For investors who understand Bitcoin’s long-term potential, the ongoing dip is an excellent window to buy in.

Grok also recommends investing in infrastructure coins that could play a crucial role in Bitcoin’s journey ahead. Bitcoin Hyper ($HYPER), for example, is building a Layer 2 solution to bring more speed and programmability to the Bitcoin network.

Strategic investors have flooded its native token presale – with whales gobbling up tokens worth $379.9K, $274K, and $161.3K in one shot – sending it past the $25.3M milestone already.

Is Bitcoin Hyper ($HYPER) the Next Crypto to Explode?

A top crypto that could take off before year-end, along with Bitcoin, is Bitcoin Hyper’s native token $HYPER.

In fact, our Bitcoin Hyper price prediction sees the token outperforming Bitcoin and Ethereum this season thanks to the high market relevance of its underlying technology.

The low presale price ($0.013195) and high staking rewards (46%) currently on offer have also been compelling factors, driving traction to the presale.

Read our ‘How to Buy Bitcoin Hyper’ guide for step-by-step instructions on joining the presale.Once the token hits the exchanges after its upcoming TGE, the market will decide its price, and waiting until then to buy the token could prove to be a costly mistake.

Bitcoin Hyper will solve one of the most critical problems faced by crypto users today – the Bitcoin blockchain’s limited speed and functionality.

Using Solana’s Virtual Machine and a noncustodial Canonical Bridge, Bitcoin Hyper’s layer-2 solution could make transactions on the Bitcoin blockchain much faster and cheaper.

That’s not all. SVM integration allows users to build dApps on top of the Bitcoin blockchain, opening up avenues in DeFi, gaming, NFTs, and much more.

But none of these functionalities compromise the well-established security and transparency of Bitcoin, as transactions are periodically settled on the base layer using ZK Proofs. The token has also completed extensive smart contract audits by Coinsult and Spywolf.

However, the current presale window is about to close, and the next price surge is only a day away.

Join the $HYPER presale now to unlock early-bird deals.

But as always, do your own research before investing in crypto. This is not financial advice.

Authored by Bogdan Patru: https://bitcoinist.com/bitcoin-price-prediction-from-grok-as-hyper-presale-hits-25-3m

You May Also Like

SOL Faces Pressure, DOT Climbs 2.3%, While BullZilla Presale Rockets Past $460K as the Top New Crypto to Join Now

Co-Founder Predicts $1,000 SOL Price as Solana Treasuries Skyrocket to $4B

Read the full article at coingape.com.