The Graph Price Prediction 2026, 2027 – 2030: Will GRT Price Go Up?

The post The Graph Price Prediction 2026, 2027 – 2030: Will GRT Price Go Up? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of The Graph crypto is $ 0.03613874.

- Price predictions for 2026 range from $0.05 to $1.75.

- In 2030, GRT may hit a high of $3.55, reflecting long-term growth.

AI may be taking center stage in today’s tech revolution, but behind every smart application lies the challenge of accessing and organizing reliable data. That’s where The Graph (GRT) steps in—an innovative indexing protocol transforming how blockchain data is queried.

As interest in The Graph surges, especially after its major 2025 upgrades and the launch of substreams-powered subgraphs, the question on everyone’s mind is: Can GRT price reach $1? In this article, we break down its technical potential, rising developer adoption, and market sentiment in our detailed The Graph Price Prediction 2026–2030.

Table of contents

- Story Highlights

- The Graph (GRT) Analysis 2025 Displays Muted Price Action

- Why On-Chain Hints Flourishing Network and Ecosystem Growth In “The Graph”?

- GRT Price Chart History (2021-2025)

- GRT Price Prediction 2025 December

- GRT Price Prediction 2026

- GRT Coin Price Prediction 2026-2030

- What Does The Market Say?

- FAQs

The Graph Price Today

| Cryptocurrency | The Graph |

| Token | GRT |

| Price | $0.0361 |

| Market Cap | $ 385,072,320.54 |

| 24h Volume | $ 24,633,614.3459 |

| Circulating Supply | 10,655,388,250.0687 |

| Total Supply | 11,430,396,583.4018 |

| All-Time High | $ 2.8751 on 12 February 2021 |

| All-Time Low | $ 0.0352 on 19 December 2025 |

The Graph (GRT) Analysis 2025 Displays Muted Price Action

The Graph Network has recently improved its fundamental growth, yet this strength is sharply diverging from its prolonged bearish GRT price action.

The network, is majorly used by developers and data consumers who pay to query data, is flourishing, per onchain. yet, the GRT remains significantly suppressed, presenting a notable contrast that is at the heart of its current analysis.

Why On-Chain Hints Flourishing Network and Ecosystem Growth In “The Graph”?

As per the data onchain, the performance of The Graph Network can be directly assessed by the growing “volume of queries” and the “accrual of query fees”.

In this context, the data reveals that over the last six months, its query volume has impressively reached 11.6 billion, which displays a clear sign of robust developer adoption that has been particularly fast since the network’s migration to Arbitrum.

Similarly, the query fees generated by data consumers on Arbitrum have also reached an all-time high of $8.11 million in August.

This success is supported by a large community of over 167,000 delegators and 7,204 active curators, all contributing to the network’s health.

In addition, the growing ecosystem is also in the spotlight by recent integrations with major brands like Tron, pointing to a strengthening on a fundamental level.

GRT Price Chart History (2021-2025)

