Cardano Price Prediction 2025: Can ADA Hold Its Last Major Support Zone?

The post Cardano Price Prediction 2025: Can ADA Hold Its Last Major Support Zone? appeared first on Coinpedia Fintech News

The debate around Cardano price prediction 2025 has intensified as the Cardano crypto ecosystem faces one of its weakest on-chain periods in years. While the Cardano price today struggles to retain key support levels, on-chain data, user behavior, and shrinking stablecoin liquidity are shaping the next potential trend for ADA in 2025.

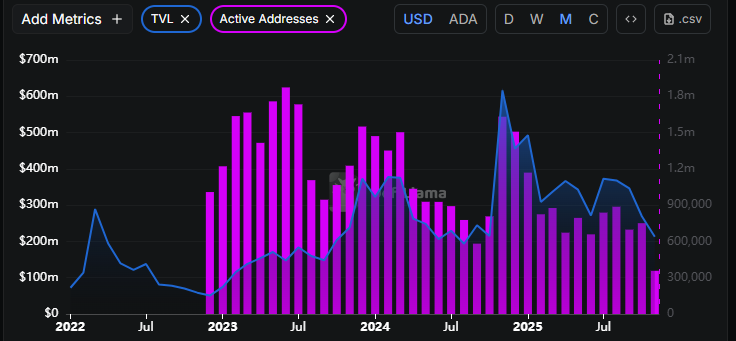

Cardano’s On-Chain Weakness Deepens Through 2025

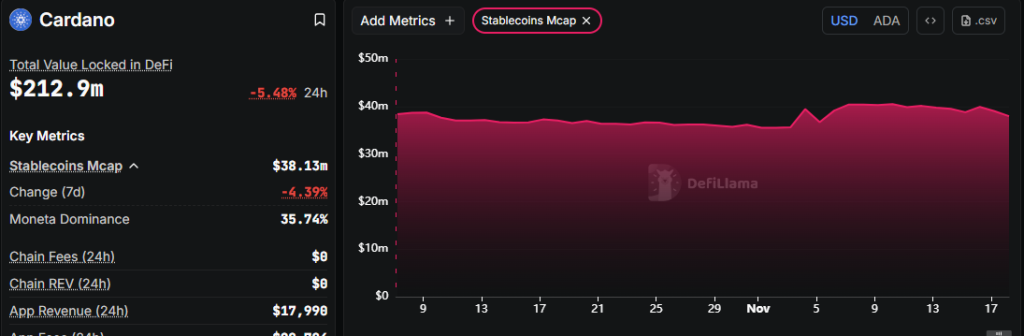

Looking at the broader Cardano price chart and ecosystem trends, November data highlights a persistent decline across major on-chain metrics. Cardano’s TVL has fallen to $212.9 million, while active addresses stand at 357,270, both significantly lower on a year-to-date and three-year basis.

Also, the past 7 days show stablecoin liquidity on Cardano shrinking to $38.13 million, according to DefiLlama, reflecting reduced capital efficiency and limited DeFi engagement. These shifts raise concerns about the sustainability of ADA price USD trends as 2025 progresses.

Despite these declines, the network continues to expand in long-term holder count, surpassing 3.175 million wallets. Recent data suggests retail accumulation remains active even as larger investors become increasingly cautious during periods of low activity.

Market Sentiment Turns Bearish as ADA Tests Critical Levels

Sentiment across the market has grown more skeptical, largely driven by Cardano’s stagnant daily revenue, flattened DEX trading volumes, limited stablecoin integration, and minimal user growth.

Critics argue that despite its $16.7 billion market cap and top-10 global ranking in November 2025, the platform’s activity levels do not justify its valuation when compared to other large-cap assets.

As a result, more holders appear to be exiting positions, contributing to growing downward pressure on the token. Analysts now emphasize that ADA has broken below weekly support, with the next major demand zone located in the $0.30–$0.32 region. This area may determine the trajectory of the ADA price prediction for the months ahead.

Technical Setup Suggests a Make-or-Break Phase for 2025

While on-chain weakness is evident, some analysts still express cautious optimism about ADA’s technical posture. They highlight that the long-term support range has historically triggered relief rallies or accumulation phases. If ADA manages to defend the $0.30 zone, the Cardano price prediction 2025 could stabilize and possibly attempt a recovery if sentiment strengthens.

Conversely, sustained weakness across revenue, liquidity, and address activity may keep pressure on Cardano price today, making the upcoming months pivotal for the wider ADA price forecast.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Top AI Crypto Presales 2026: IPO Genie Crushes the Competition with Pre-IPO Deal Intelligence and Massive Upside