Tether, the world's most profitable company per capita: its CEO is a former plastic surgeon, and its billions of profits are accelerating diversified investments

Author: Nancy, PANews

In the crypto world, a "money printing machine" is running at an astonishing efficiency: the stablecoin giant Tether. With a team of only a hundred people, this company serves hundreds of millions of users around the world and generates tens of billions of dollars in profits. The man behind all this, Giancarlo Devasini, has not only achieved a gorgeous transformation from a plastic surgeon to a crypto-financial power, but has also led Tether from marginal innovation to the center of the global financial stage through strategic layout.

Today, Tether not only sits firmly on the throne of stablecoin dominance, but also extends its tentacles into diversified fields such as mining, media, and agriculture through large-scale investments, embarking on an ambitious global expansion war.

A team of 100 people made tens of billions in profits and became the seventh largest buyer of U.S. debt

As the world's largest stablecoin issuer, Tether has transformed from an initial niche financial experiment into a giant in the crypto industry, demonstrating amazing profitability and market influence.

Over the past decade, Tether's publicly disclosed net profit has reached tens of billions of dollars. Although Tether lacked detailed financial data disclosed regularly in its early development stages, the company began to fully disclose financial reports in 2022 to improve transparency. According to comprehensive public data, Tether's cumulative net profit reached at least US$19.9 billion in just over two years from the fourth quarter of 2022 to the end of 2024.

Especially in 2024, Tether achieved a total profit of more than US$13 billion with a lean team of only about 150 employees, equivalent to an average profit of about US$93 million per employee. This figure makes it one of the companies with the highest per capita profitability in the world, far exceeding traditional financial giants such as BlackRock, and even comparable to Visa in terms of trading volume.

From the perspective of profit composition, U.S. Treasury bonds are undoubtedly Tether's core profit engine. Since the Federal Reserve began to raise interest rates in 2022, Tether has invested a large amount of reserve funds in U.S. Treasury bonds, gradually becoming one of the main buyers of U.S. Treasury bonds. In 2024 alone, Tether purchased $33.1 billion in U.S. Treasury bonds, becoming the seventh largest buyer of U.S. Treasury bonds, exceeding countries such as Canada, Mexico, Norway, South Korea, Germany and Saudi Arabia. The quarterly reserve report as of the end of December last year showed that the total value of U.S. Treasury bonds held by Tether was $94 billion.

In addition to asset allocation, the widespread adoption of stablecoin USDT is also an important pillar of Tether's profit capture. As a digital asset anchored to the US dollar, USDT not only surpasses the limitations of traditional financial instruments in terms of functionality, but also plays multiple roles in global financial transactions: in high-inflation countries such as Venezuela and Turkey, USDT has become the preferred tool for residents to fight against the depreciation of their own currencies and circumvent capital controls, providing a safe haven for people in economically turbulent areas. In some restricted markets and gray areas, USDT is a flexible and difficult-to-track financial medium.