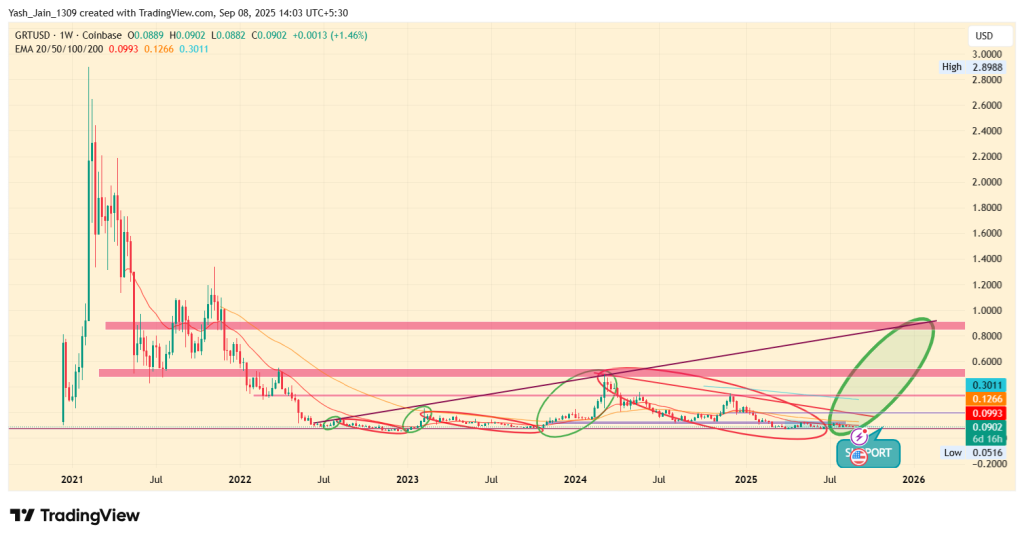

Despite having strong fundamentals holding its ground, the Graph (GRT) token has seen a muted price journey. It’s currently down more than 80% from its 2024 peak and over 95% from its all-time high in 2021. This disconnect between its price and its core strength is a key point of technical analysis.

Since the 2021 crash, GRT has been declining on its monthly chart and reached $0.055 by 2022 end. Then in the beginning of 2023 started rising and reached $0.49 in March 2024. Since then, the price of GRT has continued a multi-month correction.

Currently, GRT is in a prolonged downtrend that has lasted several months on the weekly chart from the last seen high of $0.49 in early 2024. But, the expectations were strong when it hit the late 2022 support area. It was expected that with a weekly consolidation, the price could rise, as prices often respond to previous demand areas, but it has lost this level in December, making things worse for GRT price action

GRT Price Prediction 2025 December

In 2025, GRT/USD has been bleeding but has reached a key dynamic support trendline on the GRT weekly chart. However, the demand is lacking and could continue to trade on this support.

This is because the macroeconomic factors aren’t supportive, and there is excessive caution in the market, keeping GRT prices subdued.

The GRT price prediction 2025 suggests that it will conclude the year below $0.040.

GRT Price Prediction 2026

Moreover, the challenges faced in 2025 were significant, yet the trajectory for the future is becoming clearer as we move into 2026.

A detailed analysis of market patterns reveals that it is strategically sidestepping major demand areas. This suggests a deliberate approach to liquidate a larger number of long positions, paving the way for an upcoming future rally.

This presents an exciting opportunity for a substantial upward movement in prices, likely to materialize in Q1 of 2026. The potential for a strong reversal is high, with expectations of retesting critical levels around $0.20 or even reaching $0.34 early in Q1 2026.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026(weak demand case) | 0.05 | 0.20 | 0.34 |

| 2026(strong demand case) | 1.05 | 1.20 | 1.75 |

GRT Coin Price Prediction 2026-2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 1.05 | 1.20 | 1.75 |

| 2027 | 1.55 | 1.70 | 2.15 |

| 2028 | 2.15 | 2.20 | 2.65 |

| 2029 | 2.25 | 2.70 | 3.25 |

| 2030 | 3.15 | 3.20 | 3.55 |

What Does The Market Say?

| Firm Name | 2026 | 2030 |

| Changelly | $0.320 | $1.89 |

| priceprediction.net | $0.493 | $2.26 |

| DigitalCoinPrice | $0.27 | $0.58 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At the time of writing, the price of 1 The Graph Token was $ 0.03613874

GRT price in 2026 may range from $0.05 in weak demand to $1.75 in strong demand, with an average target near $1.20.

By 2030, GRT could trade between $3.15 and $3.55 if adoption continues and the protocol becomes a core data layer for Web3.

GRT has strong fundamentals, growing developer adoption, and real utility, making it a promising long-term project, though price volatility remains high.

Yes, based on network growth and adoption, some projections suggest GRT could reach between $1.05 and $1.75 by 2026, though market conditions will ultimately determine its price path.

GRT

BINANCE

You May Also Like

Structural job strain caps rand gains – Commerzbank

Trump gushes over Nicki Minaj's skin to mark Black History Month: 'So beautiful'