👨🏿🚀TechCabal Daily – SA calls crypto risky. Again.

Good morning.

Happy TGIF!

It’s a good time to think about the shareholder value you have provided this week. In interesting news, South Africa has flagged cryptocurrency as a risk to its finance sector. Sound familiar? Nigeria did the same four years ago.

It would be interesting to see how the South African economy navigates this new development.

–

Zia

Let’s get into it!

- Quick Fire

with Gospel Uche

with Gospel Uche - South Africa flags crypto as risky

- Nigeria’s smartphone market is making a comeback

- Funding Tracker

- World Wide Web 3

- Job Openings

fEAtURES

Quick Fire  with Gospel Uche

with Gospel Uche

Gospel Uche, founder of the Northwest AI & Emerging Tech Summit

Gospel Uche, founder of the Northwest AI & Emerging Tech Summit

Gospel Uche is a product & growth marketing lead operating at the intersection of AI, innovation, digital experience design, and ecosystem development. He is the Founder of the Northwest AI & Emerging Tech Summit, one of the UK’s fastest-growing regional AI innovation platforms, bringing together organisations such as Google UK, Manchester Digital, Zally, Manchester University, University of Bolton, University of Salford, and BPP University.

In addition to his work in the AI ecosystem, Gospel has an extensive background in Web3 product and growth marketing, where he has led and executed over 1,000 partnerships and collaborations across the global DeFi, NFT, and blockchain ecosystem over the past 4–5 years. His campaigns have contributed to product adoption, brand expansion, and community growth for multiple emerging Web3 companies.

- Explain your job to a five-year-old.

Imagine you have a lot of friends who all want to build something amazing, like robots, games, or cool apps, but they don’t know each other yet. My job is to bring all those friends together so they can share ideas, help each other, and build something even bigger together.

- When you think about partnerships in Web3, what single factor tells you a collaboration will actually move the needle rather than become another hype-driven announcement?

In Web3, the difference between real partnerships and empty hype comes down to one thing: aligned incentives, backed by measurable user value.

Before confirming any partnership, I ask two questions: Does this collaboration create real utility for users, not just marketing noise? Second, are both parties equally invested in the long-term outcome?

When incentives and strategy align, the partnership becomes an engine for sustained adoption, not just a press release.

- What is one thing people consistently misunderstand about scaling AI adoption in real-world civic projects like the Bee Network Tap and Go rollout?

Most people think AI adoption is primarily a technical challenge. In reality, it is a public trust and experience design challenge.

The Bee Network Tap-and-Go rollout in Manchester proved this clearly. AI succeeds in civic environments not because the model is powerful, but because people trust that it improves their daily lives. My work around the Bee Network highlighted that messaging, community engagement, and user education are just as important as the technical deployment itself.

- What is one thing you are very good at but not particularly interested in, and one thing you are very interested in but not very good at yet?

I’m exceptionally good at managing large-scale community growth operations, especially in Web3, but it’s not my deepest passion anymore. I can do it with ease because I’ve done it for years, but my interests have evolved toward bigger systems.

On the other hand, I’m deeply interested in AI policy, public trust frameworks, and ethical digital infrastructure, especially at the civic level. I’m learning fast, but I know there’s still a lot more I want to master, particularly around regulation, governance, and responsible adoption at scale.

Powering businesses across Africa to pay and get paid in local currencies.

With Fincra, businesses, startups, global enterprises and platforms can easily send and receive payments in multiple African currencies, empowering trade, and growth across the continent. Create your account in 3 minutes.

Cryptocurrency

South Africa flags crypto as a risk

Image Source: Google

Image Source: Google

The South African Reserve Bank has flagged cryptocurrencies as a potential risk to domestic financial stability in its latest Financial Stability Review for 2025. The report, covering June to November, revealed that almost R63 billion has flowed from South African bitcoin wallets abroad. But apart from dollar bills, the Reserve Bank sees these flows as a channel that could obstruct exchange controls and affect the stability of the local financial system.

Why it matters: The Reserve Bank and National Treasury are working on frameworks to regulate cross-border crypto flows and amend exchange control rules. The Financial Stability Board’s 2024 review found South Africa lacking in stablecoin regulations and with only partial rules on crypto assets. Without clear regulations and better data on adoption and usage, vulnerabilities in the financial system could rise.

What if crypto’s risks become unbearable? The Reserve Bank could tighten regulations, restrict cross-border transactions, or impose stricter oversight on exchanges and wallets, which might slow adoption or push activity underground.

Here lies the crossroads: Crypto is here to stay; they know it. But regulators and firms need smarter frameworks and data to manage risks while unlocking the sector’s promise for innovation.

Enjoy smooth payments while you’re home this Detty December

Coming home for Detty December? Enjoy smooth payments every day with your Paga US account. Send money to any bank instantly. Don’t miss out, get started now.

analysis

Nigeria’s smartphone market is back

Image Source: Google

Image Source: Google

After a bruising 2024, Nigeria’s smartphone market is officially on the rebound, with shipments surging by 29% in Q3 2025. This is the second straight quarter of recovery, and it is directly linked to the Naira’s performance.

The currency volatility triggered by the CBN’s 2023 FX reforms choked the market, slowing imports to a crawl. Now, the relative stability of the Naira, hovering between ₦1,450 and ₦1,500/$ since the start of 2025, has given vendors the confidence to flood the market with refreshed, sub-US$150 devices and has spurred upgrades in open-market retail.