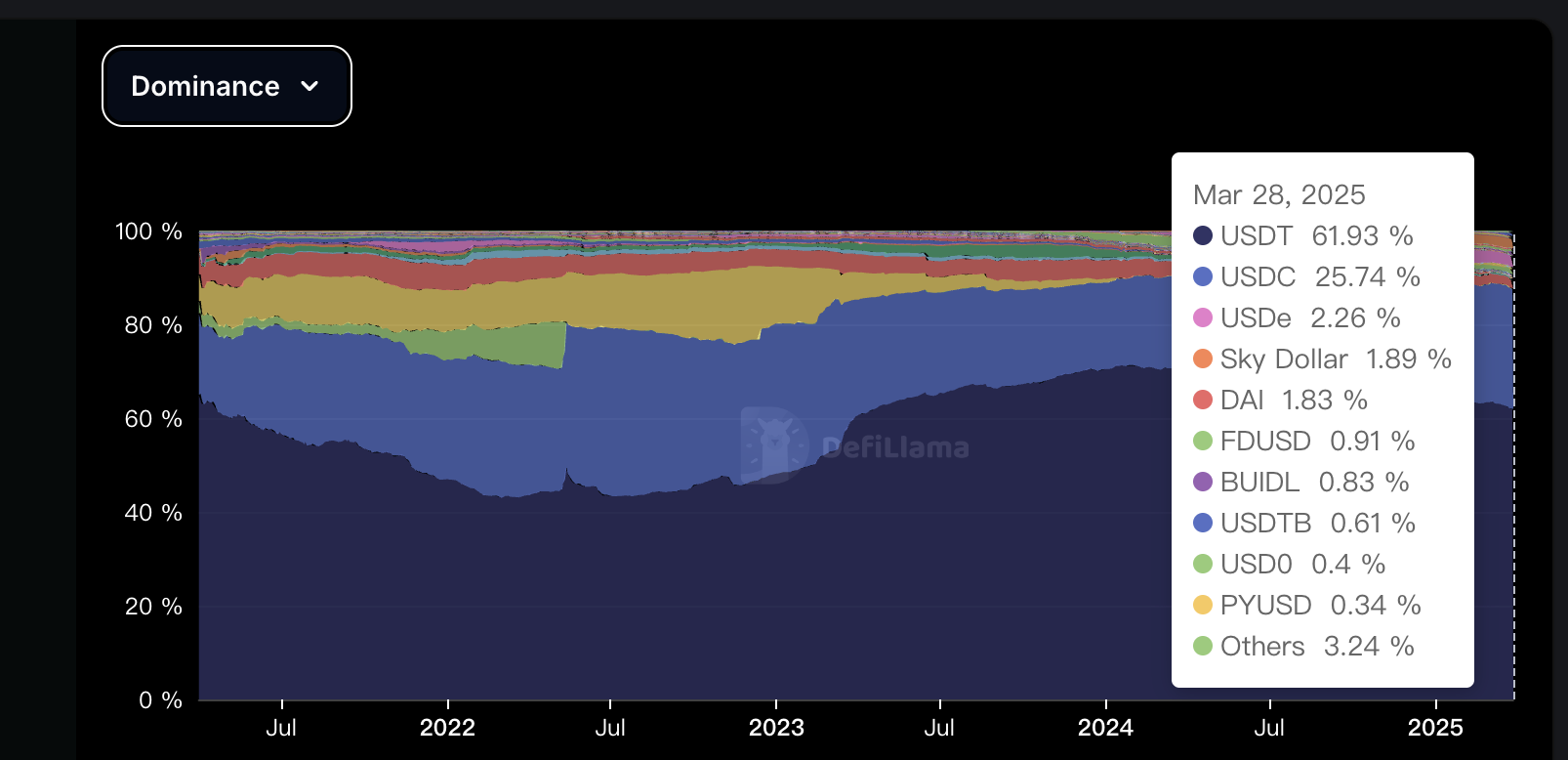

Today, USDT is dominating the global stablecoin market and has become the most widely used stablecoin. According to DeFiLlama data, as of March 28, 2025, the issuance scale of USDT has exceeded 143.7 billion US dollars, with a market value of over 144.8 billion US dollars, accounting for about 61.9% of the stablecoin market. According to Tether CEO Paolo Ardoino, the number of USDT users worldwide is conservatively estimated to have exceeded 400 million, and the growth momentum is rapid. He expects it to reach 1 billion soon.

Behind the scenes, the person in charge was an Italian plastic surgeon

The mastermind and actual helmsman of the largest cryptocurrency printing press is recognized as Tether's former chief financial officer, Devasini. According to Forbes estimates, Devasini owns 47% of the shares, making him the largest shareholder of Tether, with a net worth of $9.2 billion. However, this core figure of Tether maintains a low-key life in Lugano, the Bitcoin center of Switzerland, and rarely accepts interviews. Even his business card reads "No title, no job, nothing."

Devasini's experience is quite legendary. According to a previous report by the Wall Street Journal, Giancarlo Devasini, who was born in Turin, Italy, was originally a plastic surgeon and later did electronic product import business in Hong Kong. In 1995, Italian prosecutors accused him of participating in a software piracy gang and committing fraud. After that, Devasini founded the technology company Solo in Italy. The company's annual revenue once exceeded 100 million euros, and he later sold it before the outbreak of the financial crisis in 2008. Today, this Italian, who is about 60 years old, has become one of the core figures in crypto finance.

