McGregor vs Khabib NFT Drama: ZachXBT Exposes Hypocrisy Over Failed Meme Coin

The long-standing rivalry between Conor McGregor and Khabib Nurmagomedov has resurfaced in an unexpected arena, igniting a controversy that blends personal history, digital collectibles, and renewed criticism over celebrity involvement in crypto projects.

What began as a jab from McGregor over Khabib’s recent NFT drop has evolved into a wider debate involving blockchain investigator ZachXBT, who publicly accused the Irish fighter of hypocrisy over his own failed meme coin launch.

McGregor Criticizes Khabib’s Papakha NFTs, On-Chain Investigator Fires Back

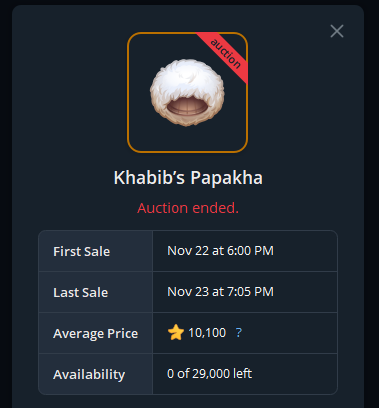

The dispute intensified on November 26 after McGregor accused Nurmagomedov of orchestrating a “multi-million dollar scam” tied to a Telegram-based NFT collection known as the “Papakha” drop.

The project featured 29,000 digital versions of the traditional Dagestani hat Khabib famously wore during his UFC walkouts, marketed as a cultural tribute to his late father, Abdulmanap Nurmagomedov.

Source: Telegram marketplace

Source: Telegram marketplace

The NFTs reportedly sold out in just 25 hours. Controversy followed when promotional posts disappeared from Khabib’s Instagram and X pages, prompting McGregor to claim that fans were misled.

Nurmagomedov responded, insisting that the collection was legitimate and designed as an “exclusive digital gift” symbolizing Dagestani traditions.

He defended the distribution through Telegram and dismissed any claims of wrongdoing. The exchange revived tensions between the two athletes, but the debate escalated further when on-chain investigator ZachXBT entered the discussion.

Hours after McGregor’s post, on-chain investigator ZachXBT reignited the controversy by turning McGregor’s own criticisms against him.

ZachXBT reminded the public of McGregor’s April 2025 meme coin, $REAL, which was offered in a sealed-bid auction with staking rewards for participants.

Despite the ambitious launch, the project raised only 39% of its targeted goal, prompting full refunds to investors.

ZachXBT’s post questioned whether it was credible to label Khabib a scammer while McGregor himself had previously failed to deliver on a digital token project, effectively drawing parallels between the two fighters’ crypto endeavors.

Celebrity Crypto Failures Spotlighted Amid Meme Coin Market Slide

Both McGregor and Nurmagomedov have histories of controversial crypto ventures. Nurmagomedov faced criticism in 2023 for promoting a potentially fraudulent NFT in partnership with GoMining.

He also faced mixed reactions for promoting the Sharia-compliant finance platform Wahed.

Meanwhile, McGregor has had his own setbacks, including the 2022 McGregor Realm NFT project and the failed $REAL meme coin. These prior incidents have amplified the current dispute, as each fighter references the other’s past failures to strengthen their narrative.

ZachXBT’s participation in the McGregor–Khabib spat coincides with a broader surge in enforcement against undisclosed promotions.

Notably, in September, the investigator published documents revealing that more than 150 crypto influencers failed to label paid advertisements in token campaigns, raising concerns about market integrity.

Meme coins were among the hottest narratives and top-performing sectors in crypto in 2024. However, their rapid surge came to an abrupt halt in 2025 amid broader turbulence across the meme and NFT markets.

After peaking at $116.7 billion in early January, the sector collapsed to $39.4 billion in November, marking a 66% decline as several political and celebrity-backed launches rapidly lost value or were accused of misconduct.

The downturn was compounded by a sharp contraction in speculative appetite across NFTs and low-liquidity tokens.

While the meme coin market has shown brief signs of stabilization by recently rising to $46.64 billion with a 1.3% daily gain and a 24-hour trading volume of $5.05 billion, the sector remains far below its earlier highs.

The ongoing dispute between McGregor and Nurmagomedov shows the renewed scrutiny facing celebrity crypto promotions, especially at a time when failures, stalled presales, and alleged misrepresentations continue to attract attention.

Recent controversies have included the $433 million BlockDAG presale, which ZachXBT linked to an undisclosed founder, and the WEB3 token sale, which he tied to individuals associated with past NFT rug pulls.

You May Also Like

Structural job strain caps rand gains – Commerzbank

Trump gushes over Nicki Minaj's skin to mark Black History Month: 'So beautiful'