Bitcoin Reclaims $90K as Crypto Markets Snap Back After Heavy Selloff

- Bitcoin saw a 6% uptick, climbing back above $92K. This sparked a broad market rebound after a sharp selloff wiped out nearly $1 billion in leveraged positions.

- While traders welcomed supportive industry headlines, overall sentiment remains fragile amid ongoing market stress.

- Despite the price rise, negative funding rates indicate traders remain bearish, suggesting the recovery is fragile in the near term.

Bitcoin climbed back over US$90,000 (AU$137,700) on Tuesday, recovering part of Monday’s sharp selloff that wiped out nearly US$1 billion (AU$1.53 billion) in leveraged positions and rattled sentiment across crypto markets.

Even shares of the Bitcoin mining company led by Eric Trump, American Bitcoin Corp (ABTC), dropped hard this Tuesday, losing half its value in early trading sessions. More specifically, a 51% decline, according to data from Yahoo Finance

Source: Yahoo Finance.

Source: Yahoo Finance.

It seems the market is looking at supportive headlines as a sign of relief, as the US Securities and Exchange Commission (SEC) Chair Paul Atkins flagged plans to detail an “innovation exemption” for digital asset firms.

Read more: Kalshi Goes Onchain With Solana in Bid to Challenge Polymarket

Meanwhile, Vanguard said it would allow ETFs and mutual funds primarily holding cryptocurrencies to trade on its platform, according to Bloomberg.

Wintermute strategist Jasper De Maere told the publication that the move reflects both sector-specific news and crypto “catching up” with broader risk assets.

It seems to be a combination of industry specific headlines and crypto catching up to the broader market that is driving this strong price activity.

Jasper De Maere, desk strategist at Wintermute

Jasper De Maere, desk strategist at Wintermute

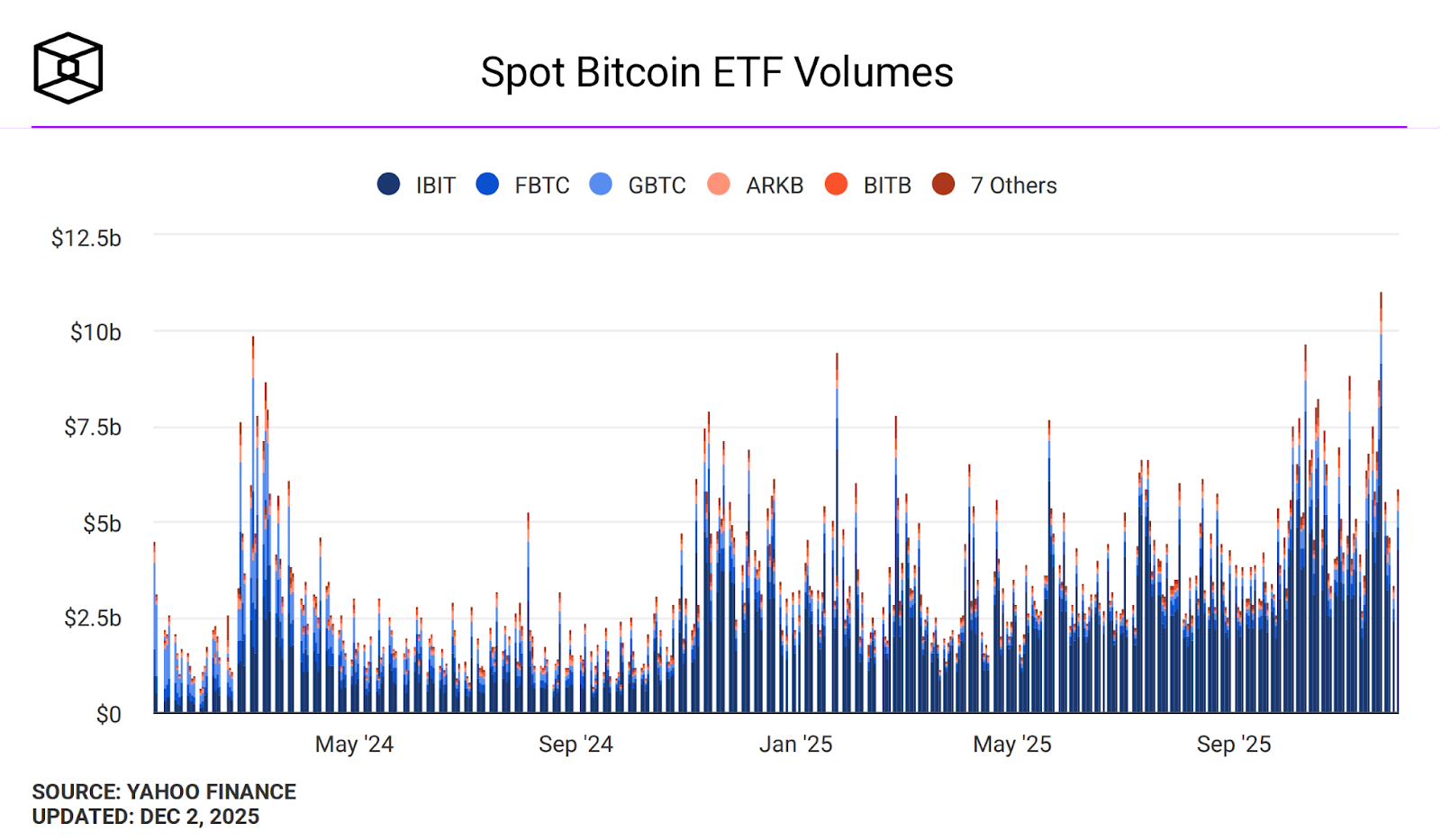

Have BTC-ETFs Turned Things Around?

Despite the sell-off pressure that rippled across the market, US spot Bitcoin ETFs saw some steady gains today, reaching US$5.9 billion, a sign that institutions and retailers are still interested in exposure to the main cryptocurrency, according to The Block data.

Despite Tuesday’s bounce, Bitcoin funding rates in perpetual futures have turned negative in recent days, according to CryptoQuant — a sign that demand for bearish exposure now outweighs interest in leveraged long positions, and that any recovery may remain fragile in the near term.

In simple words, this means that even though Bitcoin went up, traders are still nervous, and we can see that on futures markets, where more people are now shorting the crypto asset. This is because the funding rate is negative: traders who are short are getting paid by those who are long (betting on a rise).

Read more: Upbit Halts Trading After $36.8M Solana Network Hack

The post Bitcoin Reclaims $90K as Crypto Markets Snap Back After Heavy Selloff appeared first on Crypto News Australia.

You May Also Like

Campaign For A Progressive Income Tax In Colorado Faces Setback

The Adoption of Web3 in Europe: Current Status, Opportunities, and Challenges