It all started in 2012, when the Bitcoin white paper sparked Devasini's interest in cryptocurrency. He posted a message on a Bitcoin forum asking if anyone was willing to buy DVDs or CDs for 0.01 Bitcoin each (about 11 cents at the time), promising free shipping for large orders.

It was during that period that Devasini also met Raphael Nicolle, the founder of Bitfinex. With his rich business experience and connections, he established key banking relationships for Bitfinex and promoted the internationalization of the platform, including moving the registered place to the British Virgin Islands and setting up the headquarters in Hong Kong, and gradually became a core figure of Bitfinex. In 2014, he co-founded Tether with Bitfinex executives and launched USDT.

Devasini is deeply involved in Tether's issuance decisions and fund management, and plays a key role in cooperation with major customers. For example, Alameda Research once applied for and obtained billions of dollars in USDT support from Tether, and Devasini is considered to be the driving force behind the scenes. Bloomberg quoted chat records submitted by former Alameda CEO Caroline Ellison as showing that Devasini once said to Alameda traders: "We are a big family... We will conquer the world." FTX founder SBF also supported Devasini in a public interview, saying, "Devasini is very proud of the career he has built at Bitfinex and Tether. He responds around the clock, not just to crises or incredible opportunities, but also to daily operations. Those 'unfounded criticisms' of Tether seem rash."

In addition, there are reports that Devasini is actively seeking political allies to obtain regulatory "umbrella" for Tether. The Wall Street Journal previously reported that Devasini privately stated last year that Howard Lutnick, chairman of Cantor Fitzgerald and US Secretary of Commerce, would use his political influence to defuse the threats facing Tether. US Senator Elizabeth Warren also pressured Howard Lutnick during his nomination to explain his relationship with Tether. It should be noted that Cantor manages part of Tether's reserves and holds 5% ownership. But Tether denied the market's claim that Lutnick influenced regulatory actions.

Today, Tether is expanding at an astonishing rate, and Devasini has also moved from behind the scenes to the strategic forefront, becoming the chairman of the group, focusing on macroeconomic strategies aimed at deepening the application of USDT in global digital assets.

Diversification strategy accelerates, mining and media receive heavy investment

Against the backdrop of stricter regulation and intensified market competition, Tether is weaving a cross-industry business network through diversified investments.

