Will Jesus Christ return before GTA VI debuts? 5 craziest Polymarket bets

Polymarket and similar prediction markets brought gambling to non-sports spaces. The “degen” culture of decentralized finance has made some of the bets look really ridiculous. What are the five most absurd bets on Polymarket in 2025?

- On Polymarket, people bet on everything: from election winners to the weather in London on a particular date. Such a wide spectrum creates space for odd prediction matters.

- Sometimes the outcomes of these predictions are interpreted controversially, prompting users to demand a review of the results.

- While some publications treat Polymarket bets as a public sentiment indicator, others argue that excessive cash inflows can manipulate Polymarket data. In situations like political elections, it can be used to influence the real-world outcomes.

Table of Contents

- Will the return of Christ happen before the release of GTA VI?

- Will Trump mention “hottest” during the UK Prime Minister?

- Will the US confirm that aliens exist in 2025?

- Is the Earth flat?

- Will Trump be confirmed to be Satoshi Nakamoto?

- Bonus material: Volodymyr Zelensky’s outfit

Will the return of Christ happen before the release of GTA VI?

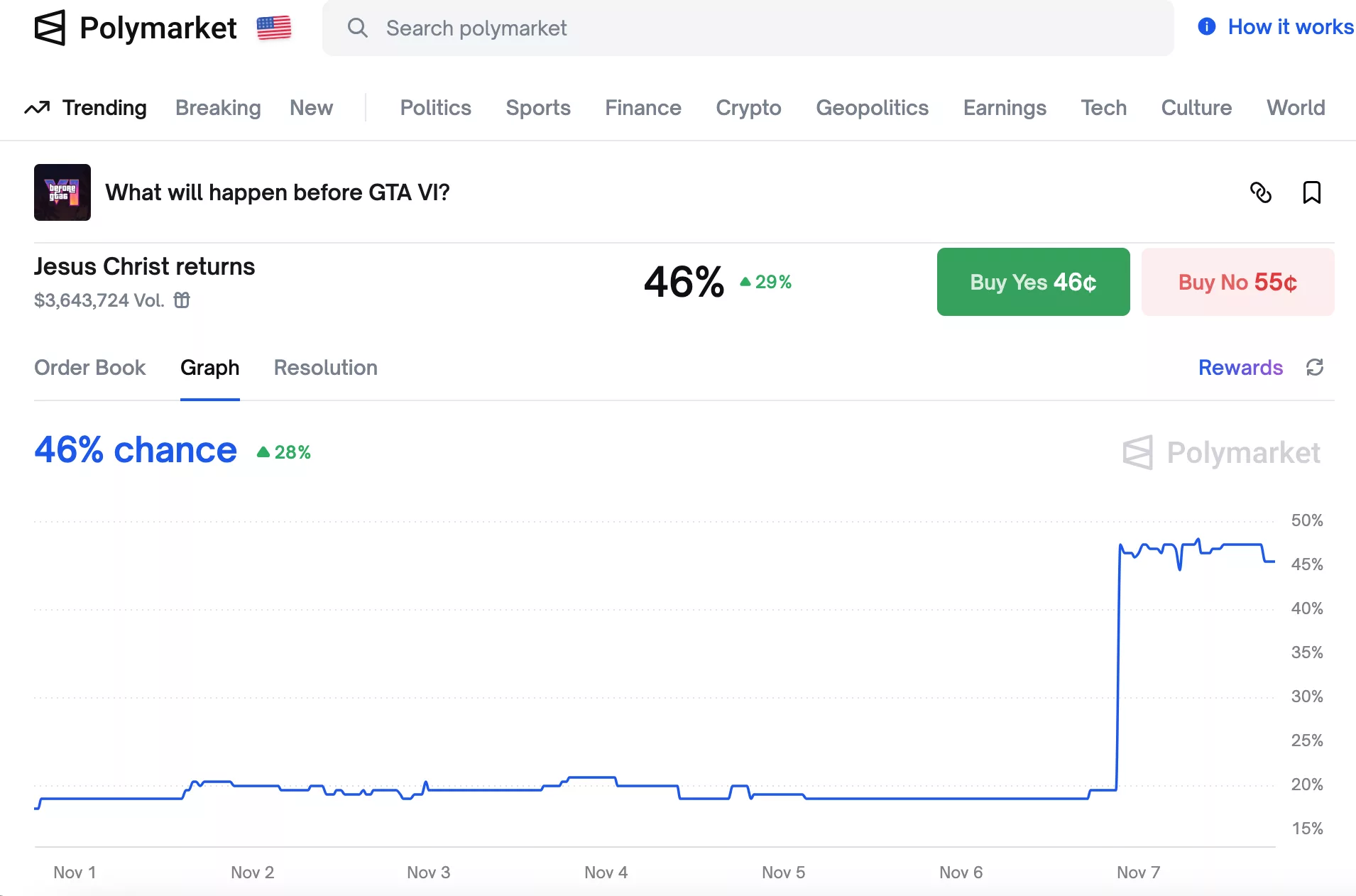

Grand Theft Auto VI has been one of the most anticipated video games of 2024. First, its release was rescheduled for May. But on Nov. 6, Rockstar Games postponed the release. Now, the game is expected to be released in the fall of 2026, meaning fans will have to wait an extra year.

One of the surprising outcomes of this announcement was a surge in people betting on a Second Coming in 2025. To be specific, people chose a “Jesus Christ returns” option to the question “What will happen before GTA VI?”

Before Rockstar Games announced the delay, the number of people betting on Second Coming was below 20%. On Nov. 7, this number peaked at 48%. By evening, this number dropped by 2%. The cumulative amount of stakes exceeded $3.6 million. As of press time, the Second Coming option closely follows options such as “China invades Taiwan” and “Bitcoin hits $1 million.”

It’s understood that such a high bet on Jesus’ return only reflects the scale of disappointment about the game’s release delay. To confirm it, you can visit another Polymarket page where people bet on whether Jesus will return in 2025. As of Nov. 7, the “yes” has been voted for by only 2%.

Will Trump mention “hottest” during the UK Prime Minister?

So many Polymarket users bet on what one person will say during the speech or some other public event that the platform has a special “Mentions” section. One of the 2025 bet markets that attracted over $1,300,000 in stakes was whether President Donald Trump would say the word “hottest” during his meeting with the UK Prime Minister Sir Keir Starmer on September 8.

It may seem odd that people are so invested in whether Trump will call anything “hottest” during the meeting. However, the key is that in such cases, “investing” should be taken literally. People would bet on anything as long as they saw a chance to chase a quick buck. It appears that Trump didn’t say “hottest,” but the page of this bet on Polymarket indicates there was a dispute.

Speaking about anything “hottest” in the UK, it’s worth saying some people bet on whether there will be the highest temperature on a particular day in London.

Will the US confirm that aliens exist in 2025?

While NASA claims there is no scientifically supported evidence of extraterrestrial life, people don’t lose faith that we are not alone in the Universe and dedicate their lives to finding convincing signs and witnesses.

However, it’s still surprising that many people are willing to sacrifice money for their belief that by Dec. 31, 2025, the President of the U.S. or other authorities will confirm that extraterrestrial life or technology exists.

On Polymarket, the “yes” option surged in January 2025 after reported UFO sightings in California. The “yes” option peaked at 14% before falling below 7%. Interestingly enough, even the notorious July claims that a space object called 3I/ATLAS may be an alien spaceship approaching Earth by the fall didn’t have any effect on Polymarket.

As of Nov. 7, only 4% of Polymarket users believe the U.S. government will confirm the existence of aliens in 2025. The cumulative stake amounts to $4.6 million. Many more people–39%–think that Time’s Person of 2025 will not be a human being.

Is the Earth flat?

While some scientists believe there is a chance we will find life outside the Earth at some point (not necessarily intelligent life), it’s been a while since any scientist claimed that the Earth is flat.

However, if by Dec. 31, solid evidence that the Earth is flat is getting published, 0.7% of betters on Polymarket will hit a jackpot. The bet on whether the Earth is flat absorbed some $200,000 in stakes as of Nov. 7.

Will Trump be confirmed to be Satoshi Nakamoto?

Who is Satoshi Nakamoto? This is the question that thrills many in the crypto community. While some just enjoy the myth about the enigmatic Bitcoin creator, some are trying to guess who the real Satoshi is. The list of suspects includes various contenders from Roger Ver to Jack Dorsey.

One of the unusual guesses is that the name Satoshi Nakamoto points to the Japanese tech companies’ names: Samsung, Toshiba, Nakamichi, and Motorola. However, Polymarket offers even an odder take: Donald Trump, the first pro-crypto POTUS himself, is the real Satoshi. No wonder, only 0.6% of all betters said “yes” to whether Trump will be confirmed as Satoshi Nakamoto by Dec. 31, 2025.

Bonus material: Volodymyr Zelensky’s outfit

That was the five craziest bets on Polymarket in 2025. However, there is one more case that turned a typical Polymarket prediction into a mess, raising concerns over the way the rules are formulated.

In May 2025, people began betting on whether Ukrainian President Volodymyr Zelensky would wear a suit before July. The interest in his outfit refers to Zelensky’s ascetic outfits, which he began to wear following the escalation of the Russian-Ukrainian military conflict in 2022.

During Zelensky’s visit to the Oval Office on Feb. 28, his outfit became an object of critical remarks by the correspondent of Real America’s Voice, Brian Glenn. Upon seeing Zelensky, Donald Trump said, “You’re all dressed up today.”

The rules read that “the market will resolve to ‘Yes’ if Volodymyr Zelensky is photographed or videotaped wearing a suit between May 22 and June 30.” Initially, the outcome was resolved as “yes,” but the image used as evidence caused a debate over whether Zelensky’s outfit could be called a suit.

Despite many people, including professional reporters, confirming that Zelensky’s outfit checked as a suit, the platform changed the outcome, resolving the market to “no.” This was not the only instance where Polymarket’s verdict raised questions, which added even more risks to the gambling aspect.

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12