Dogecoin Price Analysis: DOGE Targets Key Resistance at $0.20

Highlights:

- The Dogecoin price has slipped 3% to $0.14 as the derivatives market plunges.

- Crypto analyst notes that DOGE is holding strong above its key support zone, which is exactly where previous rallies began.

- According to Ali Martinez, DOGE faces strong resistance at $0.20, where $ 11.72 billion has been accumulated.

The Dogecoin price is currently trading at $0.14, down 3% as the crypto market tumbles. Furthermore, the daily trading volume has decreased by 9% to $1.15 billion, indicating a decline in trading activity. However, according to a well-known crypto analyst, BitGuru, the dog-themed meme coin is holding strong above its key support zone, and this is exactly where previous rallies have started.

The analyst has further stated that DOGE is poised to push toward mid-range levels, with a potential breakout toward $0.18 if momentum continues to pick up. This is the phase where quiet accumulation typically gives way to the next big move.

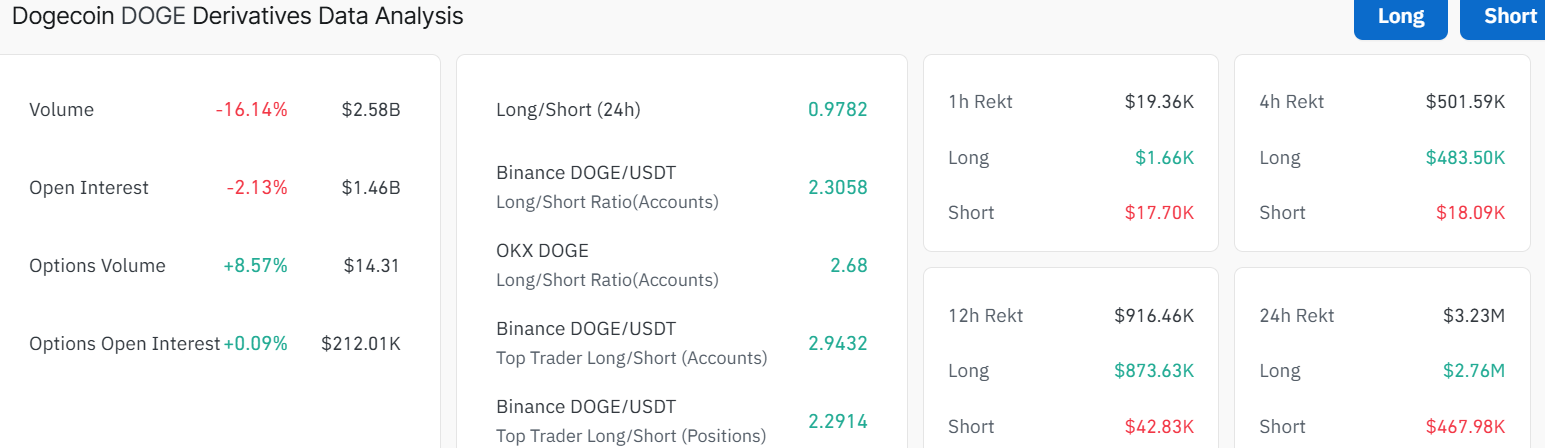

According to CoinGlass statistics, the number of DOGE futures OI has slipped to $1.46 billion. This represents a 2.13% decline, indicating a decrease in investor interest in the market. The OI plunge is an indicator of money leaving the market, which could further exacerbate the Dogecoin price drop if investors don’t regain stamina.

Dogecoin Derivatives Market: CoinGlass

Dogecoin Derivatives Market: CoinGlass

On the other hand, the volume has decreased by 16% to $2.58 billion, indicating a decline in market activity for DOGE. Notably, the long-to-short ratio is at 0.9782, indicating some bearish outlook in Dogecoin price.

DOGE Eyes a Breakout Above the Falling Wedge

The DOGE/USD 1-day price action indicates that the dog-themed meme coin is currently trading around $0.14, down 3% over the last 24 hours. Meanwhile, the 50-day Simple Moving Average (SMA) at $0.16 and the 200-day SMA at $0.20 are acting as immediate resistance zones. Moreover, the moving averages crossed paths on November 8, 2025, signalling a death cross in the market. According to BitGuru, the $0.14 support zone is where the previous rallies have started.

DOGE/USD 1-day chart: TradingView

DOGE/USD 1-day chart: TradingView

The RSI (Relative Strength Index) at 41.06 sits just below neutral, suggesting Dogecoin price still has room to run. Meanwhile, the MACD has crossed above the orange signal line, signalling a potential rebound towards $0.16 resistance soon.

Looking at the bigger picture, fueled by the positive technical indicators, the Dogecoin price could soon test resistance around $0.16. If it breaks that, the next stop might be $0.20 mark. Further, popular analyst Ali Martinez has noted that $0.20 is the major resistance zone for Dogecoin price. This is because this level is where 11.72 billion DOGE tokens were accumulated.

Conversely, if the current price level gives way, a slide back to $0.13 or even $0.12 may occur. However, the bulls need to regain stamina, as the derivatives market is showing a negative sentiment. In the short term, traders can expect a bounce to $0.16-$0.20 in the coming days, fueled by dip-buying FOMO. However, if Bitcoin and the market hold steady in the long term, DOGE could ride the wave to $0.27 by the end of December.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Team Launches AI Tools to Boost KYC and Mainnet Migration for Investors