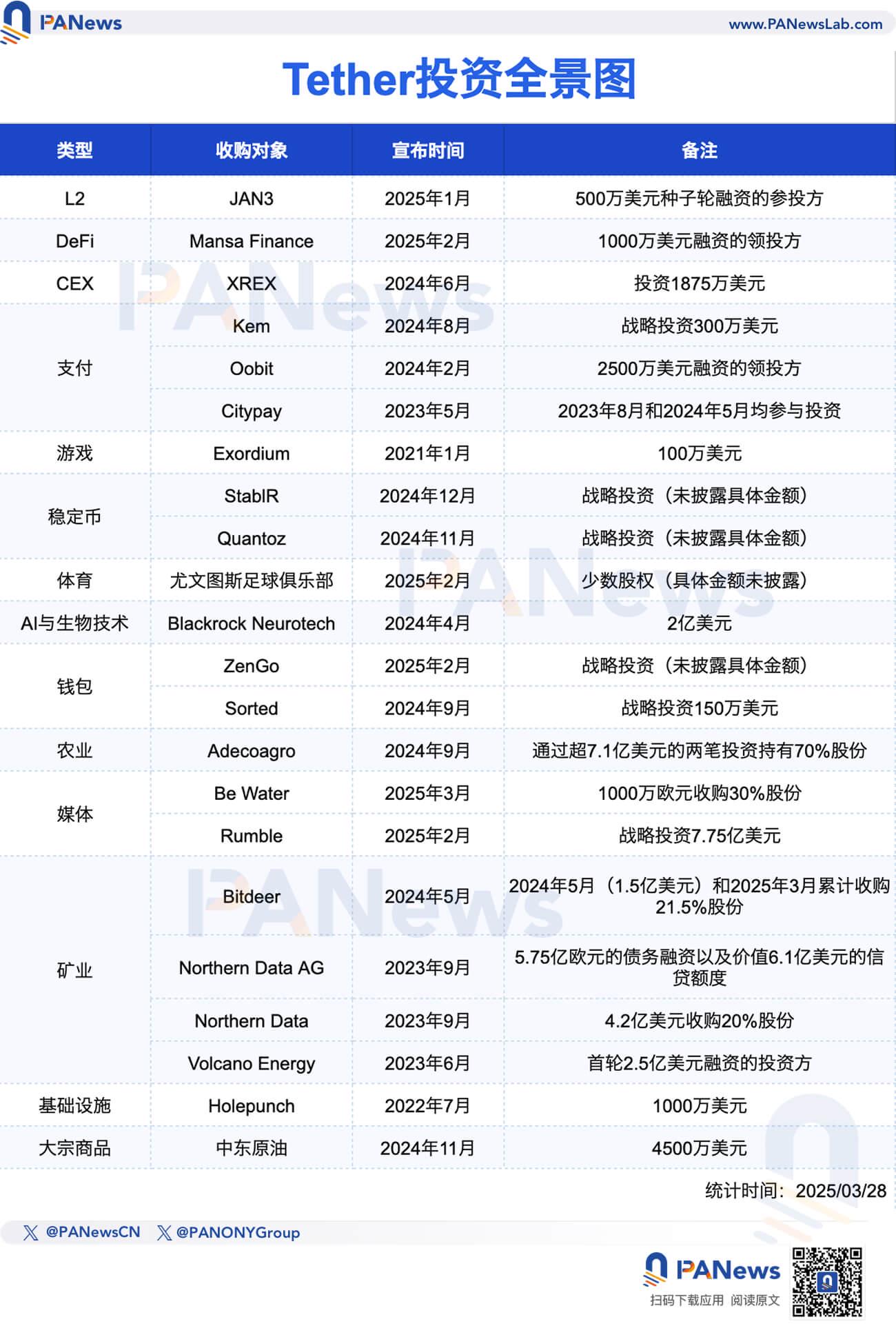

According to incomplete statistics from PANews, Tether has publicly disclosed a total of 22 investment projects since 2021, spanning multiple fields such as encryption, media, sports, agriculture, commodities, biotechnology, etc. Among them, the encryption field is Tether's core investment direction, especially in mining, payment, stablecoins, wallets and other tracks, accounting for more than half of the total investment.

In terms of the scale of funds, Tether's investment in mining is the most generous, with a cumulative investment of more than US$2.1 billion, far exceeding other fields. The largest investment was in the German mining company Northern Data AG, to which Tether provided US$575 million in debt financing and a credit line of US$610 million. Volcano Energy, Northern Data and Bitdeer also received hundreds of millions of dollars in investment. The second largest investment was in the media industry, with Tether's total investment reaching US$780 million, most of which was invested in Rumble ($775 million). PANews once mentioned in a report that this high investment has a strong political color and is more like a business backed by the Trump circle . Rumble has a deep relationship with US President Trump and is even called "Trump concept stock" by the outside world. Narya Capital Management, the venture capital fund of US Vice President JD Vance, has also participated in Rumble's investment. In the agricultural field, Tether holds up to 70% of the shares of Argentine agricultural giant Adecoagro through two investments, with a total amount of more than US$710 million. In addition, Tether acquired a majority stake in biotechnology company Blackrock Neurotech for US$200 million, with a valuation of US$350 million.

From a time perspective, Tether mainly focused on crypto construction, especially mining and payment, from 2021 to September 2024. Since then, its investment pace has significantly accelerated, and its strategic direction has become more diversified, gradually expanding from a single field to a global layout across multiple industries.

Although Tether has successfully built a powerful crypto business empire through diversified investments and dominance in the stablecoin market, as the crypto market matures and the regulatory environment continues to change, Tether will face more complex challenges in the future. This will depend on how to balance innovation, compliance and expansion in the ever-changing global arena.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future