Top 3 Meme Coins to Invest in Now as Bitcoin Steady Above $90,000

Bitcoin’s stability above the $90,000 level has energized broader crypto discussions, with many market participants turning their attention toward emerging and established meme-driven projects. Market history demonstrates that investor demand for high-upside meme coins sharply rises whenever Bitcoin locks into a consolidation band at a significant milestone, such as the $100,000 region

As BTC moves within a consistent consolidation range, several meme tokens are drawing increased visibility for their expanding ecosystems, community activity, and branding strength.

Three projects currently generating notable conversation are Little Pepe (LILPEPE), Floki (FLOKI), and ApeCoin (APE) – each gaining traction for different reasons. Little Pepe, in particular, is receiving attention for its rapid presale progress and its meme-native Layer-2 design.

Little Pepe (LILPEPE): A Rapidly Rising Newcomer with Strong Presale Interest

Little Pepe remains a standout meme coin of the moment, not just because of its cultural energy, but also because of the substantial capital flowing into its presale. Built on its own meme-native Layer-2 chain with full EVM compatibility, Little Pepe offers the infrastructure most meme tokens never reach;

- Staking and on-chain rewards,

- ,A zero-tax system,

- Anti-sniper protection,

- The signature Pepe Launchpad designed to incubate new meme projects.

Investors are treating LILPEPE less like a meme and more like a Layer-2 growth asset. The buying activity during the presale has been extraordinary. At $0.0022 per token in Stage 13, Little Pepe has already sold 96.44% of its allocation, raising $27.42 million out of the $28.77 million target.

Beyond the presale momentum, Little Pepe now boasts a full CertiK verification, which strengthens investor trust and alleviates the contract-risk fears common in the meme sector. This audit, combined with its Layer-2 technology, makes LILPEPE stand out as the most structurally sound meme token entering the market this year. Investors are eyeing a potential $300 million market cap shortly after launch.

Little Pepe has evolved into one of the more prominent new meme-themed projects of the year. Unlike many meme coins that launch with minimal technical features, Little Pepe introduces its own Layer-2 chain, designed specifically for meme-centric development and full EVM compatibility.

Floki (FLOKI): Utility Expansion Supporting Renewed Attention

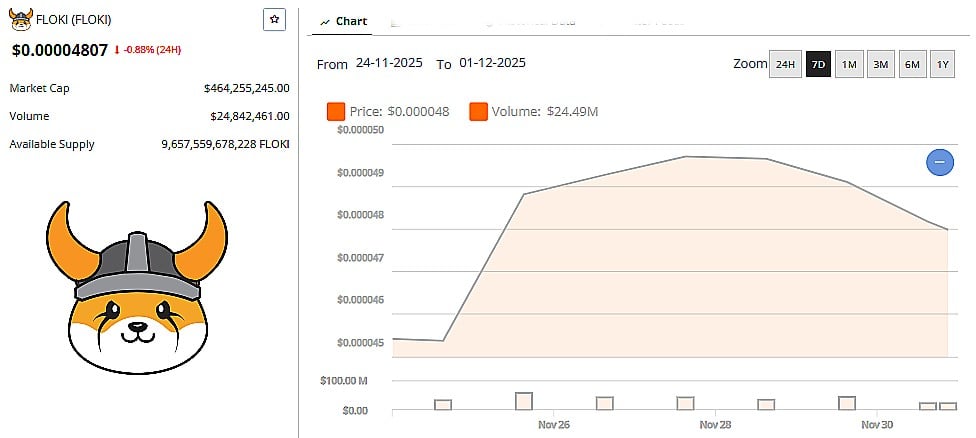

FLOKI’s short-term stabilization has offered traders a brief pause after a sharp early decline. The token rebounded from the $0.0000470–$0.0000480 area and has since formed a sequence of higher lows on the 1-hour timeframe, suggesting improving sentiment among near-term participants. Even so, repeated rejection at the $0.0000500 region highlights the presence of a stubborn supply zone that has so far prevented any meaningful continuation.

FLOKI price source: BNC market data

The mid-range portion of the chart shows a narrow horizontal consolidation that took shape after a failed breakout attempt on the 25th, reflecting subdued volatility and a temporary balance of pressure from both sides. While this intraday structure tilts mildly upward, buyers have not displayed the conviction needed to drive a sustained reversal.

With the token once again testing resistance, the open interest suggests that any attempt to break above $0.000050 will require a stronger inflow of liquidity and more aggressive positioning. Trading around the mid-$0.00005 range, FLOKI has benefited from ecosystem developments that include DeFi integrations, metaverse components, education-oriented platforms, and various brand collaborations. Engagement from larger wallets during market dips has also contributed to FLOKI maintaining a stable presence among trending meme-themed projects.

Market data from Brave New Coin shows FLOKI trading at $0.00004807, a 4.1% increase over the past week that brings its market capitalization to $464.2 million on daily volume of roughly $25 million. Despite the modest rise, trading activity remains relatively subdued compared with periods of stronger market participation.

ApeCoin (APE): Market Participants Watching for Metaverse Progress

ApeCoin (APE) continues to occupy a key position within the broader Yuga Labs-adjacent ecosystem, often discussed in relation to metaverse and gaming developments.

Currently trading near the $0.26 region, ApeCoin remains associated with ongoing DAO governance updates, digital-identity concepts, and anticipated metaverse initiatives. This has helped APE maintain visibility – and investors to gain exposure to projects positioned at the intersection of culture, gaming, and digital community spaces.

Conclusion

Investor behavior is on the uptick as Bitcoin settles above $90,000: retail investors are returning and meme coins with sound fundamentals are absorbing the most liquidity. With unrivaled presale demand, confirmed contract security, market accumulation, and Layer-2-powered utility that offers it real breakout potential, Little Pepe (LILPEPE) is at the forefront of this change. While ApeCoin draws strategic buyers expecting metaverse growth, Floki offers utility-backed momentum bolstered by growing investor interest. These three tokens are arguably the best options for investors looking for potential high-upside meme plays in a recovering market.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation