XRP Whale Wallets Collapse 20%, But Biggest Holders Hoard More Than Ever

XRP’s largest holders are undergoing a sharp structural shift on the XRP Ledger: there are significantly fewer “whale and shark” wallets than two months ago, yet the remaining large accounts now custody more XRP than at any point in the past seven years, according to new data from on-chain analytics firm Santiment.

XRP Whales Shrink, Holdings Hit 7-Year High

In a post on X, Santiment described what it called “a fascinating trend” in the behavior of the network’s biggest holders. The firm wrote: “XRP Ledger is seeing a fascinating trend of whale & shark wallets shrinking in number, but continuing to grow in coins held. There are -20.6% less 100M+ $XRP wallets compared to 8 weeks ago, but they still own a 7-year high 48B coins collectively.”

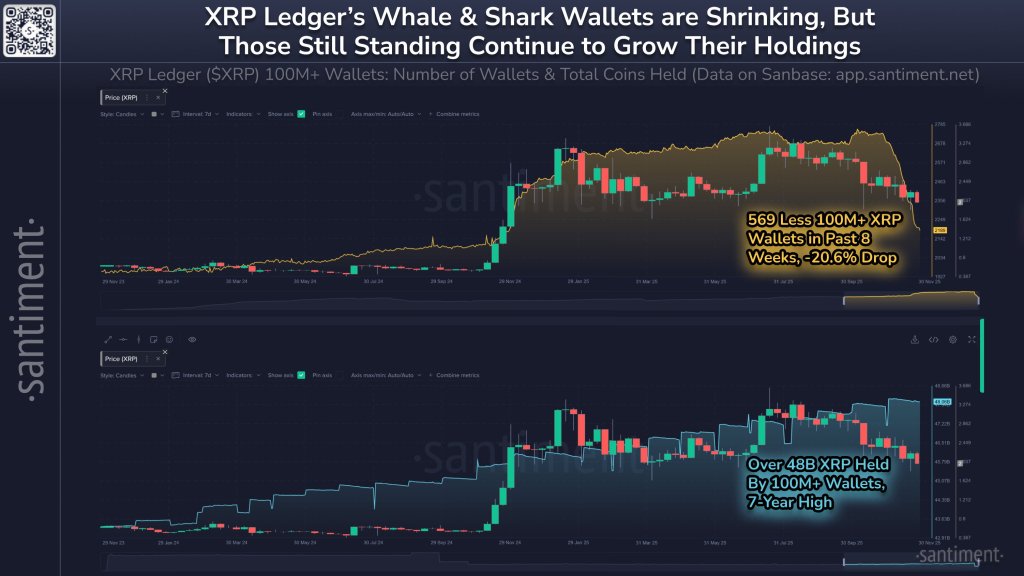

The accompanying chart, taken from Santiment’s Sanbase analytics platform, tracks wallets holding at least 100 million XRP – the cohort the firm labels “whales and sharks.” The visual is split into two main panels, each overlaid with XRP’s price in weekly candlesticks.

In the upper panel, a yellow line traces the number of 100M+ XRP wallets across roughly a one-year window. A highlighted callout notes that there are now “569 less 100M+ XRP wallets in past 8 weeks, -20.6% drop.” That is a steep contraction in a relatively short period for such a concentrated wealth bracket on a major network. The metric shows a pronounced decline toward the right edge of the chart, while the XRP price has also fallen sharply.

The lower panel focuses on the aggregate holdings of that same wallet cohort. Here, a blue line representing the combined balance of all 100M+ addresses climbs to a multi-year peak. The annotation on the chart states: “Over 48B XRP held by 100M+ wallets, 7-year high.” In other words, despite the double-digit percentage drop in the number of very large wallets, the total amount of XRP they control has continued to increase and now sits at its highest level since at least 2018, based on Santiment’s data window.

Taken together, the two panels depict a clear concentration dynamic on the XRP Ledger: fewer very large wallets, but a larger stockpile of coins controlled by those that remain in the 100M+ bracket. Mathematically, if the count of wallets falls by more than one-fifth while the group’s combined balance rises to a seven-year high of 48 billion XRP, the average balance per wallet in this tier must have increased markedly over the eight-week period highlighted by Santiment.

Santiment’s wording in the X post is strictly descriptive and stops short of giving any directional price view, limiting its characterization to a “fascinating trend” of shrinking wallet counts paired with growing balances. Meanwhile, the independent crypto sentiment index FOMOmeter (@FOMOmeterCrypto) account on X commented: “Whales are pulling XRP into fewer hands while the crowd treats it as background noise, a clean low conviction phase that FOMOmeter is built to quantify.”

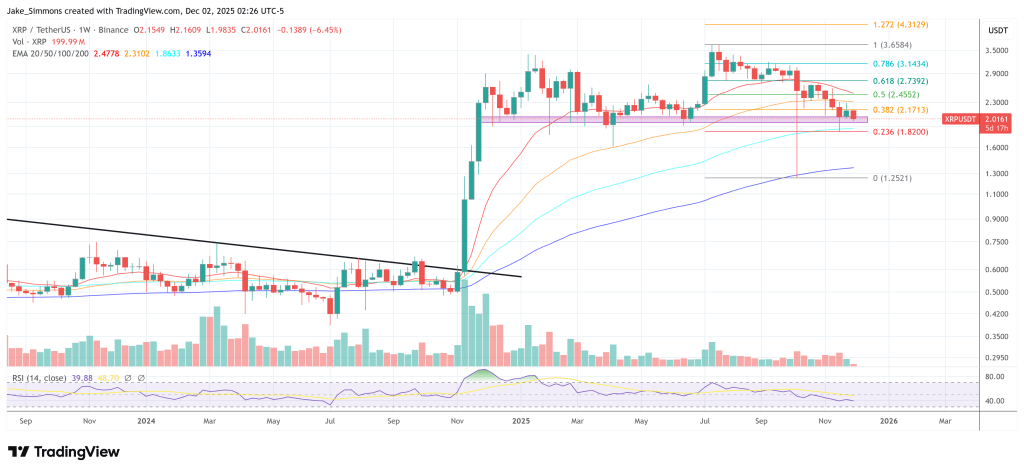

At press time, XRP traded at $2.01.

You May Also Like

SOL Faces Pressure, DOT Climbs 2.3%, While BullZilla Presale Rockets Past $460K as the Top New Crypto to Join Now

Ripple Completes Rail Acquisition, Leading Stablecoin Innovation