Best Altcoins To Buy As Chainlink ETF Pulls In $41M And Oracle Demand Rises

Takeaways:

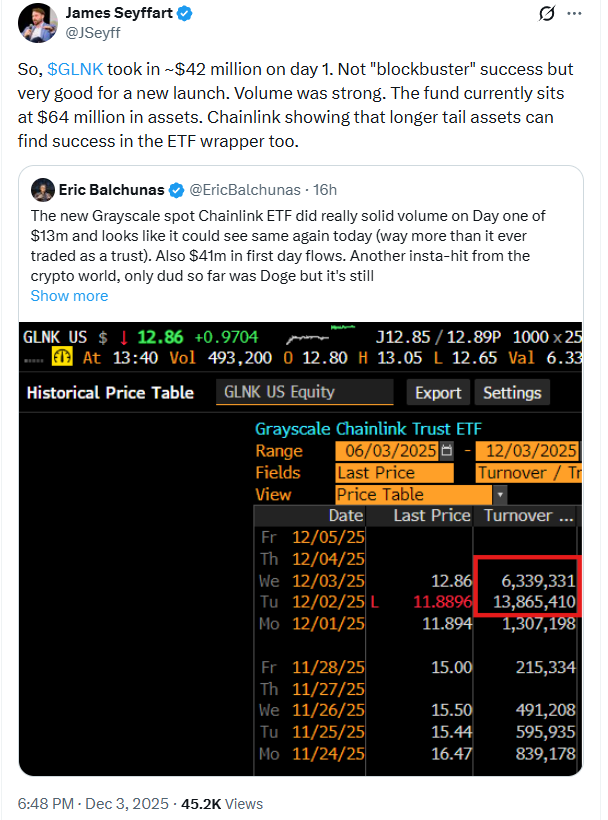

- Grayscale’s $41M Chainlink ETF debut highlights growing institutional appetite for core oracle and data infrastructure rather than speculative altcoins.

- Bitcoin Hyper introduces SVM-powered smart contracts, low-latency execution, and high-throughput DeFi rails directly to Bitcoin via a Layer-2 architecture.

- PEPENODE advances the meme coin meta with a mine-to-earn virtual node system and a gamified dashboard that increases user engagement.

- Chainlink’s DONs, CCIP, and new Runtime Environment reinforce its position as foundational infrastructure for tokenization and cross-chain institutional deployments.

The first US Chainlink ETF pulling in $41M on launch has done more than revive Chainlink’s chart – it has crystallized a narrative.

Institutions are no longer just speculating on crypto; they’re buying exposure to core infrastructure that secures data, liquidity, and cross-chain activity for the next cycle.

Source: X/@JSeyff

Source: X/@JSeyff

In that context, altcoin selection starts to look very different. You’re not just chasing memes or fleeting narratives. You’re looking for assets that sit in the transaction path: oracles, execution layers, and rails that move $BTC and stablecoins at scale while talking to TradFi infrastructure.

Even meme coins are evolving into more structured, yield-like systems with node economies and gamified mining.

Here are three best altcoins to buy right now, as each aligns with this infrastructure-heavy thesis. Bitcoin Hyper ($HYPER) is a high‑throughput Bitcoin-Layer 2; PEPENODE ($PEPENODE) is a mine‑to‑earn meme coin with node mechanics; and Chainlink ($LINK) is the established Oracle and interoperability layer institutions are now buying via ETF exposure.

1. Bitcoin Hyper ($HYPER) – First Bitcoin Layer-2 With SVM Execution

Bitcoin Hyper ($HYPER) positions itself as the first ever Bitcoin Layer-2 with Solana Virtual Machine (SVM) integration, targeting the core pain points of Bitcoin: slow settlement, high fees in congestion, and limited programmability.

The design splits responsibilities: the Bitcoin Layer-1 handles settlement, while a real‑time SVM Layer-2 executes transactions and smart contracts.

Developers will be able to deploy Rust-based, SPL‑style contracts while still anchoring security and finality back to Bitcoin through periodic state commitments and a decentralized canonical bridge for $BTC transfers.

On the user side, $HYPER will focus on high‑speed $BTC‑denominated payments, low‑fee DeFi (swaps, lending, staking protocols), and NFT or gaming dApps that need fast block times.

Wrapped $BTC will move through the Layer-2 with significantly lower fees than native Bitcoin, enabling micro-transactions and more capital‑efficient DeFi positions for $BTC holders who don’t want to leave the Bitcoin security umbrella.

$HYPER is currently priced at $0.013375, with staking at 40% APY. Learn how to buy $HYPER now to join the presale today.

The presale has already raised $28.9M, putting $HYPER firmly on the radar of early‑stage infrastructure hunters. In fact, whale buys of $502.6K and $379K have even been recorded.

🚀 Join the $HYPER presale before the next price increase.

2. PEPENODE ($PEPENODE) – Gamified Mine-to-Earn Meme Coin Economy

PEPENODE ($PEPENODE) takes the meme coin template and fuses it with a crypto-mining economy, positioning itself as the world’s first mine-to-earn meme coin.

Instead of relying purely on speculation and social momentum, it introduces a virtual mining system where users can spin up nodes that earn tiered rewards based on participation and in‑ecosystem activity.

This gives PEPENODE a more durable engagement loop than many one‑dimensional meme coin plays, which often rely on short‑lived hype cycles. Adding to the diversification, PEPENODE users can earn rewards in other leading memes – such as $FARTCOIN and $PEPE.

From a capital‑formation standpoint, the presale is still early but meaningful. PEPENODE has raised more than $2.2M so far. With tokens currently priced at $0.0011778 and staking at 573%, this leaves more upside optionality if the mine‑to‑earn mechanic gains traction across retail traders.

➡️ Check out our guide to buying $PEPENODE before you jump in.

For investors who like meme coin culture but want some form of structural utility and gamification behind it, PEPENODE offers a more systematized way to get exposure rather than betting on raw virality alone.

🚀 Join the PEPENODE presale today.

3. Chainlink ($LINK) – Oracle and Cross-Chain Backbone for Institutional Flows

Chainlink ($LINK) remains the dominant decentralized oracle network, connecting smart contracts to real‑world data feeds, FX rates, indices, and off‑chain infrastructure.

The network’s decentralized oracle networks (DONs) deliver verified off‑chain data on‑chain, while its Cross-Chain Interoperability Protocol (CCIP) underpins secure messaging and value transfer between blockchains.

That cross‑chain capability is increasingly relevant as institutions experiment with multi‑chain tokenization stacks and need unified, audited data and messaging layers rather than fragmented bridges.

Today, Chainlink reportedly secures over $103B in value across more than 2.5K projects, underlining its status as the leading oracle provider for both DeFi protocols and traditional finance integrations.

With the first Chainlink ETF attracting $41M on day one, that data backbone narrative is now investable in regulated markets, which can also spill over into spot $LINK demand on crypto exchanges.

🚀 Buy Chainlink at today’s price of ~$14.49 through leading exchanges.

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own researchs.

The post Best Altcoins To Buy As Chainlink ETF Pulls In $41M And Oracle Demand Rises appeared first on Coindoo.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise