Starknet (STRK) Price Prediction 2025, 2026-2030

- Bullish STRK price prediction for 2025 is $0.1595 to $0.2511.

- Starknet (STRK) price might reach $3 soon.

- Bearish STRK price prediction for 2025 is $0.0615.

In this Starknet (STRK) price prediction 2025, 2026-2030, we will analyze the price patterns of STRK by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

STARKNET (STRK) PRICE PREDICTION 2025

|

|

| STARKNET (STRK) PRICE PREDICTION 2026, 2027-2030 |

| CONCLUSION |

| FAQ |

Starknet (STRK) Current Market Status

| Current Price | $0.1274 |

| 24 – Hour Price Change | 7.78% Up |

| 24 – Hour Trading Volume | $96.25M |

| Market Cap | $613.6M |

| Circulating Supply | 4.8B STRK |

| All – Time High | $3.66 (On Feb 20, 2024) |

| All – Time Low | $0.04671 (On Oct 11, 2025) |

What is Starknet (STRK)

| TICKER | STRK |

| BLOCKCHAIN | Ethereum |

| CATEGORY | ERC-20 |

| LAUNCHED ON | February 2024 |

| UTILITIES | Governance, security, gas fees & rewards |

Starknet is a layer-2 scaling solution for Ethereum that utilizes zero-knowledge rollups (ZK-rollups) to enhance the scalability and efficiency of decentralized applications (dApps). By processing transactions off-chain and generating cryptographic proofs, Starknet significantly increases transaction throughput while maintaining the security of the Ethereum blockchain.

Starknet key features include high throughput, EVM compatibility, and reduced transaction costs, making it an ideal solution for dApps that require quick and cost-effective transactions.

The native token of StarkNet, STRK, became publicly available on February 22, 2024, through a Provision Airdrop. STRK plays a crucial role within the ecosystem, enabling governance participation, staking for network security, and serving as a means to pay transaction fees. With StarkNet’s innovative approach and the introduction of the STRK token, the ecosystem is set to thrive and foster a vibrant community of developers and users.

Recently, Starknet has successfully approved token staking on the mainnet, through governance voting,

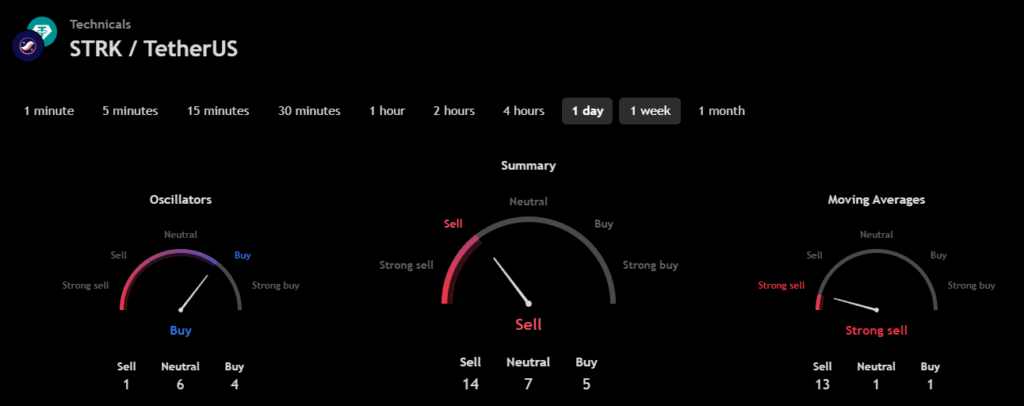

STRK 24H Technicals

(Source: TradingView)

(Source: TradingView)

Starknet (STRK) Price Prediction 2025

Starknet (STRK) ranks 81st on CoinMarketCap in terms of its market capitalization. The overview of the STRK price prediction for 2025 is explained below with a daily time frame.

In the above chart, Starknet (STRK) laid out an Horizontal Channel pattern. A horizontal channel or sideways trend has the appearance of a rectangle pattern. It consists of at least four contract points. This is because it needs at least two lows to connect, as well as two highs. Horizontal channels provide a clear and systematic way to trade by providing buy and sell points.

The longer the horizontal channel, the stronger the exit movement will be. There is frequently a price on the channel after exit. The exit often occurs at the fourth contact point on one of the horizontal channel’s lines.