Between the lines: For Nigeria, the smartphone is the primary gateway to the internet, but six in ten Nigerians remain offline because devices are too expensive. The data shows that the country’s digital inclusion mandate is entirely hostage to the foreign exchange rate. When the Naira sneezes, mobile internet access catches a cold.

This growth is rippling across the continent, with Africa’s overall smartphone shipments jumping 24% and major markets like South Africa (31%) and Kenya (17%) also posting double-digit growth. Much of this is driven by Transsion, which is supercharging the sub-$100 entry-tier segment.

However, the relief might be short-lived. Analysts predict that rising Bills of Materials (BOM) costs and persistent currency weakness will squeeze the low-end 4G segment, where most African demand is concentrated, potentially leading to a market contraction in 2026.

Stay up to date with Paystack news!

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here

insights

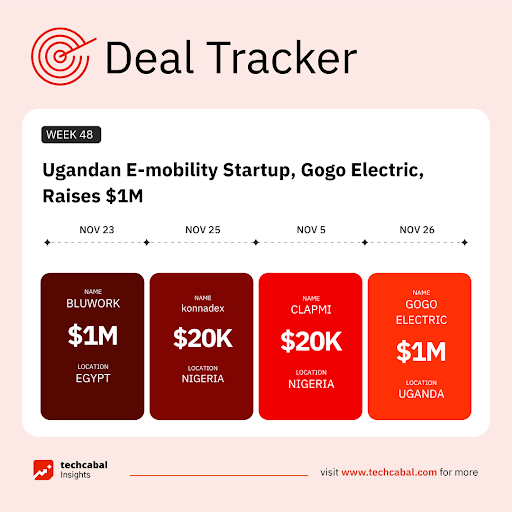

Funding Tracker

Image Source:TechCabal Insights

Image Source:TechCabal Insights

This week, Gogo Electric, a Ugandan electric mobility startup, secured $1M funding from the EU-funded Electrification Financing Initiative. (Nov 26)

Here are the other deals for the week:

- Bluworks, an Egyptian HR tech startup, raised $1M in seed funding, in a round led by Enza Capital, A15, and Beltone Venture Capital, with participation from Acasia Ventures alongside strategic angel investors. (Nov 23)

- BasiGo, a Kenyan electric mobility startup, secured an undisclosed investment from Proparco to aid its expansion across Kenya and Rwanda. (Nov 25)

- Konnadex, a Nigerian Fintech startup, secured a $20k grant from Lisk. (Nov 25)

- ClapMi, a Nigerian creative startup, secured a $20k seed grant from List. (Nov 25)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, what is the state of exit in Africa? Find out here

AI in a Nutshell gives you weekly AI knowledge and insights

Want to stay close to AI but hate long reads? AI in a Nutshell gives you weekly AI knowledge, news, tools, and insights – short, smart, and fun. Perfect for curious (but lazy) readers who still want to stay ahead. Subscribe here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $91,444 |

+ 0.19% |

– 18.89% |

| Ether | $3,017 |

– 0.77% |

– 24.88% |

| XRP | $2.19 |

– 0.91% |

– 16.32% |

| BNB | $894 |

– 0.15% |

– 19.40% |

* Data as of 05.57 AM WAT, November 28, 2025.

Events

- The 7th edition of the Art of Technology Lagos (AOT Lagos) will take place on Thursday, December 4, 2025, at the Landmark Event Centre. Organised by Eko Innovation Centre in partnership with the Lagos State Ministry of Innovation, Science and Technology, this year’s conference will explore how future technologies can help build a more sustainable Lagos. The event will gather government leaders, investors, startups, and innovators to shape practical policies and solutions for the city’s growth. Highlights include keynote sessions, workshops, the AOT Ecosystem Awards, a Career Pavilion, and the Collaborate Lagos Pitch, where entrepreneurs present solutions to real urban challenges. Register to attend by December 4.

- Every startup has a story worth hearing. My Startup in 60 Seconds by TechCabal offers founders a one-minute spotlight to share their vision, challenges, and achievements. Beyond visibility, it connects you to investors, customers, and Africa’s tech ecosystem. Apply to be featured or explore other TechCabal advertorial opportunities. This is a paid opportunity.

- ProductDive is set to host The DIVE 2025 Conference on December 10, 2025, at the Landmark Event Centre, VI, Lagos, with virtual access for participants across Africa. Under the theme “Winning with Product Teams for Profit,” the conference seeks to transform how tech teams think about value creation, collaboration, and execution.

- Career Brunch by GenZ HR, in partnership with Xara, will take place on the 29th November 2025 at MIVA Open University, Lagos. Get your tickets to be part of the career, tech & creative economy panel, talent lounge, and lifestyle corner.

- Delve into AI: Who should own Africa’s data?

- Vodacom now enables Tanzanians to pay merchants globally via M-Pesa

- Visa taps Aquanow to extend stablecoin settlements to Africa

Written by: Opeyemi Kareem, Fancy Goodman and Zia Yusuf

Edited by:Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

XRP’s Biggest Drawback Uncovered by Top Analyst, It Is Not Price

Institute of Museum and Library Services Awards $4.1 Million to Support the Trump AI Action Plan