A Simple Hardware Question Exposes the Limits of Today’s LLMs

\ As engineers and builders, we're trained to trust data and specifications. So, when I decided to stress-test a popular Large Language Model (LLM) on a piece of hardware I know intimately—printheads—the results weren't just wrong; they were a masterclass in confident fabrication.

My query was straightforward: "Compare the HP 841 industrial printhead with a standard HP A3 office printhead." The LLM responded with a detailed, articulate argument that was, technically speaking, precisely backward. It touted the office-grade component as superior. This isn't a simple mistake; it's a fundamental failure of how LLMs "understand" the physical world.

\

\

The LLM's Architectural Flaw: It's a Statistician, Not an Engineer

Let's be clear: an LLM is not a reasoning engine. It's a stochastic parroting engine. Its core function is to predict the next most statistically plausible token (word fragment) based on its training corpus. It has no sensor for truth, no grounding in physics, and no concept of mechanical wear.

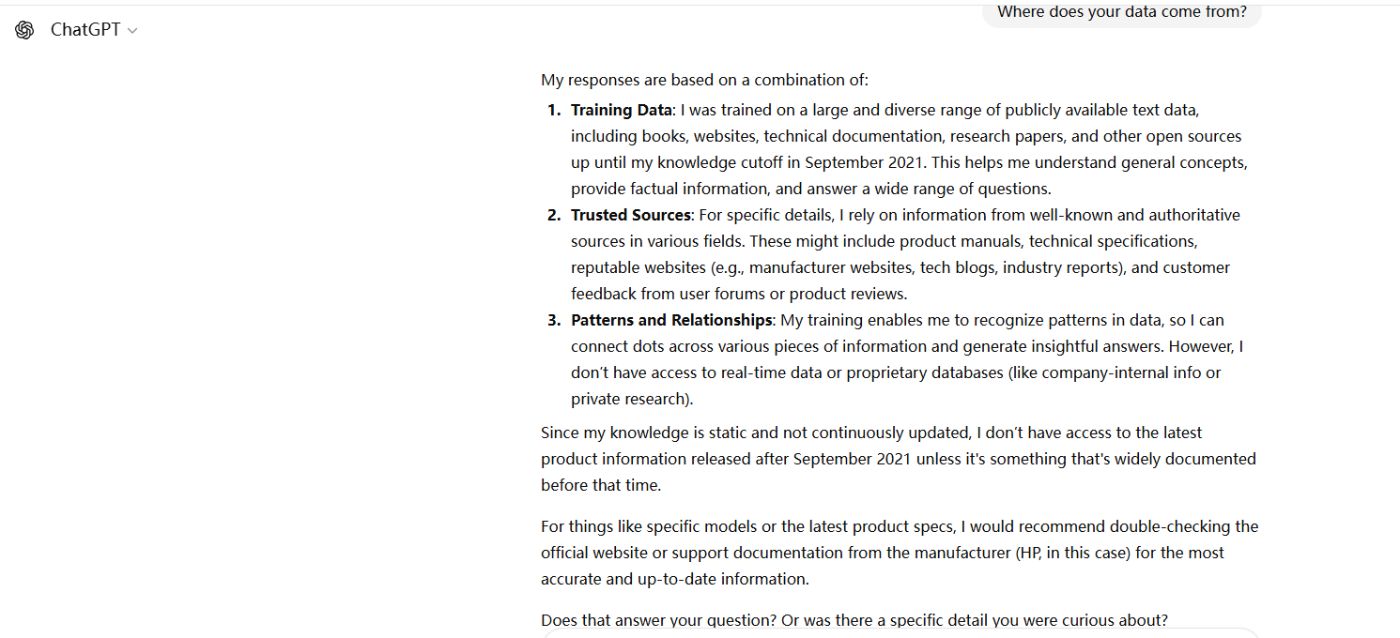

When asked about a technical subject, it doesn't retrieve facts from a verified database. Instead, it assembles an answer based on patterns it has seen in its training data.

The problem is, the internet is filled with:

- Volume-skewed data: There are far more discussions, reviews, and queries about common office A3 printers than niche industrial printheads.

- Ambiguous language: The term "A3" is often used as a proxy for "large format" or "high-quality" in casual writing, muddying the technical waters.

- Outdated and incorrect forum posts.

The LLM absorbed this messy, imbalanced corpus and produced a response that sounded authoritative but was built on a foundation of statistical noise. It's the equivalent of asking a million people on the street about quantum mechanics and basing your thesis on the most common phrases they utter.

A Technical Reality Check: The HP 841 vs. A3 Printhead

My goal here isn't just to say the AI is wrong; it's to provide the ground truth that the LLM lacks. The difference between these components isn't a matter of opinion; it's a matter of engineering intent.

The following comparison isn't AI-generated; it's sourced from datasheets, tear-downs, and real-world deployment.

| Feature | HP 841 (Industrial PageWide) | Standard HP A3 Office Printhead | |----|----|----| | Target Application | High-throughput commercial printing, central reprographic departments | Low-to-medium volume office/desktop printing | | Core Architecture | Page-wide, fixed-array, single-pass | Scanning carriage, shuttle-based, multi-pass | | Throughput (A4) | 70-80 PPM | 15-30 PPM | | Duty Cycle | Hundreds of thousands of pages/month | Tens of thousands of pages/month | | Design Lifespan | Years (or millions of pages) | 1-2 years (or hundreds of thousands of pages) | | Cost Model | Extremely low cost-per-page | Higher cost-per-page |

The Engineering Deep Dive: Where the LLM Misses the Point

The specs above tell a clear story, but the real differentiators are in the physical design, which an LLM can never comprehend.

- Electrical & Contact Design:

-

HP 841: Uses a wide, dual-sided contact cable. This is for superior current delivery, lower resistance, and resilience against oxidation—a critical feature for 24/7 operation. It's built like a server power supply.

-

A3 Printhead: Typically uses a simpler, single-sided flex cable. It's sufficient for intermittent use but a single point of failure under constant load. It's a consumer-grade component.

\

- Fluid Systems & Reliability:

- HP 841: Features a sophisticated ink system with a short, tall ink sac to maintain optimal pressure and flow. Its internal architecture is designed with anti-airlock mechanisms to prevent the number one cause of printhead failure: air bubbles clogging the micro-channels.

- A3 Printhead: Often has a longer, more passive ink path prone to starvation and air ingestion. It's the primary reason for print quality degradation and premature death.

My Perspective: Why This Matters Beyond Printers

This isn't just about printheads. It's a cautionary tale for any technical decision-maker. LLMs are phenomenal for brainstorming, boilerplate code, and summarizing well-trodden topics.

But when your question requires:

- Specialized, up-to-date technical knowledge

- An understanding of physical properties and engineering constraints

- The ability to discern between marketing fluff and technical reality

…you must treat the LLM's output as unverified, potentially hazardous draft material. It is a tool for acceleration, not a source of truth.

The final authority must always be official documentation, empirical testing, and domain expertise. In the case of the HP 841, its design is a masterpiece of industrial engineering, optimized for a single metric: total cost of ownership at scale. To claim an office-grade component is superior is to fundamentally misunderstand the problem it was built to solve.

Let's use AI for what it's good at, but never outsource our technical judgment to a model that has never held a printhead in its hand, nor seen one fail under production load.

\

You May Also Like

Russian Crypto Fraudster and Wife Found Dead in UAE Desert

Suspected $243M Crypto Hacker Arrested After Major Breakthrough in Global Heist