At the time of analysis, the price of Starknet (STRK) was recorded at $0.1274. If the pattern trend continues, then the price of STRK might reach the resistance levels of $0.1593, $0.2304 and $0.4916. If the trend reverses, then the price of STRK may fall to the support levels of $0.1089.

Starknet (STRK) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Starknet (STRK) in 2025.

From the above chart, we can analyze and identify the following as the resistance and support levels of Starknet (STRK) for 2025.

| Resistance Level 1 | $0.1595 |

| Resistance Level 2 | $0.2511 |

| Support Level 1 | $0.0980 |

| Support Level 2 | $0.0615 |

STRK Resistance & Support Levels

Starknet (STRK) Price Prediction 2025 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Starknet (STRK) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Starknet (STRK) market in 2025.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $0.1398Price = $0.1252 (50MA > Price) | Bearish/Downtrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 43.0899 <30 = Oversold 50-70 = Neutral>70 = Overbought | Nearly Oversold |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak Volume |

Starknet (STRK) Price Prediction 2025 — ADX, RVI

In the below chart, we analyze the strength and volatility of Starknet (STRK) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Starknet (STRK).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 21.1277 | Weak Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 48.26 <50 = Low >50 = High | Low Volatility |

Comparison of STRK with BTC, ETH

Let us now compare the price movements of Starknet (STRK) with those of Bitcoin (BTC) and Ethereum (ETH).

From the above chart, we can interpret that the price action of STRK is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of STRK also increases or decreases, respectively.

Starknet (STRK) Price Prediction 2026, 2027 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Starknet (STRK) between 2026, 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| Starknet (STRK) Price Prediction 2026 | $4 | $0.05 |

| Starknet (STRK) Price Prediction 2027 | $5.5 | $0.04 |

| Starknet (STRK) Price Prediction 2028 | $7.2 | $0.03 |

| Starknet (STRK) Price Prediction 2029 | $8.5 | $0.02 |

| Starknet (STRK) Price Prediction 2030 | $9.3 | $0.01 |

Conclusion

If Starknet (STRK) establishes itself as a good investment in 2025, this year would be favorable to the cryptocurrency. In conclusion, the bullish Starknet (STRK) price prediction for 2025 is $0.2511. Comparatively, the bearish Starknet (STRK) price prediction for 2025 is $0.0615.

If there is a positive elevation in the market momentum and investors’ sentiment, then Starknet (STRK) might hit $3. Furthermore, with future upgrades and advancements in the Straknet ecosystem, STRK might surpass its current all-time high (ATH) of $2.18 and mark its new ATH.

FAQ

1. What is Starknet (STRK)?

StarkNet is a layer-2 scaling solution for Ethereum that uses zero-knowledge rollups to enhance dApp performance, while its native token, STRK, facilitates governance and staking within the ecosystem.

2. Where can you buy Starknet (STRK)?

Traders can trade Starknet (STRK) on the following cryptocurrency exchanges such as Binance, OKX, Bybit, and KuCoin.

3. Will Starknet (STRK) record a new ATH soon?

With the ongoing developments and upgrades within the Straknet platform, Starknet (STRK) has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of Starknet (STRK)?

Starknet (STRK) hit its current all-time high (ATH) of $3.68 on February 20, 2024.

5. What is the lowest price of Starknet (STRK)?

According to CoinMarketCap, STRK hit its all-time low (ATL) of $0.04671 on October 11, 2025.

6. Will Starknet (STRK) hit $3?

If Starknet (STRK) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $3 soon.

7. What will be the Starknet (STRK) price by 2026?

Starknet (STRK) price might reach $4 by 2026.

8. What will be the Starknet (STRK) price by 2027?

Starknet (STRK) price might reach $5.5 by 2027.

9. What will be the Starknet (STRK) price by 2028?

Starknet (STRK) price might reach $7.2 by 2028.

10. What will be the Starknet (STRK) price by 2029?

Starknet (STRK) price might reach $8.5 by 2029.

Top Crypto Predictions

Avalanche (AVAX) Price Prediction

Internet Computer (ICP) Price Prediction

First Neiro On Ethereum (NEIRO) Price Prediction

Disclaimer: The opinion expressed in this chart is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

You May Also Like

Mockery abounds as 'All-American Halftime Show' faces technical difficulties

ARK Invest Sells $22M in Coinbase Shares While Increasing Exposure to Bullish