Next 1000x Crypto? Maxi Doge Nears $4M as XRP ETF Buzz Builds

What to Know:

- ETF chatter around $XRP is building even as policy noise persists, a mix that often seeds sharp risk rotations if clarity arrives.

- Relief rallies during shutdown headlines show risk demand isn’t gone; it’s tactical and catalyst-driven, favoring liquid beta first.

- Meme coin projects with simple hooks can capture reflexive flows faster than heavier utility plays during early-cycle rotations.

- Maxi Doge’s crypto presale packages an impressive $3.9M+ raise and a meme-first roadmap aimed at community-driven engagement in 2025–2026.

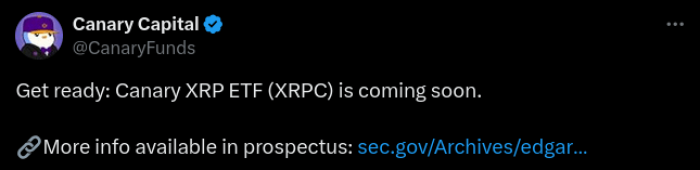

The market is still nursing its bruises from October’s wipeout, yet the narrative backdrop just got more interesting. Last Friday, November 7, Canary Capital teased an upcoming $XRP spot ETF on X.

Canary’s SEC filing reveals that the fund will trade under the ticker XRPC and give investors traditional market exposure to XRP without direct crypto custody. It holds only $XRP and cash, steering clear of derivatives or leverage, and comes with an annual management fee of 0.5%.

Crypto outlet Bitcoinsensus also flagged how talk of XRPC is swelling even as the US government shutdown drags on, keeping macro nerves frayed and liquidity patchy. That combination of cautious price action with new-issue optimism is exactly the kind of split tape that sends capital hunting for asymmetry.

Signs of relief matter. Data from Yahoo Finance showed $BTC, $ETH, and $XRP catching a bounce as hopes of a Democrat-Republican deal to end the shutdown improved.

What this means is that risk appetite isn’t dead; it’s just waiting for policy clarity. For now, momentum points sideways, but the bid returns quickly when the fog lifts.

At the same time, the ETF pipeline continues to inch forward. Canary Capital also plans to launch spot funds tied to Litecoin and Hedera despite the government shutdown, which speaks to a more streamlined, rules-based path for crypto products.

$XRP filings have progressed with amended paperwork that edges the discussion closer to SEC action. FX Empire’s $XRP ETF chatter has even floated a near-term launch window and healthy first-month inflow expectations if an $XRP product clears.

That shift matters for traders. If ETF headlines continue landing while macro steadies, beta can broaden fast. That’s the setup pushing some to scout presales again.

For traders watching risk rotations, a meme coin-led token that leans into staking and community hype is a familiar, high-beta expression of the market optimism bubbling beyond the surface.

Maxi Doge ($MAXI) is trying to slot into that lane with its strong presale momentum and high-octane meme narrative.

Maxi Doge ($MAXI) – Meme Beta with Audited Contract and Degen Branding

Maxi Doge ($MAXI) is an Ethereum token that wraps meme energy around simple utility: stake for rewards, join weekly trading contests, and plug into partner events to test your futures trading skills.

The idea is straightforward – keep fundamentals community-focused, lower friction, and let viral culture do the heavy lifting when the market mood flips.

Throughout the presale, the project rewards early adopters with dynamic staking rewards from a 5% tokenomics pool. Right now, the rewards sit at 78% APY, with over 9.6B tokens staked to date.

And when the $MAXI coin hits Uniswap and other exchanges after the listing, the team will roll out weekly competitions and trading tournaments with rewards for top leaderboard scorers.

Read more about the Maxi Doge project and its potential in our guide to buying $MAXI.

Read more about the Maxi Doge project and its potential in our guide to buying $MAXI.

With these contests, Maxi Doge doubles down on its ‘degen’ crypto bro branding – a cultural wink to traders who thrive on volatility and humor as much as alpha.

In crypto, being a degen isn’t reckless; it’s a flex of conviction and community, and the project channels that ethos by wrapping staking, trading contests, and viral engagement into a single, meme-powered ecosystem.

That positioning matters now: as ETF chatter revives risk appetite and capital starts rotating toward high-beta plays, tokens with personality and participation hooks like $MAXI often become the first beneficiaries of returning liquidity.

Visit the official $MAXI presale website now.

Maxi Doge Presale Nears $4M and Targets 78% Staking Yield

Presales live and die on clear mechanics. Here the numbers are doing the talking for Maxi Doge’s presale: over $3.9M raised so far, a current stage price around $0.0002675, and attention-grabbing 78% staking rewards during the sale period.

High APYs hint at early-stage incentive design rather than sustainable yield, but they also encourage stickier behavior into and just after listing.

For traders calibrating the next 1000x crypto narratives, that combination of low unit price and visible staking carrot is exactly what sparks the first wave of on-chain momentum when sentiment turns.Distribution and rollout also matter. The roadmap points to DEX and CEX listings after the presale with contests and partner events designed to keep the timeline noisy.

Staking allocations and liquidity provisions aim to seed activity without smothering it, while $MAXI’s token audit trail helps reduce first-day jitters.

None of that removes risk – meme coins are still volatility engines – but in a market where ETF headlines are coaxing sidelined capital back into beta, $MAXI has the right mechanics to be noticed quickly.

Ready to jump in? Secure your Maxi Doge ($MAXI) presale slot.

Ready to jump in? Secure your Maxi Doge ($MAXI) presale slot.

Disclaimer: This is not financial advice. Always do your own research. Presales are highly risky, yields are variable, and meme coins can experience severe volatility and liquidity gaps.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/xrp-etf-hope-government-shutdown-maxi-doge-next-1000x-crypto/

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

SOL Treasury Company Forward Industries: Market Turmoil Offers Opportunity to Consolidate Other Treasury Companies